Jackson Hole Central Bankers Symposium starts today.

From the U.S., Manufacturing PMI and New Home Sales were worse than expected. Also, Chicago manufacturing data undershot economists’ forecasts.

German Manufacturing PMI better than expected but German ZEW Economic Sentiment again worse than the expectations (for the 4th time in a row): the ZEW research institute said its monthly survey showed its economic sentiment index fell to 10.0, the weakest reading since October.

Fed’s policymakers agreed a fall in longer-term inflation expectations would be undesirable. They disagree on whether inflation expectations were well-anchored. Most of them expected inflation to pick up in next few years, but many saw rising chances of inflation remaining below target (2%).

Eurozone CPI data came as expected while last German GDP (Preliminary release) was worse than expected.

Last U.S. Core Inflation figures ticked down again (for the fourth time in a row). Also, U.S. PPI (another Inflation data) worse than expected.

On the other hand, the ECB's big dilemma is that while the euro zone economy has grown for 17th straight quarters and employment is rising faster than expected, wage growth remains anaemic, keeping a lid on consumer prices. Economists are now trying to figure out whether wages are showing an unexpectedly delayed response or whether wage setting dynamics may have fundamentally changed in the post-crisis, globalized economy.

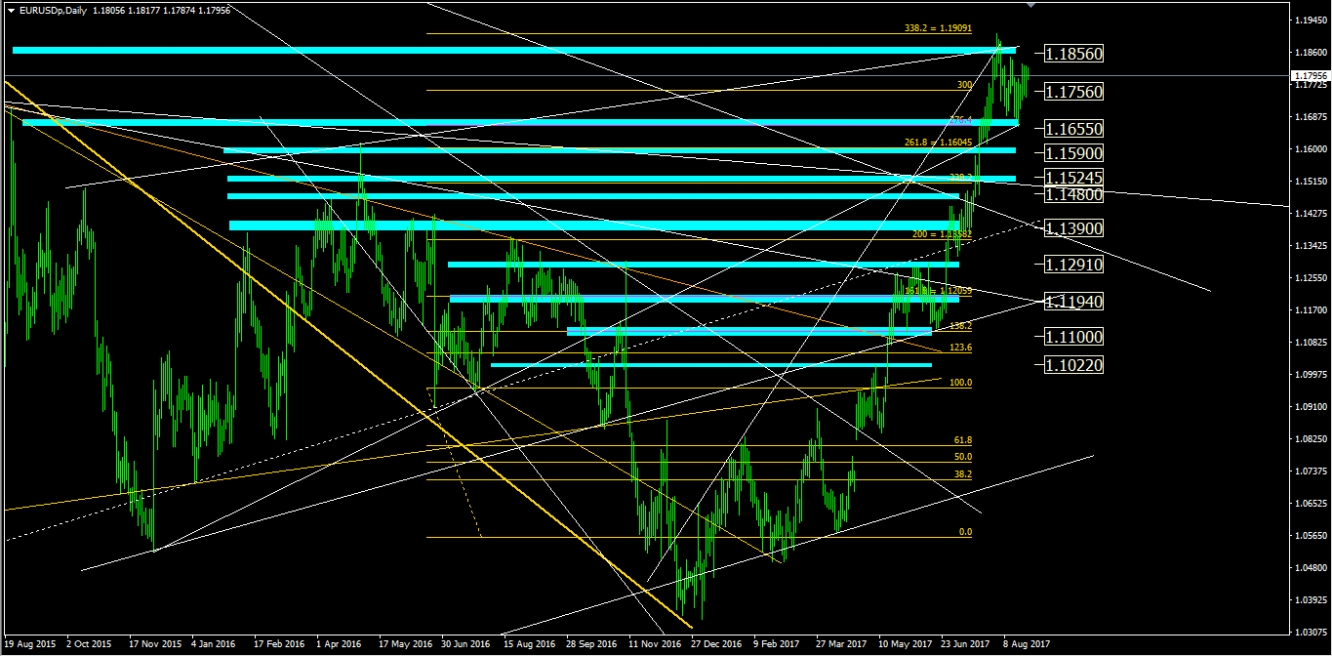

We are now on an important Resistance area. As we wrote previously, we expect both a re-test back to 1.1756 and the continuation of this retracement down to 1.1655 (First important Support, tested first time on the 17th).

Our special Fibo Retracement is confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Overbought

1st Resistance: 1.1756

2nd Resistance: 1.1856

1st Support: 1.1655

2nd Support: 1.1590

Jackson Hole Central Bankers Symposium starts today. Eyes on UK GDP (Preliminary release) as well.

