6A daily chart

As the half time whistle blows on another trading year, it’s time to take a look at four of the major currency futures, as Greece finally defaults and puts us all out of our misery! And if we start with the 6A, or the Aussie dollar, this pair continues to wallow in a sea of congestion trading between the deep resistance in the 0.7750 region, as defined with the red dotted line, and the support below in the 0.7550 area, which continues to provide a platform preventing any further move lower. Just like many other markets, volumes remain average and Monday’s move higher with a wide spread candle was associated with only modest volume, a clear signal of a lack of participation in this move, with falling volume again yesterday. The currency strength indicator to the left of the chart confirms the current price action with the Aussie dollar, the blue line meandering mid stream.

6B daily chart

Moving to the British pound or cable, here too the general lack of volume is a key feature, with the rally of mid June now appearing to have reached an exhaustion point, running into resistance at the 1.5900 region. Since then the pair has retraced to consolidate in a tight range between 1.5780 to the upside and 1.5680 to the downside. Any move through the current platform of support is likely to see a deeper move back to test the 1.5470 level in due course. The currency strength indicator to the left of the chart confirms the picture, with the British pound (the yellow line) now heavily overbought on this timeframe and likely to reverse the longer term bullish trend in due course.

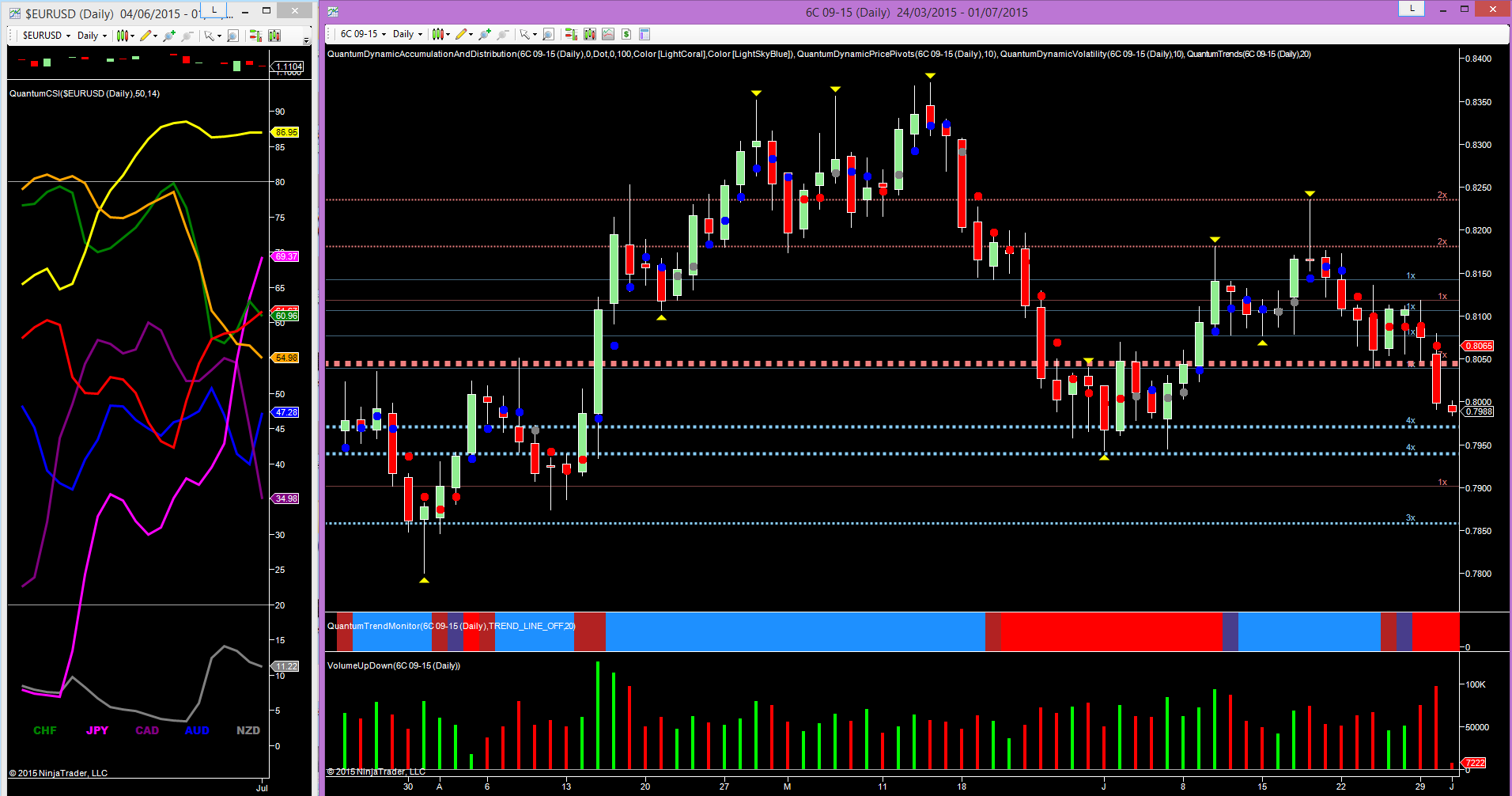

6C daily chart

For the 6C, yesterday was perhaps the most interesting of the four pairs with the CAD/USD closing with a wide spread down candle on high volume, and closing well below the platform of support in the 0.8050 which has finally been breached. The current weakness was initially signaled on June 18th with a shooting star candle and duly confirmed with a pivot high, before starting the move low from the 0.8230 region, with yesterday’s price action accelerating the momentum. In early trading the pair has moved below the 0.8000 region to trade at 0.7990 at time of writing, with the next levels at 0.7970 and 0.7940 now in sight. Any move through the lower of these will then open the way to a test of the deeper platform of support in the 0.7860 region. However, with the US dollar rising (the red line) on the currency strength indicator, and the purple line falling (the Canadian dollar) both have some way to go before reaching their respective overbought and oversold regions.

