This article provides the Currency Classification for the coming weeks based on my analysis for the 8 major currencies. This is based on the technical analysis charts using the MACD and Ichimoku indicator on 4 time frames: the monthly, weekly, daily and 4 hours. The result of the technical analysis are the Currency Classifications charts in this article.

Last 3 months currency classification updated on Week 20, 15 May 2016

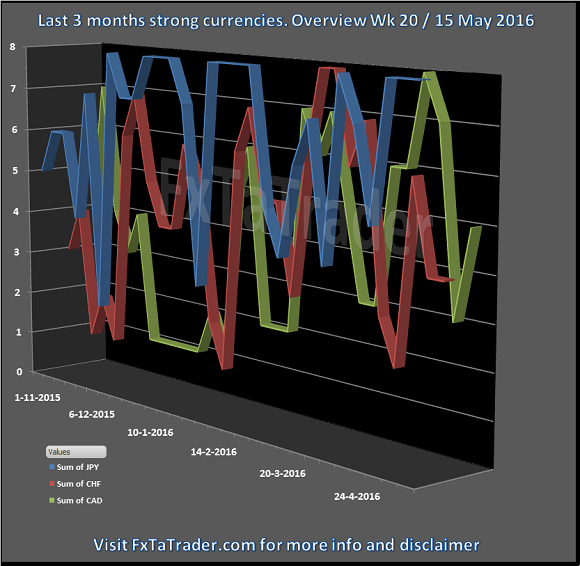

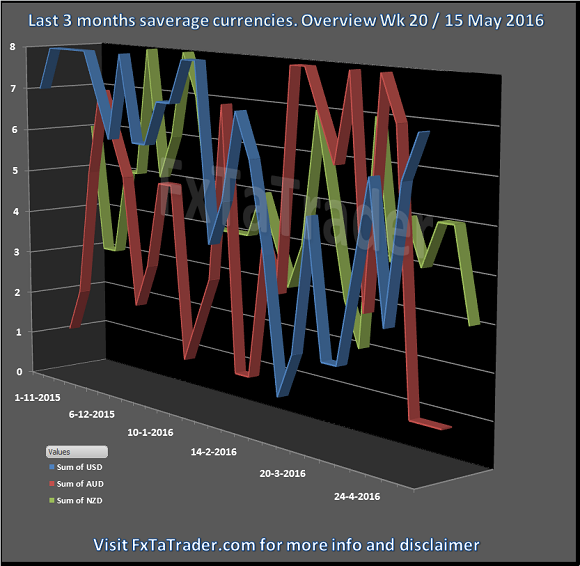

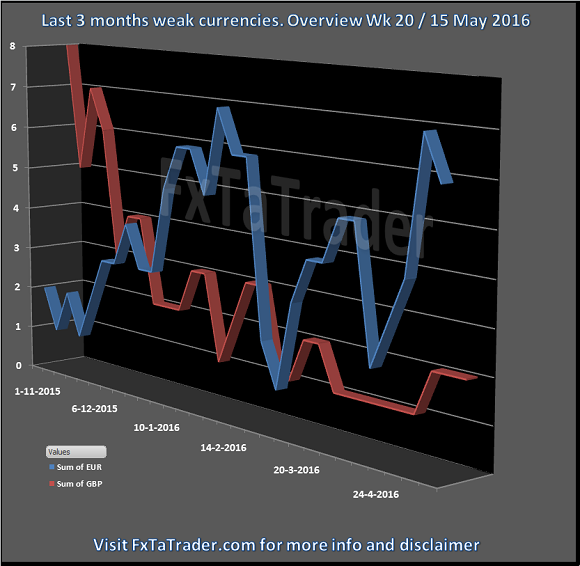

The last 3 months currency classification from a longer term perspective are provided here with the new charts:

- Strong: JPY / CAD / CHF. The preferred range is from 6 to 8.

- Average: USD / AUD / NZD. The preferred range is from 3 to 5.

- Weak: EUR / GBP. The preferred range is from 1 to 2.

The AUD and the CAD switch places. More information can be read in this article and in the articles "Forex Strength and comparison" of this week.

Here below are the charts providing the Currency classifications. There are three charts showing resp. the strong, average and weak currencies.

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. When trading according to the FxTaTrader Strategy some rules are in place. Depending on the opportunities that may come up the decision to trade a currency may become more obvious at that moment. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments.