As another trading week and month gets underway, it’s time to take a look at several of the major currency pairs in the futures market ahead of what is likely to be an interesting time. The week ahead is punctuated with interest rate decisions for Australia, Europe and the UK, coupled with Trade Balance data for the US, Canada and Australia and all rounded off with the monthly broohaha of Non Farm Payroll on Friday.

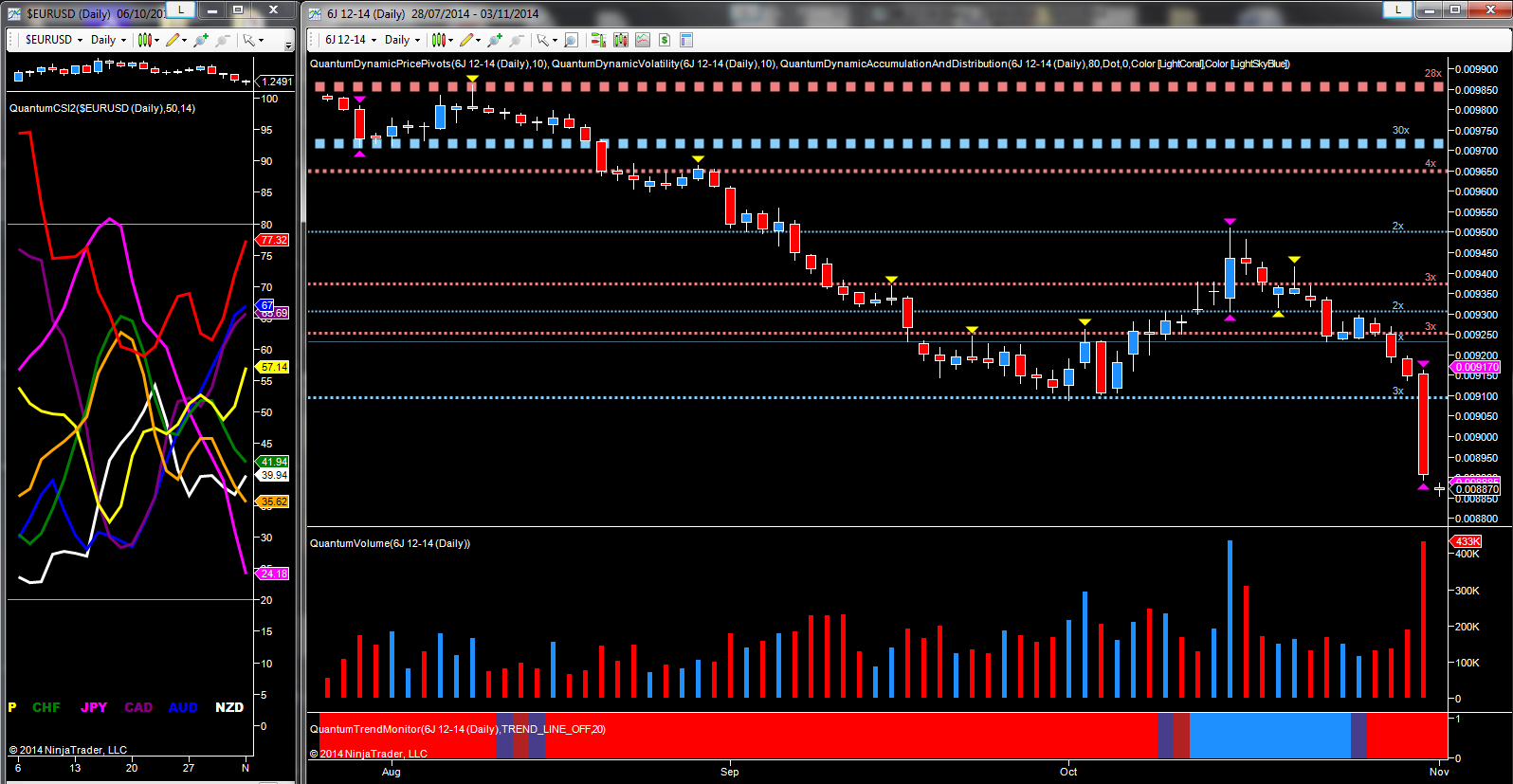

And perhaps the place to start is with the JPY/USD following last week’s announcement from the Bank of Japan of an increase in its already aggressive bond buying program, which surprised the markets sending the Yen plummeting and world equity markets soaring as a result. For the JPY/USD, the news was simply the catalyst for an increase in the already bearish momentum, with the pair ending the week and the session with a wide spread down candle on ultra high volume, and closing below the minor secondary support level in the 0.009100 region. October was ultimately a game of two halves for the pair, with the price action of the 15th October defining the reversal from bullish to bearish, as the ultra high volume, coupled with indecision clearly evident from the price action, signaled a potential reversal. This was duly confirmed as the market moved lower, breaching the 0.009380 region first, before finally breaking below the support level in the 0.009250 region on rising volume adding further confirmation to the bearish tone, with Friday’s candle delivering the final coup de grace. With Japan closed for a public holiday today, trading in the yen has been muted overnight, but the bearish tone has continued with the 6J futures contract opening gapped down to trade at 0.008878 at time of writing, and looking set to move lower to test the 0.008800 region in due course.

Moving to the Aussie, the Pound, the Euro and the Canadian dollar, last week’s price action for these currencies was dominated by a resumption in bullish sentiment for the US dollar, following the hawkish comments from the FED, which sent the USD firmly higher. From a technical perspective, the key level at 86.80 on the daily dollar index chart was duly taken out on Friday, a level which had signaled weakness in early October. However, with this level now breached and the index trading at 87.26 this morning, the US dollar now has a strong fundamental and technical picture in place, and a platform of support for further gains.

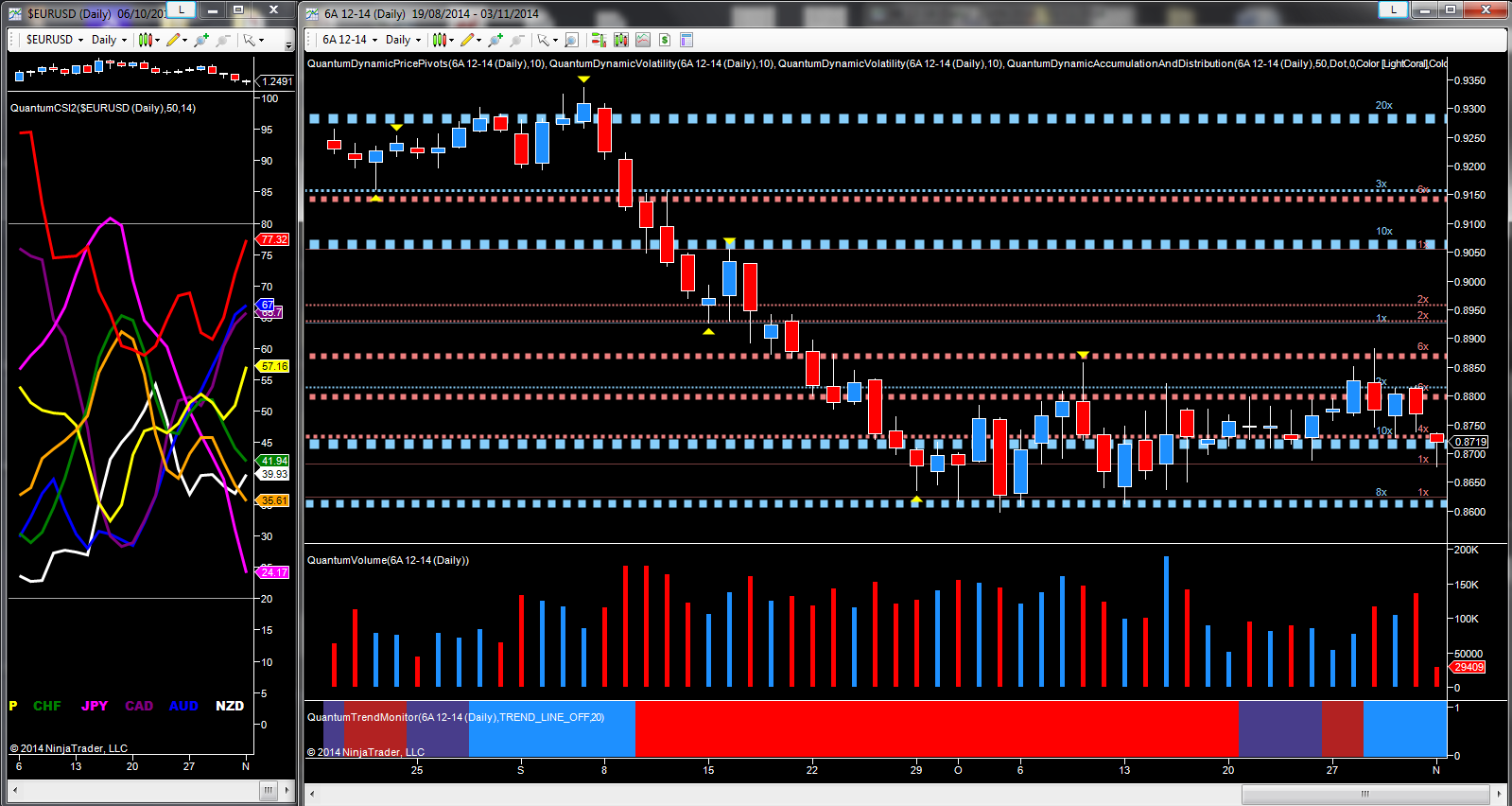

For the AUD/USD, last week was another where an attempt to rally higher was duly snuffed out, with Wednesday’s price action and deep upper wick to the candle body, duly running into resistance in the 0.8860 region on above average volume, before moving lower once again to test the strong platform of support in the 0.8720 area again. To date this level has held firm, but it is one which is being tested in early trading with a gapped down open, and should this be breached, then expect to see the pair test the level below in the 0.8620 region, as defined by the blue dotted line, where a further accumulation region awaits. The volume on Friday was high, confirming the bearish sentiment under the down candle, and with this level of resistance now in place, any recovery will have to be associated with strong and rising volumes for a breakout to develop. To the upside it is the 0.8870 region and to the downside the 0.8620 which now define the current congestion phase for the pair with the RBA waiting in the wings tomorrow.

