AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="474" height="242">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="474" height="242">

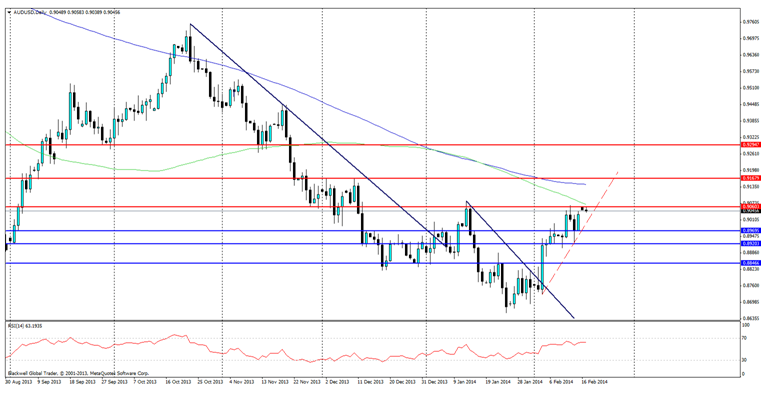

The Aussie dollar continued its climb against the USD as of last week, as a spate of weak data led to the commodity currency gaining heavily. Nevertheless, the current level of 90 cents is proving to be a hard bridge to cross for the Aussie, especially as the RBA has voiced its thoughts about the AUD being worth 80-85 cents.

Looking forward to the week, it's unlikely we will see massive movements as new vehicle sales y/y is due out on Monday, while Hourly earnings is due out on Wed morning. It's unlikely that we will see drastic movements based on the fundamental data except for the end of week US data if it comes out above or below forecasts.

Current technicals point to the 90 cent acting as a barrier for the AUD, and it's likely we will see pressure for the pair to move south. The RSI is showing strong buying pressure as traders push to force a market reaction lower, overall, its likely the current trend will break as its very steep and unlikely to hold against a big day swing. Current resistance levels can be found at 0.9060, 0.9167 and 0.9294; with major resistance found at 0.9060. Support levels can be found at 0.8969, 0.8920 and 0.8846 and are all likely to be tested as the AUD pulls back lower.

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="474" height="242">

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="474" height="242">

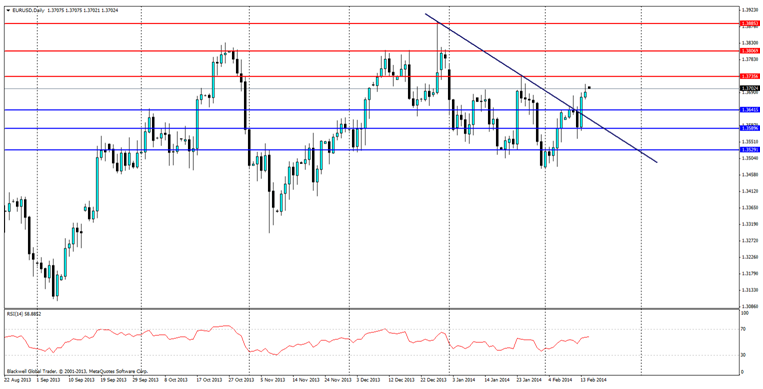

The euro looked weaker over the last week, however Mario Draghi took action at a recent ECB press conference as he talked up the possibility of negative interest rates in order to control the deflation threat this lead to a rise in the euro and has helped invigorate markets further.

The week ahead has little in store for the euro until Thursday, when PMI data is due out for Manufacturing and Services, this is expected to show modest expansion and markets would react to positively to forecasts being in line with the data. Consumer Confidence is also due out on the same day, but the markets will likely be keeping their ear to the ground so they can listen to anything the Draghi may have to say about the recent deflation threat.

After a recent trend of ranging lower on a bearish channel, the euro has broken out of its range after Draghis recent announcement as buying pressure has picked up. With the recent breakout markets are now starting to look bullish after a period of consolidation within the bearish channel. Resistance levels can be found at 1.3735, 1.3806 and 1.3885; with 1.3806 likely to act as heavy resistance. Support levels can be found at 1.3641, 1.3589 and 1.3529; and are unlikely to be tested unless data disappoints in the coming week.

GBP/USD Daily Chart" title="GBP/USD Daily Chart" width="474" height="242">

GBP/USD Daily Chart" title="GBP/USD Daily Chart" width="474" height="242">

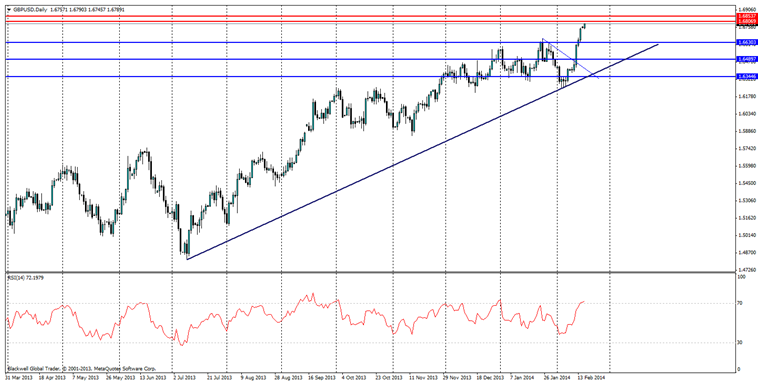

The pound has gapped higher on opening and is looking to push the 1.68 mark verse the USD as market pressure starts to increase on a weaker US dollar and a strong pound. Markets have punished last week's weak US data by driving the pound higher.