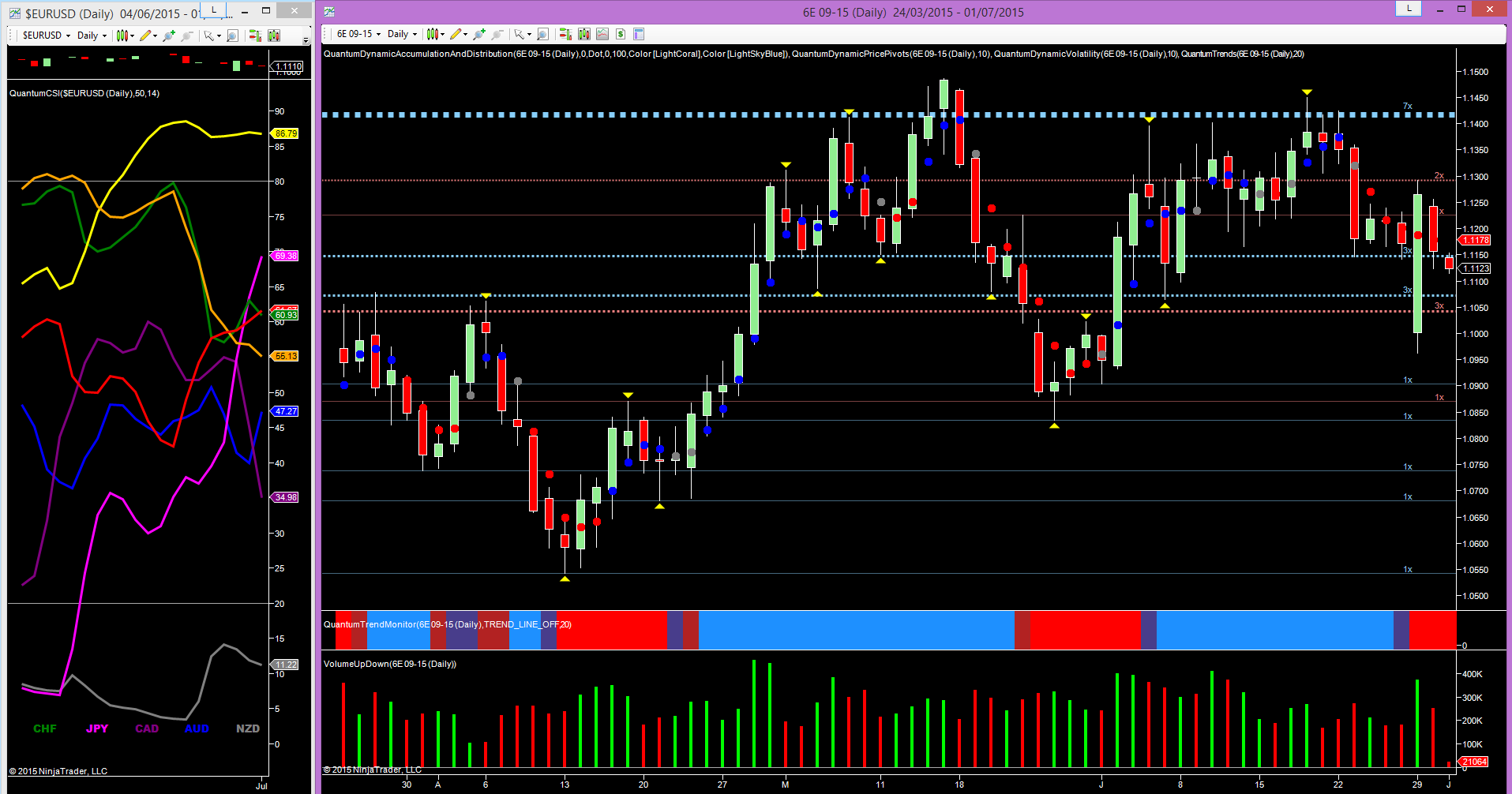

6E daily chart

Finally to the euro, or 6E: putting Monday’s extreme price action aside, the pair continues to remain bearish, having run into resistance in the 1.1450 region before reversing lower to test the 1.1150 region ahead of the weekend. What is perhaps most interesting about Monday’s widespread up candle, is the associated volume which is modest to say the least. For such an extreme move we should expect to see an ultra high volume bar given the effort required to move the market to this extent. All this confirms, and this is a classic example, is the manipulation by the market makers who saw this as an opportunity that was just too good to miss. Were they participating in the move? NO, clearly not. It was a trap move intended to take full advantage of the news from Greece, with volume once again revealing the truth behind this fake move. Rest assured, we will see more such examples over the next few days and weeks. Such opportunities are heaven sent for the insiders but are also classic examples of how volume price analysis reveals the truth behind the price action. Trading without an understanding of volume in these markets is pure madness, and plays into the hands of the insiders and market makers, and like the shoals of herring faced by a shark, more and more traders will be gobbled up in the ensuing carnage.