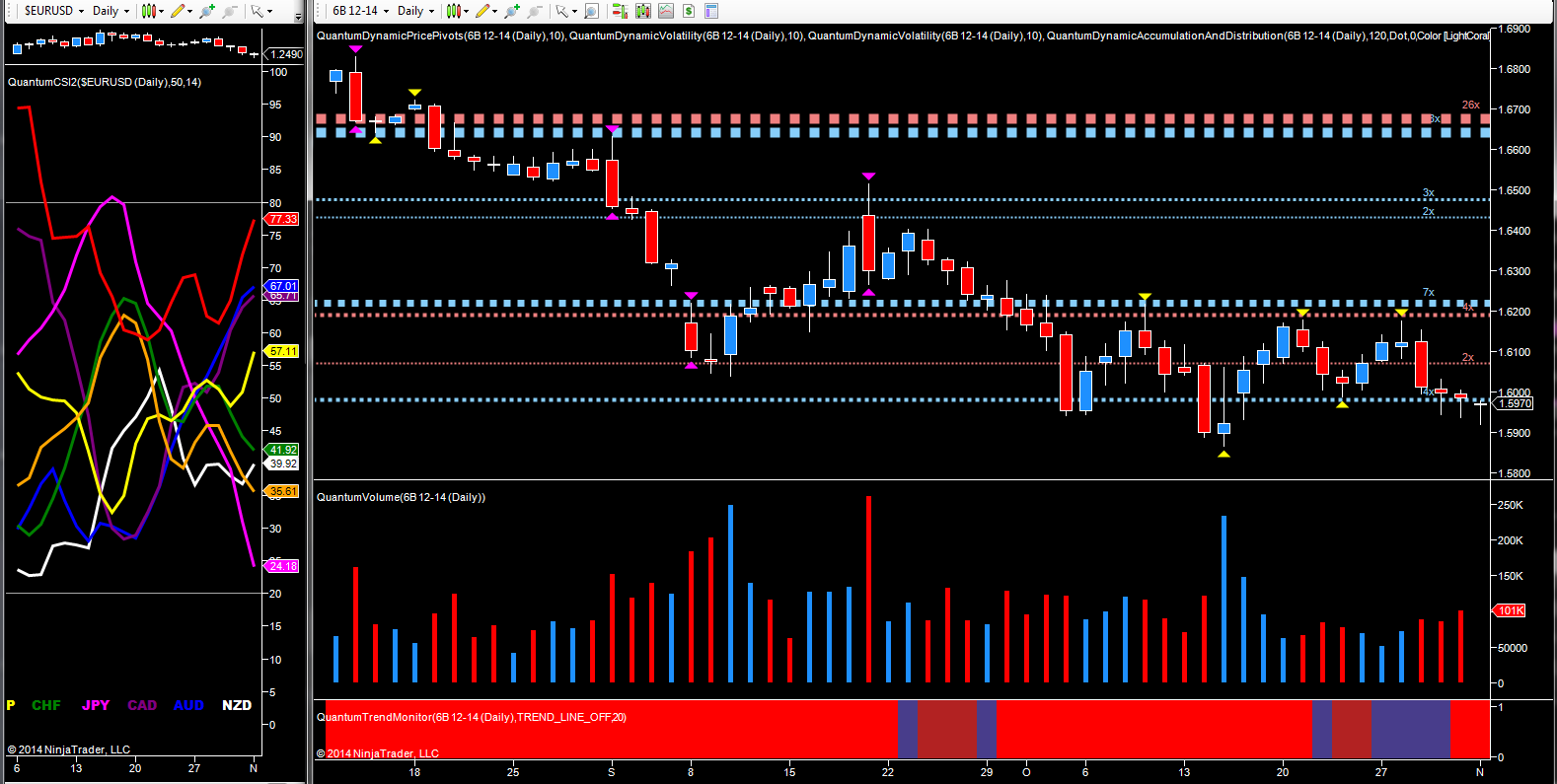

It’s a similar technical picture for the GBP/USD with every attempt to rally running into the deep resistance zone in the 1.6200 region, and defined with two levels of accumulation and distribution. All three attempts t0 breach this level failed in October, each capped with a pivot high and further confirming both the weakness and the ceiling of resistance, as the pair continue to trade in a narrow range of congestion, with the floor of potential support being tested in the 1.5975 area. Should this fail to hold, then we may see a re-test of the 1.5866 level of the 15th October.

