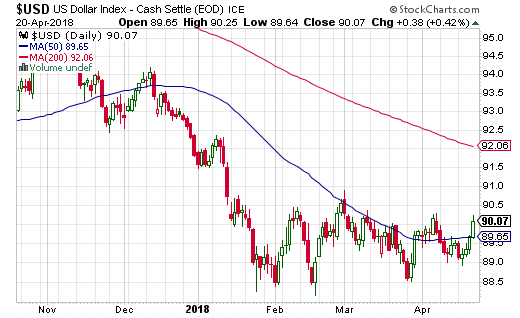

It seems the U.S. dollar index (USD) has stopped going down. Since careening to its lows in January, the U.S. dollar has bounced up and down through a well-defined range.

It is starting to look like the U.S. dollar index (USD) has stopped dropping.

Source: Stockcharts.com

The U.S. dollar gained in each of the last 4 trading days as part of its latest run-up toward the top of its trading range. This renewed strength enhanced a surge of weakness in the Mexican Peso ahead of a Presidential debate this weekend.

The Mexican peso weakened significantly going into the end of the week. USD/MXN was at one point up a whopping 3.6% for the week before falling back to its converged 50 and 200DMAs.

Based on this surge, my exit from my short USD/MXN position came just in time. At the time, I pointed out that the risk/reward favored a relief rally for USD/MXN. Now that this rally has happened, I am eager to get in short again. I assume that the debate passing without “incident” will help assuage whatever fears went into the event's driving a rush to the peso’s exits.

However, I will be patient. The U.S. dollar may break out above its trading range sometime soon based on increasing bond yields in the U.S. Moreover, NAFTA-related headlines could also cause dramatic swings in USD/MXN. So, I will likely wait until the 18.8 to 19 range before considering a fresh short. A USD breakout will make me less inclined to short USD/MXN. I do not want to sustain a long in the pair because of its high carry (interest rate).

Be careful out there!

Full disclosure: no positions