I may have flipped outright bearish on the U.S. dollar index (DXY0) just in time.

The U.S. Dollar Index (DXY0) confirmed a breakdown below support at its 200-day moving average (DMA). The dollar is also completing the same post-election reversal so many other financial assets and indicators have done.

My change in sentiment started with my increasing bullishness on the euro (NYSE:FXE). With the euro constituting about 51% of the U.S. dollar index, I realized that it would be hard to remain bullish on the dollar overall while adopting euro-bullishness. I completed my flip to dollar bearishness last week as I stepped back and looked at the United States from the eyes of a currency trader who does not live here.

The chart above validated my assessment: the U.S. dollar lost 1.0% as it plunged through its critical support at its 200-day moving average (DMA). The 6-month low essentially finished the dollar’s reversal of all its gains in the wake of the election of President Donald Trump. Over the past few months, I have chronicled this kind of reversal as a recurring theme across an array of asset classes. The dollar’s reversal added an exclamation point to these observations.

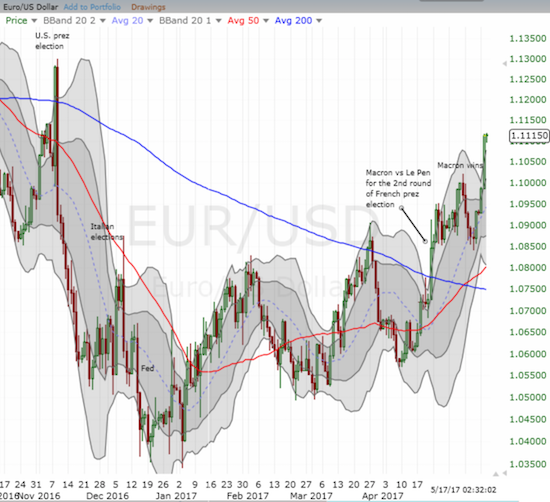

The dollar’s loss was largely driven by a huge move by the euro (FXE). The breakout for EUR/USD validated my latest buying strategy to accumulate long euro positions as traders continued to sell the news of the French Presidential election. I used the breakout to lock in profits on my euro long positions and reset for the next buy-the-dip opportunity.

The euro had a particularly good day against the U.S. dollar index. EUR/USD surged past the post-election peak in a move that continues the upward momentum from the Dec/Jan lows.

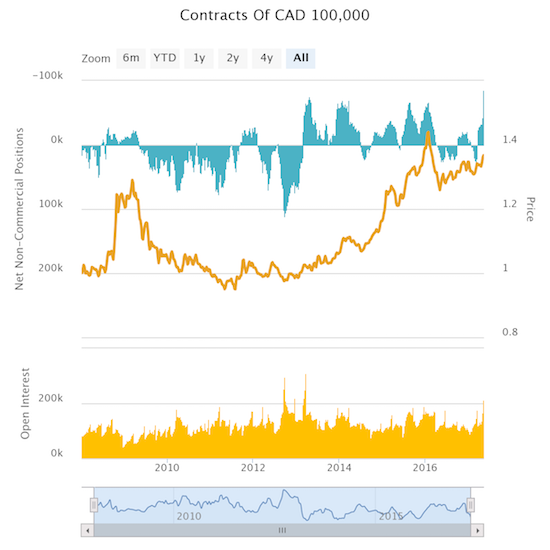

The breakdown of the U.S. dollar also makes the Canadian dollar (NYSE:FXC) an even more interesting play. Early last week I pointed out how bears were ramping up bets against the Canadian dollar. The latest data on the Commitments of Traders shows that currency speculators rushed to their largest net short position against the Canadian dollar since at least 2008. This surge in bearishness is driving head first into the breakdown of the U.S. dollar and may have become a crowded trade at the worst possible time.

Currency speculators have suddenly gone “full bear” against the Canadian dollar (FXC). Net short contracts have not been this high since at least 2008.

On Monday, USD/CAD finally broke down through the recent range of congestion. I locked in profits from my short USD/CAD position, and I am refreshing for the next short entry point. While I think the bears on the Canadian dollar have chosen an inopportune time to get so aggressive, I still recognize that this same positioning could be warning of something down the road that I am not yet fully appreciating.

USD/CAD has trudged higher for a year now. Is the general uptrend finally coming to an end?

The bottom-line is that the currency market is significantly diverging from the generally benign and bullish assessment of the setup in the United States for trades. The U.S. stock market certainly does not need to follow the dollar lower, but the earlier rally in the dollar was cited by many observers as confirmation of general bullishness on the United States. I contend that the time for giving the U.S. a free bull pass has come to an end…

Be careful out there!

Full disclosure: no positions