As expected, last night's vote in the States created huge amounts of volatility across global currency markets. The shock win by Republican candidate Donald Trump caused some of the biggest swings in forex since the Brexit vote in June. The Mexican peso and Japanese yen were both under the spotlight, but it was the greenback that got the most attention as the results were coming in.

The hourly candle chart below shows how the US dollar index plunged as the likelihood of a Trump victory began to increase dramatically overnight.

Driven by fears over the political and economic uncertainty a Trump victory could produce, along with the decreased probability of a December rate hike, this initial sell-off continued right up until the official election result was announced.

However, rather surprisingly, Trump's first speech as President-elect seemed to calm the markets somewhat. This prompted the dollar to rally higher, virtually erasing all of its earlier losses.

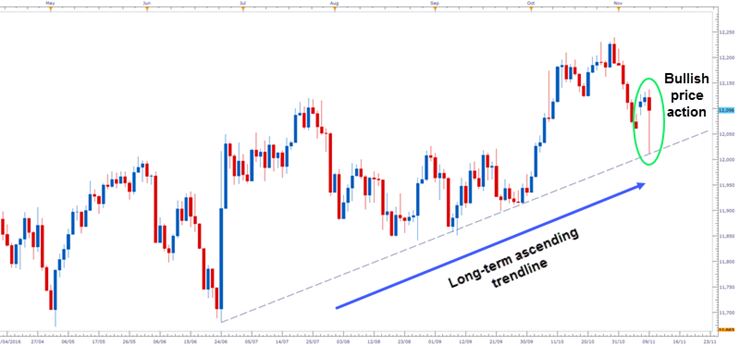

When viewed on the daily candle chart (see below) this move is particularly significant, because it forms some very bullish price action from a long-term ascending trendline.

The big question now is can the dollar bulls continue to push the greenback higher, back to its post-election highs?