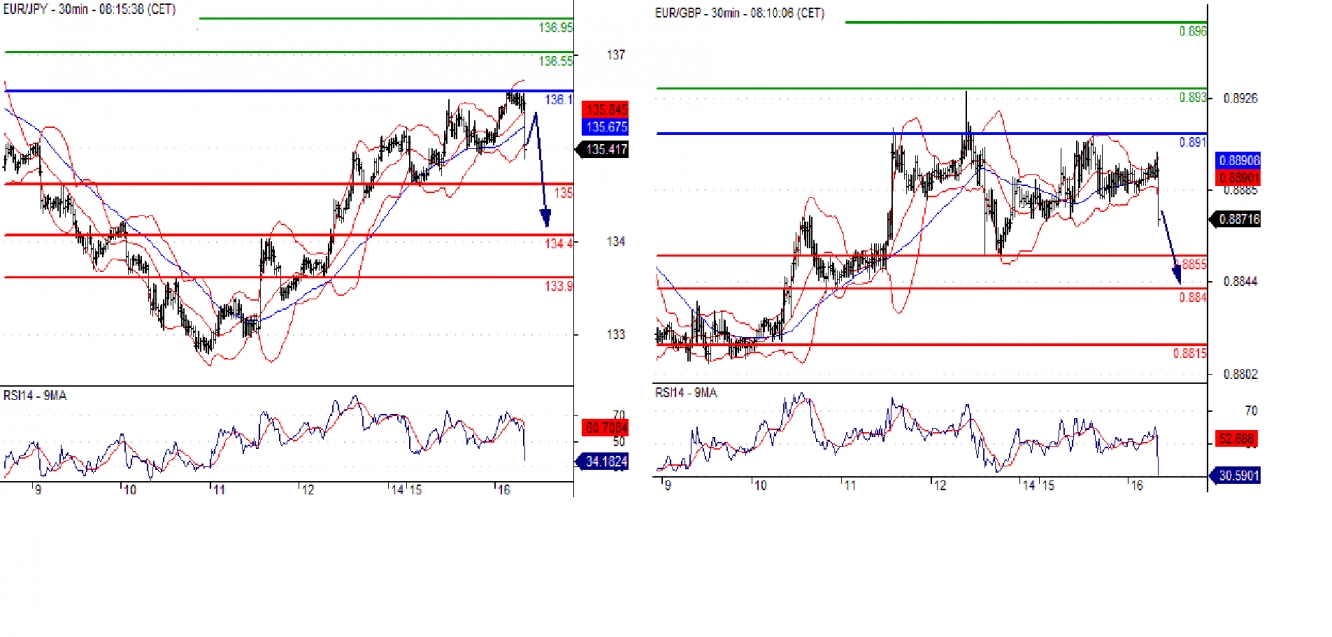

EUR/JPY Intraday: turning down.

Pivot: 136.10

Our preference: short positions below 136.10 with targets at 135.00 & 134.40 in extension.

Alternative scenario: above 136.10 look for further upside with 136.55 & 136.95 as targets.

Comment: the RSI shows downside momentum.

Supports and resistances:

136.95

136.55

136.10

135.40 Last

135.00

134.40

133.90

EUR/GBP Intraday: turning down.

Pivot: 0.8910

Our preference: short positions below 0.8910 with targets at 0.8855 & 0.8840 in extension.

Alternative scenario: above 0.8910 look for further upside with 0.8930 & 0.8960 as targets.

Comment: the RSI shows downside momentum.

Supports and resistances:

0.8960 ***

0.8930 **

0.8910 ***

0.8873 Last

0.8855 ***

0.8840 ***

0.8815 ***

AUD/USD Intraday: the upside prevails.

Pivot: 0.7940

Our preference: long positions above 0.7940 with targets at 0.7985 & 0.8015 in extension.

Alternative scenario: below 0.7940 look for further downside with 0.7920 & 0.7900 as targets.

Comment: the RSI is mixed to bullish.

Supports and resistances:

0.8040 ***

0.8015 **

0.7985 ***

0.7965 Last

0.7940 ***

0.7920 **

0.7900 ***

EUR/USD Intraday: under pressure.