The pound is set to have a very busy week as news is due out on CPI and PPI data on Tuesday, followed by Unemployment data on Wednesday and Retail Sales due out on Friday. This is likely to move the pound heavily, and positive data could lead to the 1.68 mark being broken and pushing it even higher.

Current technicals show the market as pushing heavily up to the 1.68 mark on a bullish trend line, however the RSI is signallingits overbought, and we may see a consolidation at the 1.68 mark before pushing further upwards. Current resistance levels are at 1.6800 and 1.6853; with 1.6800 likely to act as heavy resistance. Support levels can be found at 1.6630, 1.6489 and 1.6344 and are unlikely to be tested unless there is a spate of bad data.

NZD/USD Daily Chart" title="NZD/USD Daily Chart" width="474" height="242">

NZD/USD Daily Chart" title="NZD/USD Daily Chart" width="474" height="242">

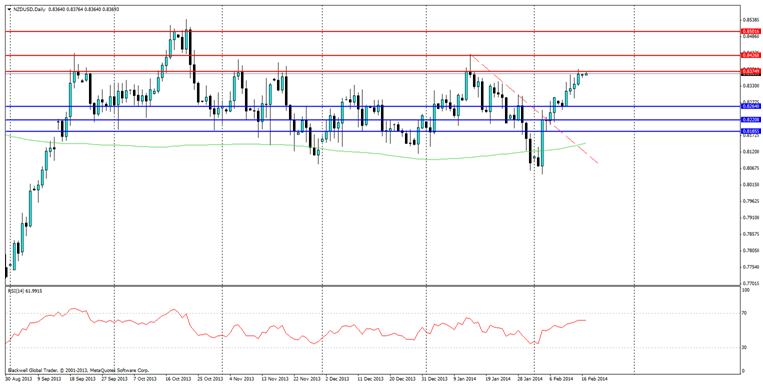

The New Zealand dollar fell heavily last week, before touching the 80 cent mark and pushing back upwards strongly on manufacturing results which showed the economy in strong stead.

The data out for this week is relatively light, and any major movers are likely to come out of US markets. However, Producer Prices for the last quarter are due out, and are expected to show moderate growth. Despite this any major moves will likely come from US market movements as market fears spill over into commodity currencies.

Market technicals show the NZD moving upwards, butits likely that we will see more ranging from the NZD overall, as it looks to stay within the 80-85 cent range in this current economic climate. RSI shows buying conditions as being strong, however its likely traders are looking to test support before pulling back. Resistance levels can be found at 0.8374, 0.8426 and 0.8501; with major resistance found at 0.8426. Support levels can be found at 0.8264, 0.8220 and 0.8185. Current market momentum is upwards, but ranging heavily and as such no trend can be deduced currently.

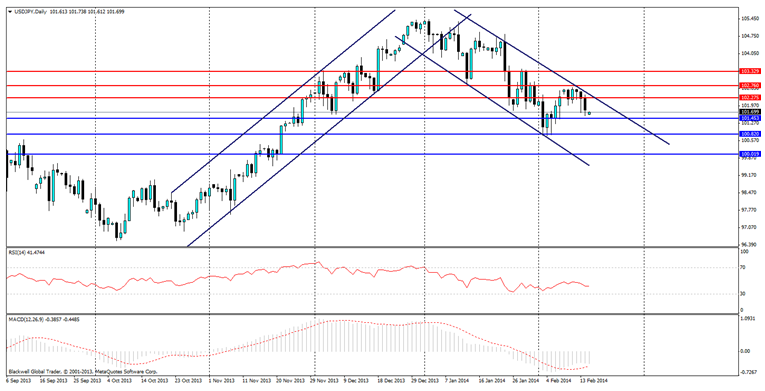

USD/JPY Daily Chart" title="USD/JPY Daily Chart" width="474" height="242">

USD/JPY Daily Chart" title="USD/JPY Daily Chart" width="474" height="242">

The yen has a relatively straightforward week, as it looked to channel lower again on the back of weaker US data. However, the strength so far in the yen has been the growth in the CPI and the belief that Japan's radical market movements are certainly hoping for the economy to recover, leading to a stronger yen against all major trading partners.

The coming week is set to be busy for yen traders, as Industrial Production data is due out for the Japanese economy on Monday. While Wednesday will showcase the BoJ monthly report as well a the business cycle index; both of which are expected to have a smaller impact.

Looking at market technicals the yen is moving lower against the USD as the bearish channel its in currently leads it lower as markets play of fundamental data with technicals. The RSI is relatively flat and MAC is giving mixed messages towards momentum. Current resistance levels can be found at 102.275, 102.760 and 103.329. Support levels can be found at 101.453, 100.820 and 100.019; with 1000.019 likely to be a testing level for the pair. Additionally the current channel should act as dynamic support and resistance for the currency.

Disclaimer: The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research . The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.