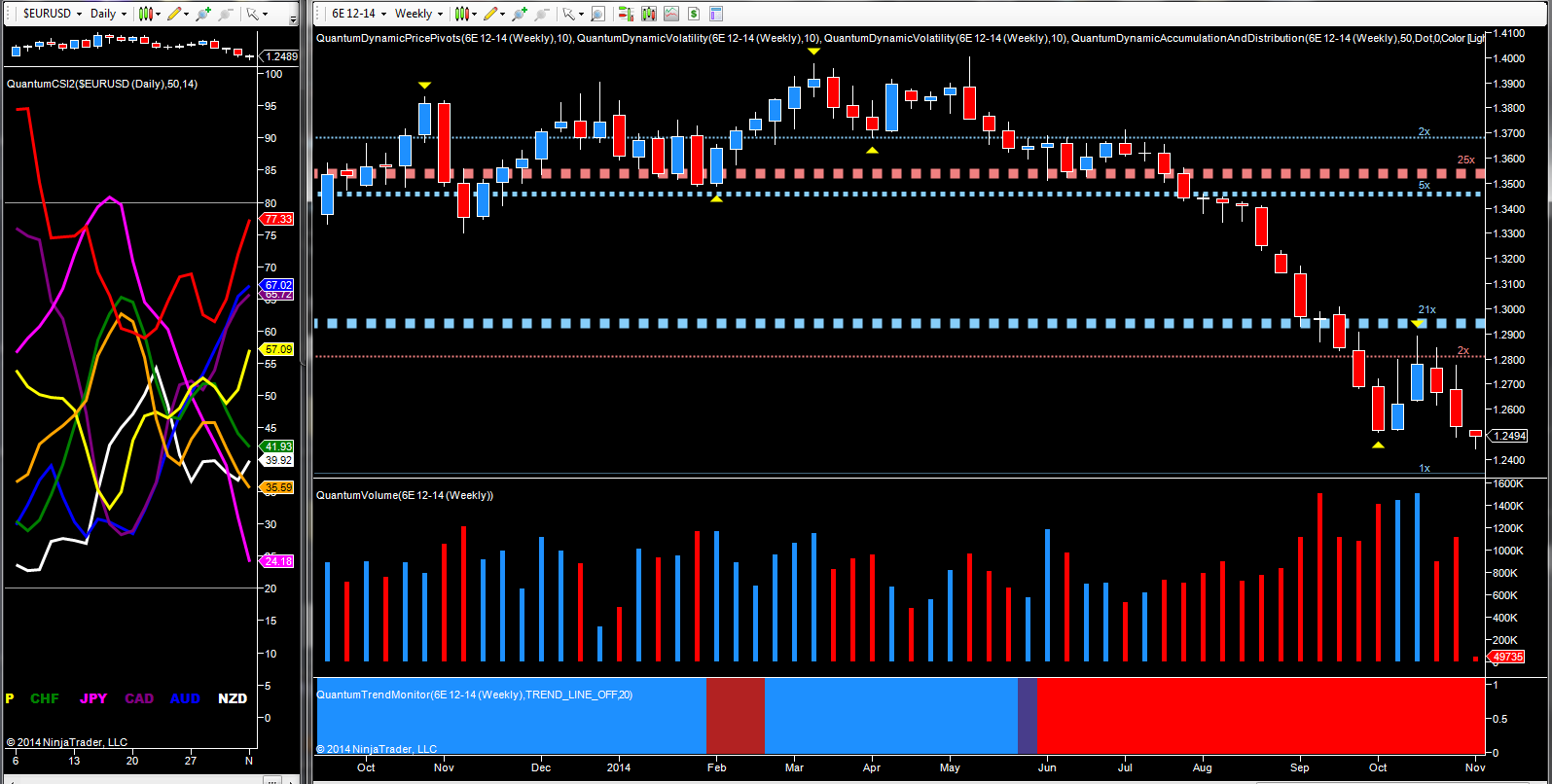

For the EUR/USD it was Wednesday, Thursday and Friday last week which confirmed the bearish picture for the single currency, with a firm move lower coupled with strongly rising volumes, validating the move lower and further confirming the bearish sentiment for the pair. Overnight, and into the London session, the pair has continued lower, taking out a potential support region in the 1.2500, to trade at 1.2496 at the time of writing, and with the heavy selling pressure on Friday, the technical outlook for the pair remains bearish with a move to test the next level of support in the 1.2400 region now looking increasingly likely.

