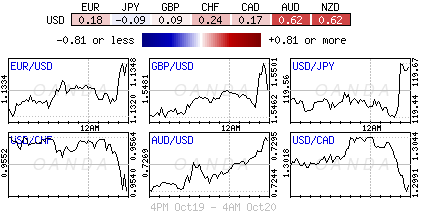

Investors remain reluctant to make any major currency bets given the lack of fresh trading clues. G7 currencies continue to trade within a well-defined trading range as investors prefer to watch equities and fixed income for opportunities. Market players will always be reluctant to take positions ahead of some important policy setting meetings (Turkey, Russia, Canada, ECB and BoJ) over the coming weeks.

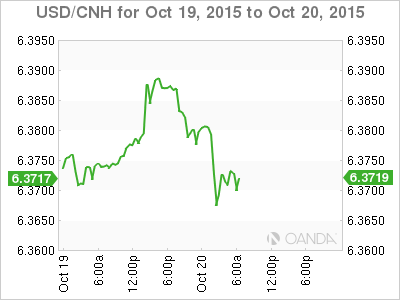

US Treasury Semi-annual Currency Report overnight again did not declare any major trading partner as a “currency manipulator.” In fact, it actually softened its stance on China in spite of August’s 11th yuan devaluation. The report is sometimes used as an occasion by the U.S administration to openly criticize trading foes, and the forex market usually takes their cues from the report; however, not this time. Whatever volatility occurred on the release was short lived. The U.S Treasury indicated that CNY remains below appropriate “medium term valuation” when compared to its previous view of being “significantly undervalued.” Not a surprise, the U.S authorities called for more Chinese policy transparency, stating that the recent devaluation underscore its importance. With some of the heat off China, stepping into the U.S’s firing line now is South Korea and Taiwan. The U.S treasury fired a warning shot by stating that Korea should not be intervening in the FX market to limit the KRW appreciation. Policy authorities should only be intervening due to “exceptional circumstances of disorderly conditions.” The treasury’s assessment had the KRW undervalued last year by -5% to -13%. Similar complaints were made against Taiwan (TWD).

Few trust Chinese data points: The market continues to debate China’s recent growth numbers or adeptly put, no one seems to trust the GDP data. Fixed asset investment growth printed a new multi-year low. Nevertheless, various individuals keep trying to influence the right markets. Overnight, former influential People’s Bank of China (PBoC) adviser Li said that China’s GDP would be about +6.8% in 2015 and +6.9% next year as the economy bottoms out in H1 in 2016. Another report expects a “moderate” rebound this quarter, despite many continuing to question the accuracy of China’s Q3 GDP print in light of a more pronounced slowdown of other data points over the weekend. New home sales value growth also slowed, down 5 ticks to +18.2%, while industrial output (IP) data was similarly downbeat, coming in at a six-month low of +5.7%. Power, steel and oil production growth were soft; but headline GDP beat estimates (+6.9%), sitting atop of a new six-year low print.

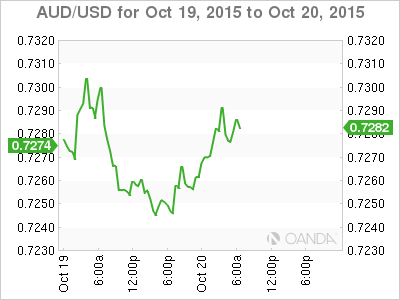

RBA minutes offered a more upbeat assessment of its economy: The RBA minutes showed no hints of an “easing” bias. In fact, the report was fairly neutral to positive, denting a minority view of economists anticipating more near term RBA easing. The fixed income market had been pricing in another -25bps cut by year-end. Aussie policy makers said that there is more evidence of economic “rebalancing” toward the non-mining sector and that the labor market continues to strengthen. They do not foresee the unemployment rate climbing any time soon. The somewhat “hawkish” notions has short-term interest rates backing up (Aussie 3-years climbed +2bps to +1.85%, while the AUD continues to perform relatively well A$0.7290).

Markets flip on Russia: In September, dealers had been pricing in a “no” rate change by the Bank of Russia. They cited RUB volatility and no signs of inflation slowdown as their reasons. However, a few weeks later and after further data from the Russian stats office indicating that Russia’s economic crisis remains intact, and that deflationary conditions persist, has the market once again pricing in another -50bps rate cut by month-end. No one seems to be that concerned about a possible spillover from the Fed tightening.