The Japanese yen (FXY) is the one major currency that has been notably weaker than the U.S. dollar for most of the past month. USD/JPY peaked in December, 2016, but it looks like the sell-off bottomed out in April.

Against the U.S. dollar, the Japanese yen was never able to reverse the Trump bump as other currencies did. USD/JPY last bottomed in April.

This yen weakness has been particularly evident against strong currencies, like the euro (Guggenheim CurrencyShares Euro (NYSE:FXE)), where April formed a sharp and abrupt trough.

Against the euro, the Japanese yen has suffered mightily. EUR/JPY now trades at a 17-month high.

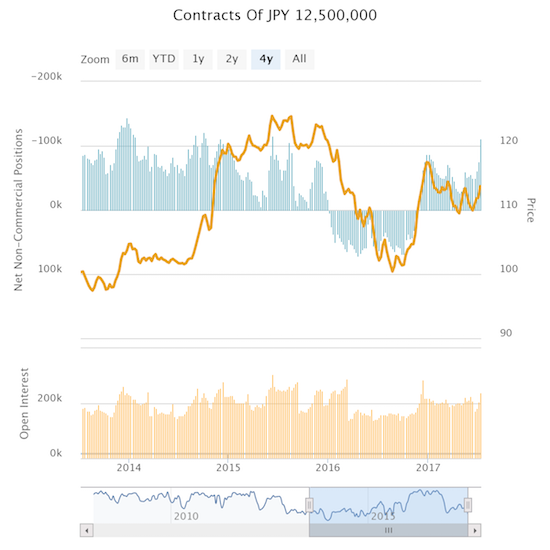

Speculators have finally seen enough. Since speculators last flipped from net bulls to net bears in December, April turned into the trough of bearish sentiment. Speculators re-accumulated net shorts slowly but surely until the latest week. Speculators rushed for shorts to the tune of -112,125 contracts, a level last seen in June, 2015. Net short contracts were -75,036 the previous week.

Speculators ramped up bets against the Japanese yen to levels last seen a little over two years ago (June, 2015).

This extended weakness caught me by surprise, but it makes sense give the Bank of Japan’s willingness to remain quite dovish even as other major central banks begin to turn their backs on further monetary easing. The Bank of Japan delivered the market a stern reminder that it is not ready for higher bond yields when on July 7th, the BoJ announced “it would buy an unlimited number of 10-year JGBs at a yield of 0.110 percent, and it increased the size of its regular buying of five- to 10-year JGBs by 50 billion yen ($439.96 million) to 500 billion yen…” (see CNBC). The 30-year and 40-year JGBs had hit yields not seen since since February of 2016. Even the 10-year had crept up to a 5-month high. Clearly, the market was trying to anticipate a (marginally) more hawkish BoJ given Japan’s relatively good economic performance and the global environment of tightening central banks.

I have been more focused on reasons to get long the yen, especially as a hedge against bullish sentiment in financial markets. However, the BoJ’s action convinced me to stand down a bit and focus on more shorting opportunities. While there is likely not a lot more room for speculators to get even more bearish on the yen, I also do not expect them to retreat anytime soon. For example, the yen looks too good as a funding currency for carry trades. From a technical standpoint, I love shorting the yen against the euro the most. It helps that I remain a euro-bull.

Be careful out there!

Full disclosure: net long the Japanese yen, long the euro