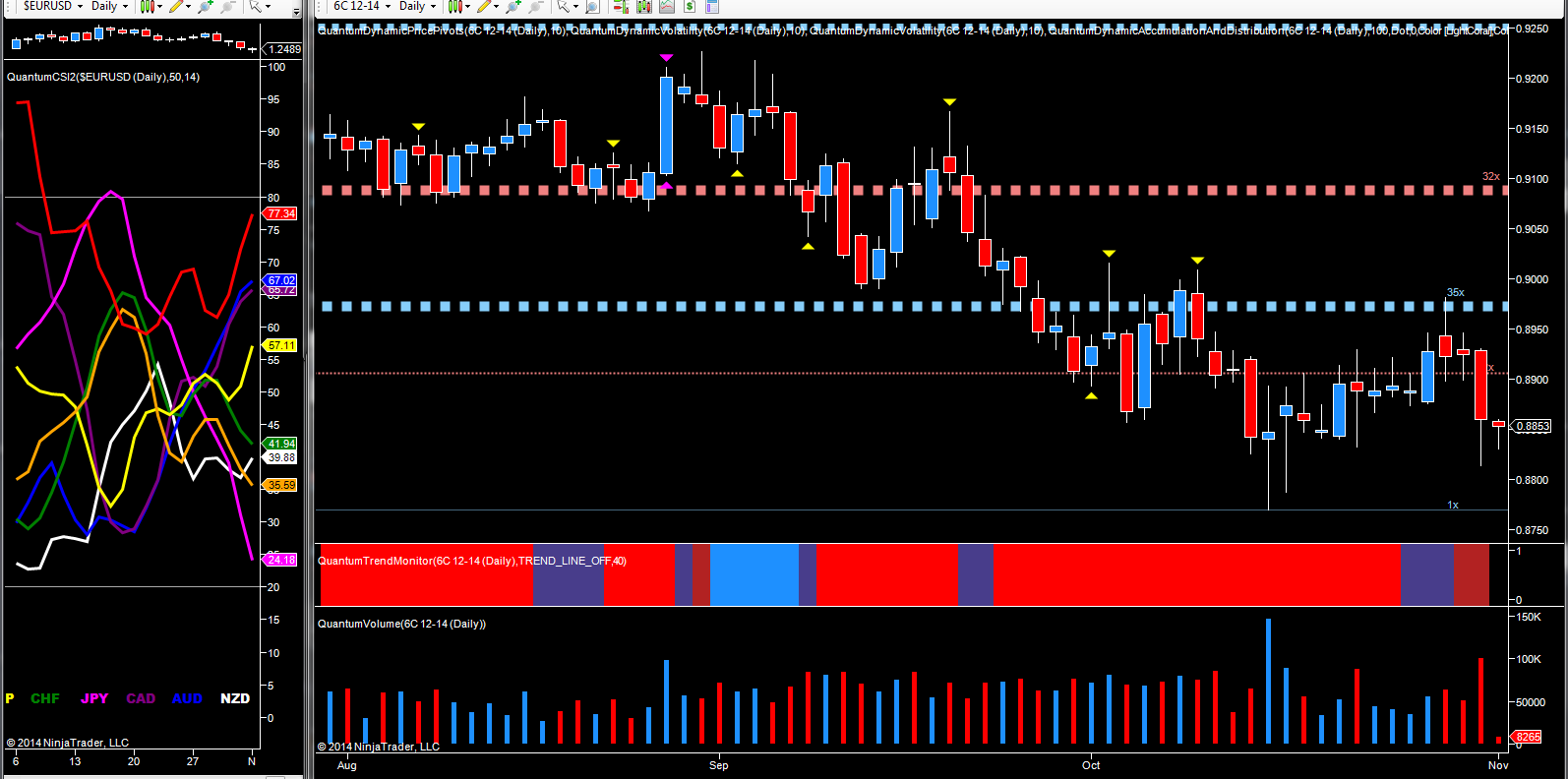

Finally to the CAD/USD which continues to remain range bound, trading between 0.8950 to the upside and the 0.8750 to the downside. The deep area of price resistance in the 0.8950 region denoted by the blue dotted line, helped to cap a rally for the pair last week, with Friday’s price action then confirming the bearish tone on high volume