Pivot: 1.2300

Our preference: short positions below 1.2300 with targets at 1.2185 & 1.2155 in extension.

Alternative scenario: above 1.2300 look for further upside with 1.2345 & 1.2395 as targets.

Comment: the RSI shows downside momentum.

Supports and resistances:

1.2395

1.2345

1.2300

1.2240 Last

1.2185

1.2155

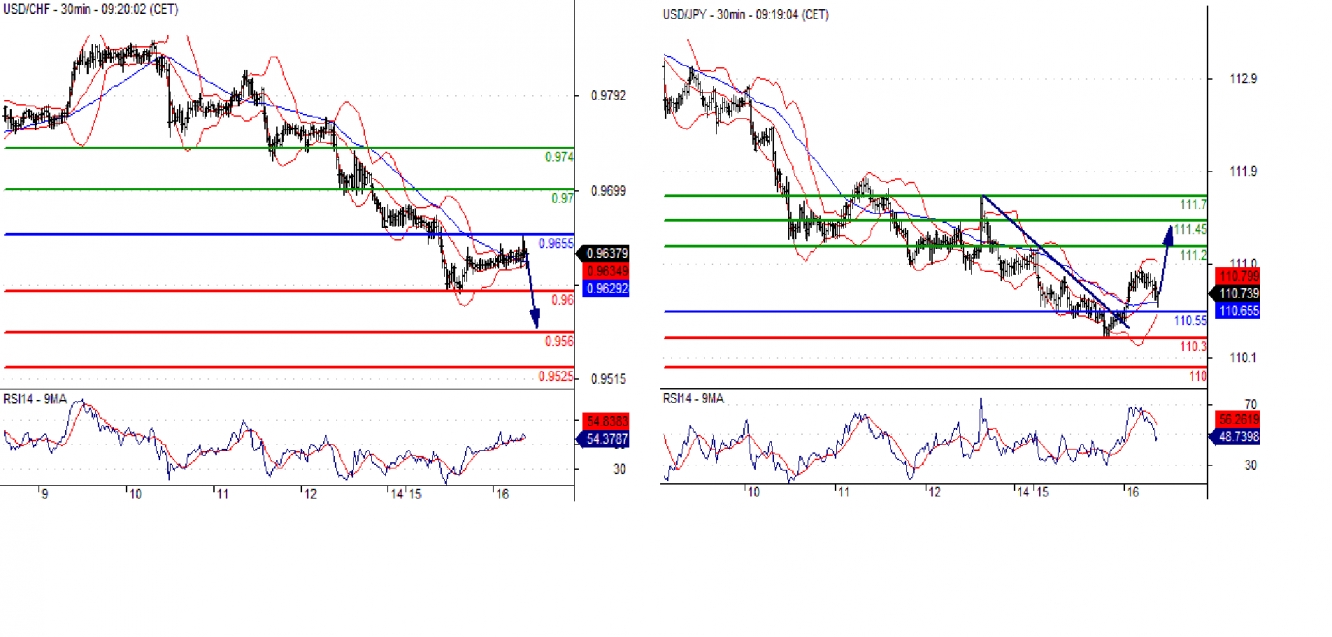

USD/CHF Intraday: under pressure.

Pivot: 0.9655

Our preference: short positions below 0.9655 with targets at 0.9600 & 0.9560 in extension.

Alternative scenario: above 0.9655 look for further upside with 0.9700 & 0.9740 as targets.

Comment: as long as the resistance at 0.9655 is not surpassed, the risk of the break below 0.9600 remains high.

Supports and resistances:

0.9740

0.9700

0.9655

0.9622 Last

0.9600

0.9560

0.9525

USD/JPY Intraday: the upside prevails.

Pivot: 110.55

Our preference: long positions above 110.55 with targets at 111.20 & 111.45 in extension.

Alternative scenario: below 110.55 look for further downside with 110.30 & 110.00 as targets.

Comment: the RSI is mixed to bullish.

Supports and resistances:

111.70

111.45

111.20

110.85 Last

110.55

110.30

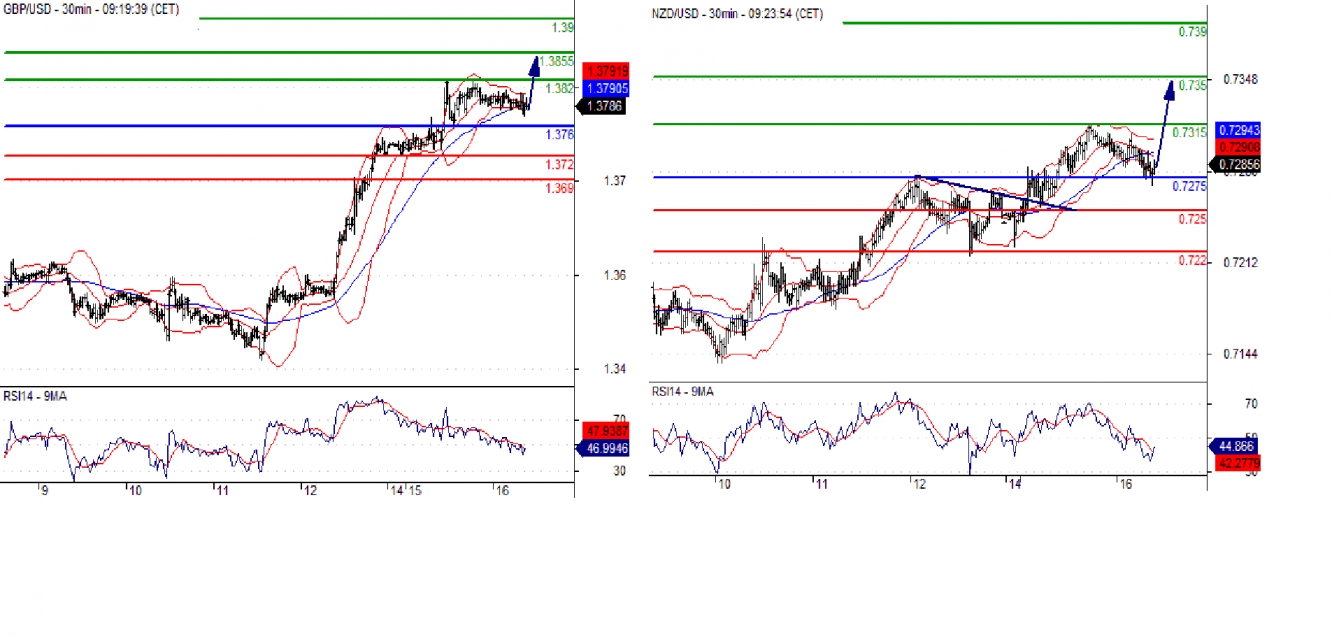

GBP/USD Intraday: bullish bias above 1.3760.

Pivot: 1.3760

Our preference: long positions above 1.3760 with targets at 1.3820 & 1.3855 in extension.

Alternative scenario: below 1.3760 look for further downside with 1.3720 & 1.3690 as targets.

Comment: the RSI lacks downward momentum.

Supports and resistances:

1.3900

1.3855

1.3820

1.3790 Last

1.3760

1.3720

1.3690

NZD/USD Intraday: caution.

Pivot: 0.7275

Our preference: long positions above 0.7275 with targets at 0.7315 & 0.7350 in extension.

Alternative scenario: below 0.7275 look for further downside with 0.7250 & 0.7220 as targets.

Comment: the RSI is mixed and calls for caution.

Supports and resistances:

0.7390

0.7350

0.7315

0.7297 Last

0.7275

0.7250

0.7220

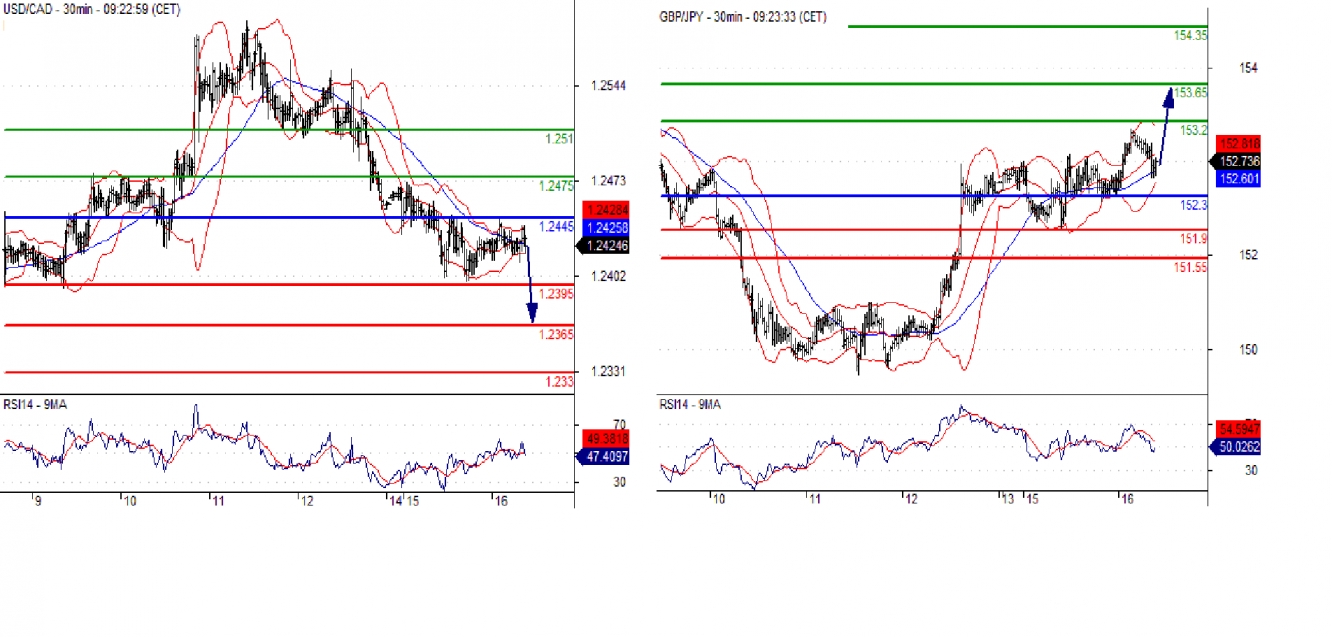

USD/CAD Intraday: consolidation.

Pivot: 1.2445

Our preference: short positions below 1.2445 with targets at 1.2395 & 1.2365 in extension.

Alternative scenario: above 1.2445 look for further upside with 1.2475 & 1.2510 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1.2445.

Supports and resistances:

1.2510

1.2475

1.2445

1.2420 Last

1.2395

1.2365

1.2330

GBP/JPY Intraday: the upside prevails.

Pivot: 152.30

Our preference: long positions above 152.30 with targets at 153.20 & 153.65 in extension.

Alternative scenario: below 152.30 look for further downside with 151.90 & 151.55 as targets.

Comment: the RSI shows upside momentum.

Supports and resistances:

154.35

153.65

153.20

152.80 Last

152.30

151.90

151.55

Crude Oil (WTI) (G18) Intraday: bullish bias above 64.10.

Pivot: 64.10

Our preference: long positions above 64.10 with targets at 64.90 & 65.40 in extension.

Alternative scenario: below 64.10 look for further downside with 63.70 & 63.10 as targets.

Comment: the RSI is mixed to bullish.

Supports and resistances:

65.80

65.40

64.90

64.46 Last

64.10

63.70

63.10

Gold spot Intraday: bullish bias above 1333.00.

Pivot: 1333.00

Our preference: long positions above 1333.00 with targets at 1349.50 & 1358.00 in extension.

Alternative scenario: below 1333.00 look for further downside with 1327.50 & 1322.50 as targets.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Supports and resistances:

1365.00

1358.00

1349.50

1338.89 Last

1333.00

1327.50

1322.50