The Bank of Japan kept stimulus unchanged on Tuesday, sparking a sell-off in the USD/JPY and sending the currency below the 102 level. Meanwhile, stock markets recovered from a 3-day stretch of losses to post mild gains amid the start of earnings season.

Looking at the fundamentals this week, we see potential opportunities developing in the GBP/USD and USD/JPY.

GBP/USD

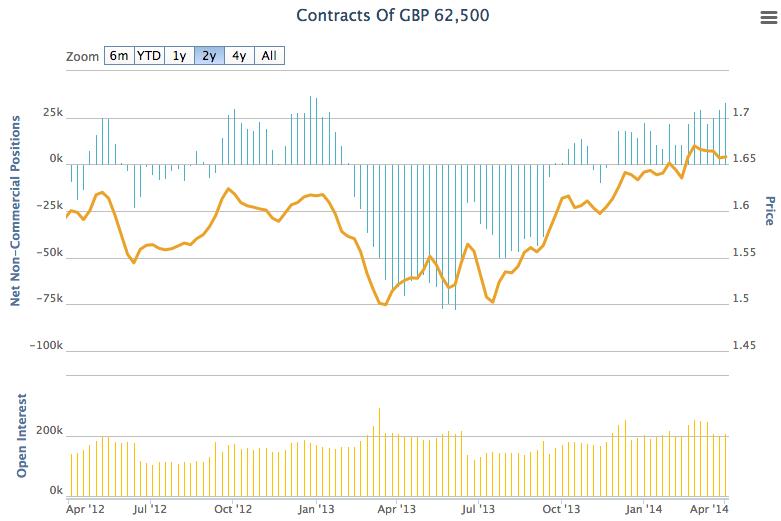

The Commitment of Traders (COT) report is released by the CFTC (US Commodity Futures Trading Commission) each Tuesday and provides an up to date breakdown of open positions in a wide number of futures markets. It’s useful for analysis as it allows us to see how commercial and non-commercial traders are positioned in the market and this data can often be used to find turning points.

This week’s data for GBP/USD indicates that non-commercial traders have become the most bullish since December 2012. Net non-commercial positions increased to 33,572 contracts and have now increased for 4 weeks in succession.

Meanwhile, the GBP/USD has moved up to 1.675 although the currency has not been able to take out it’s previous high of 1.6824. This is despite the rise in longs by non-commercial traders. The price action therefore suggests that the GBP/USD is toppy here and open position data also suggests that the market is becoming increasingly one-sided. the 1.68 looks to be a good area for short traders.

USD/CAD

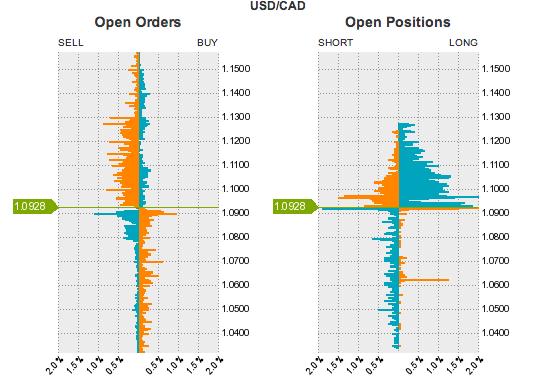

The open position ratio for the USD/CAD looks relatively well balanced with 59% of open positions long positions and 41% short. This alone is not enough to make any assumptions, however, a closer look into the order book shows a more bearish than bullish outlook.

As you can see from the chart, there are significantly more open orders that are short orders than there are long orders. In other words, traders are looking to short the USD/CAD and there is more support for bearish positions.

Likewise, there are very few open long positions below the market and this is despite the open position ratio of 59:41 discussed earlier. This gives further indication that the USD/CAD could continue to drop over the short term horizon.