Just three weeks ago, speculators sent their bullishness on the Canadian dollar to a 4-year high. I followed along with the speculators and accumulated a short USD/CAD position. Two weeks passed before the payoff. It arrived in the form of an anti-dollar reaction to a rate hike from the U.S. Federal Reserve.

The U.S. dollar is still in breakout mode against the Canadian dollar but the USD/CAD post-Fed sell-off may have capped the breakout.

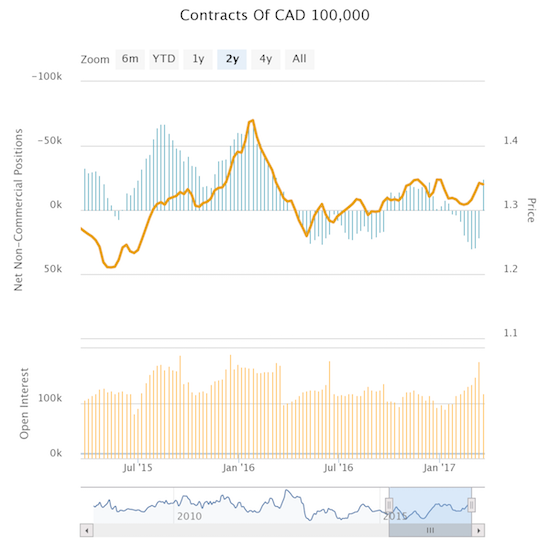

With USD/CAD seemingly ready to retest support at its 200-day moving average (DMA), speculators flipped the script to net bearish on the Canadian dollar (NYSE:FXC).

Speculators abruptly switch to net short from net long on the Canadian dollar (FXC).

I do not have a ready catalyst to explain the sudden change in heart except to say that I think the post-Fed sell-off in the U.S. dollar was way overdone and the dovish Bank of Canada should be the dominant trading themes for USD/CAD. Given my stubborn outlook on the U.S. and Canadian dollars, I was quick to start buying USD/CAD upon seeing the speculator change in heart.

The one caveat to the switch in sentiment is in the open interest. Note how open interest fell to a 5-week low. This drop likely indicates that the switch in sentiment largely occurred from bulls closing out contracts rather than bears loading up. Regardless, like the last USD/CAD trade, I will be accumulating a (long) position with the assumption that a pay-off sits not too far off in the future. I will re-evaluate the position if USD/CAD closes significantly below its 50 and 200 DMAs.

Be careful out there!

Full disclosure: long USD/CAD