The Currency Score analysis is one of the parameters used for the Ranking and Rating list which was published already this weekend. Besides this chart I also provide my weekly analysis on my strategy and the Forex ranking and rating list which is available 3 times a week on this blog.

The favorite pairs in the Top 10 of this list are being analyzed in more detail here. This article will provide my analysis and the FxTaTrader Currency Score chart which is my view on the 8 major currencies based on the Technical analysis charts using the MACD and Ichimoku indicator on 4 time frames, the monthly, weekly, daily and 4 hours. See for full details the page Currency score explained on my blog FxTaTrader.com. The calculation of the Currency Score difference will not be published. Please check the article Forex Currency Score Wk 50 and the previous ones for the examples.

- The classification of the currencies from a longer term perspective are provided at the bottom of this article for reference purposes.

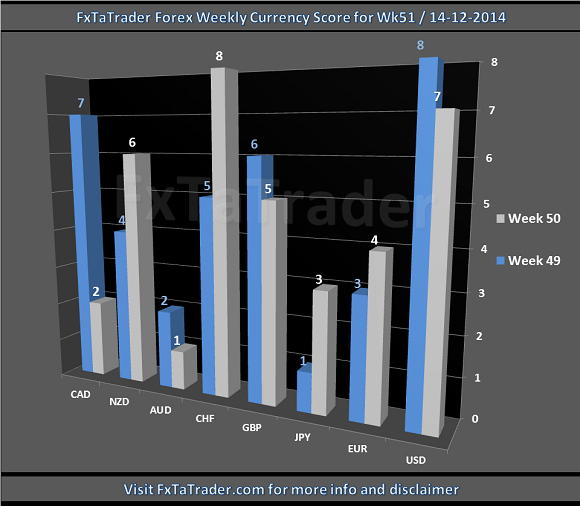

- There are a lot of changes this week as can be seen in the screenshot.

- The CHF, USD and the NZD are currently the stronger currencies. The AUD, CAD and the JPY are the weaker currencies. The best pairs to look at are combinations of those currencies.

- Currencies with a score of 4 and 5, these are this week the EUR and the GBP are difficult to trade because they are in the middle of the range. Being in the middle of the range means the currency has no clear direction when looking at the whole market and it can easily go in any direction at any time. It is better to have a currency with some momentum in a certain direction because it is then clear how to trade this currency.

- Conclusion for going long is that for the coming week it seems best to go long with the CHF, USD and the NZD. However the NZD is an average performer from a longer term perspective so it does not have the preference unless the currency score difference is significant ( >3).

- For the weaker currencies the conclusion is that for the coming week it seems best to go short with the AUD, CAD and the JPY. However the CAD is an average performer from a longer term perspective so it does not have the preference unless the currency score difference is significant ( >3).

The fact that e.g. the EUR and the GBP are in the middle of the range is something to keep in mind. Also, some currencies have a different classification from a longer term perspective which differs from the Currency score of the week and this is something to keep in mind too.

There are some rules for taking positions according to the FxTaTrader Hybrid Grid Strategy. The strategy can open multiple positions of a currency pair but each currency may only be present once in the pairs chosen for trading. It means that not all the possible positions for this coming week can be opened. For more information see FxTaTrader Hybrid Grid Strategy.

Another rule is that a pair outside the Bollinger Band in the Weekly chart is considered overbought/oversold. No positions are taken for these pairs until they are no more overbought.

Depending on the opportunities that may come up the decision to trade a currency may become more obvious at that moment.

Last week (pending) orders were placed for the EUR/CAD, USD/CAD and the GBP/AUD with, unfortunately, loss 3x EUR/CAD and profit 2x USD/CAD and 1x GBP/AUD. See the Performance page on my blog for more details. More details on the traded pairs will be provided in my strategy article that will be published also this weekend. The possible positions for coming week for the strategy will then also be described.

In the previous weeks we looked into the weaker, stronger and average performing currencies from a longer term perspective using the data of the Currency Score. We also looked into the Currency Score difference. The conclusion was in brief:

- a stronger currency can be traded against a weaker and average performing currency.

- a weaker currency can be traded against a stronger and average performing currency.

- the average performing currencies can be traded against the stronger and weaker currencies.

- only trade the average performing currencies against each other when a clear trend is being developed. The Currency Score difference may support this view.

For more information the article "Currency score explained" explains in full detail how the currency score is being generated. In my previous articles various aspects have been analyzed as described above.

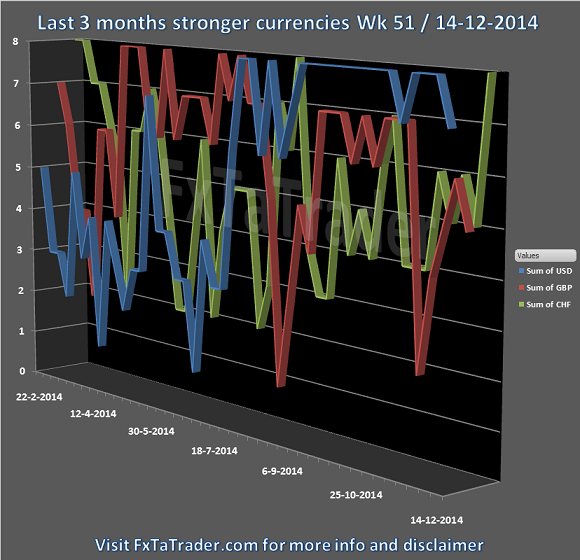

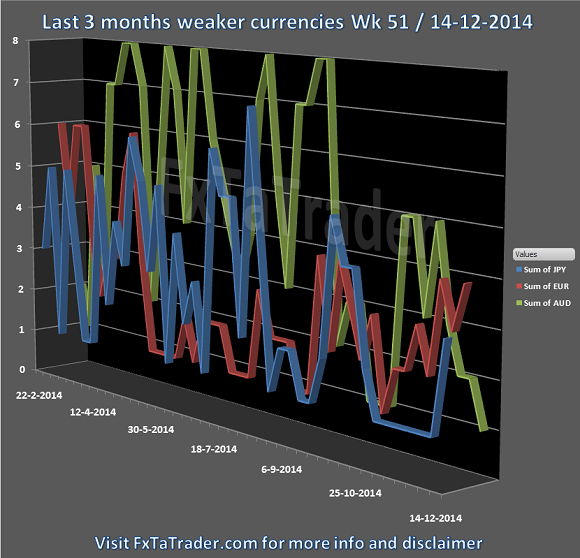

Last 3 months currency classification

All preferred combinations comply to the guide lines which define what type of currency, strong/average/weak, can be traded against the other. These are classifications from a longer term perspective where 3 months is being used as a reference. The currencies are classified for the coming week as following:

- Strong: USD / GBP / CHF

- Average: NZD /CAD

- Weak: JPY / EUR / AUD

This time I added the stronger and weaker currencies. For the average perfroming check my article of previous week Forex Currency Score Wk 50. There has been some changes during this week and this can be seen by checking the currency charts present in this article. The CHF has become a stronger currency compared to last week and the AUD a weaker currency.

This weekend I will also provide the weekly review on my FxTaTrader Hybrid Grid strategy. Good luck to all and have a great trading week.

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you like to use this article then mention the source by providing the URL www.FxTaTrader.com or the direct link to this article.

Disclaimer: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours.