Key quotes from the Societe Generale report:

Oil And The Euro

Oil prices rose, equities rallied, bond yields moved a little higher and amidst a general dearth of new economic information, the yen weakened and higher-yielding currencies rallied yesterday. Overnight, a temporary surge in Chinese exports (assisted by base-effects) has helped risk sentiment further, helping markets ignore softness in the NFIB small business optimism index, and another downward revision to growth forecasts from the IMF. Ahead today, we have eurozone industrial production (exp +0.3% y/y), US retail sales (exp a solid +0.5% m/m for the control group, + 0.7% ex autos and gas stations), and a Bank of Canada policy decision that will probably leave rates on hold.

An ICM poll on the UK’s EU membership vote yesterday gave the ‘leave’ side one of its best results so far, at 45%, compared to 42% to remain in the EU. The FT’s ‘poll of polls’ runs at 43-42 in favor of staying. The result remains too close to call, yet polls in City (and bookmakers’ odds) still show a strong view that the UK will eventually opt to stay in the EU. Sterling was knocked back a little, losing gains from an upside surprise in the CPI data, but this was the first time that the euro appeared to react negatively, which is noteworthy. ‘Brexit’ would be worse for the UK than the rest of the EU, but it would undoubtedly be bad for all of Europe’s economic prospects.

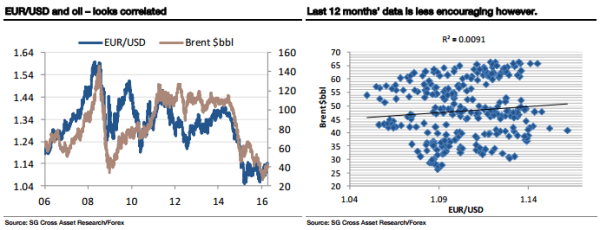

The euro remains very range bound. It still by and large tracks the Bund/Treasury spread, albeit trading a little higher than that spread would imply at the moment. That raises the question of whether it’s getting support from higher oil prices and indeed, whether further gains ahead of (or after) the Doha producers’ meting could break the current EUR/USD range. The first chart shows oil and EUR/USD over the last decade, and glancing at it, you’d think oil was a clear support for the euro. The second chart is a caveat of sorts, showing a scatter chart of EUR/USD and oil over the last year. There’s a positive correlation, but not one to get too excited about.

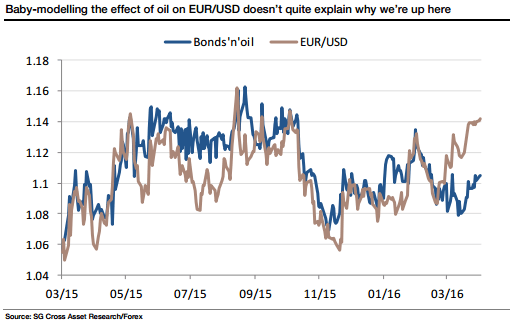

I can get a small improvement in explaining EUR/USD moves by adding oil to the Bund/Treasury correlation, but I need big oil price shifts to make much difference. Oil finding a base, is not the same as oil embarking on a major rally. When I add oil prices, I still don’t manage to ‘explain’ why EUR/USD is as high as it is, as shown in the third chart. That leaves me reluctant to chase EUR/USD even if oil prices do continue to edge higher. It doesn’t however, change a conclusion that as long as the Fed is super-dovish, and as long as yield spreads are range-bound, there is little chance of EUR/USD falling significantly or, of the dollar generally catching a bid.

There will be some nerves ahead of the BOC meeting, and that is likely to keep USD/CAD steady. I still like CAD but in a wider risk-on move, it will lag AUD and NZD, so short NZD/CAD has had its day in the sun for now. Short USD/NOK is a better oil-related trade, at this stage. I’m going to continue to be frustrated just watching the yen, because there’s no point selling it just because a risk-friendly market has taken USD/JPY back up a little. Yesterday’s bounce in SEK/JPY was just frustrating. I think this pair will rally over the medium term, but all I can do is watch. Otherwise, short EUR/RUB still appeals, short GBP/NOK likewise.