Uncertainty over the economic agenda of U.S. President Donald Trump and doubts that the Federal Reserve will deliver a third rate hike this year have fed into recent dollar weakness. Furthermore, Federal Reserve policymakers were split on the outlook for future rate hikes, as Fed members struggled to balance concerns about the slowdown in inflation with the growth in the labor market.

On the other hand, ongoing expectations that the Bank of England will keep interest rates on hold in the coming months amid concerns over the economic fallout from Brexit. UK Retail Sales better than expected and UK Job Market better than expected too: UK unemployment falls to lowest since 1975.

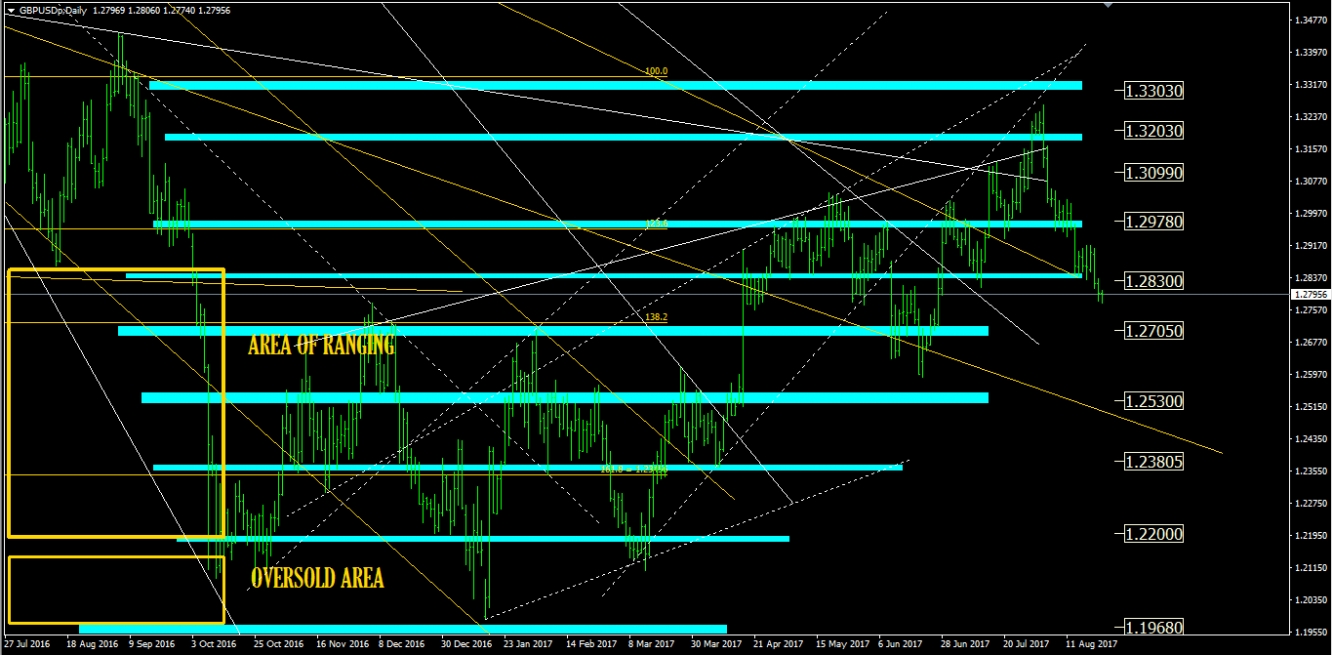

As we expected, the break below 1.2978 led GBP/USD straight down to our Support 1.2830. We still are bearish until 1.27 area, but a consolidation around 1.283 is occurring.

Our special Fibo Retracement is confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2001:

Weekly Trend: Bearish

1st Resistance: 1.2978

2nd Resistance: 1.3099

1st Support: 1.2830

2nd Support: 1.2705

Jackson Hole Central Bankers Symposium starts today.

Oil prices turned higher after data from the U.S. Energy Information Administration showed that domestic crude supplies fell less than expected last week, but that gasoline stocks declined far more than forecast.

Earlier, Oil prices were pressured and fell on concerns of oversupply as Libyan output recovers weighed down by concerns amid ongoing global supply glut concerns.

Last Australia Employment Change was seen better than Expected but Full Employment Change was negative. The Reserve Bank of Australia minutes painted a possible stronger than expected growth spurt in the coming year in an otherwise light data day with North Korea a bit toned down on firing missiles at or near U.S. territory Guam.

Turbulence surrounding U.S. President Donald Trump’s administration following the backlash over his statements on the white supremacist rally in Charlottesville. Market players see the recent political turmoil as an obstacle to Trump being able to follow through on infrastructure spending and tax reforms.

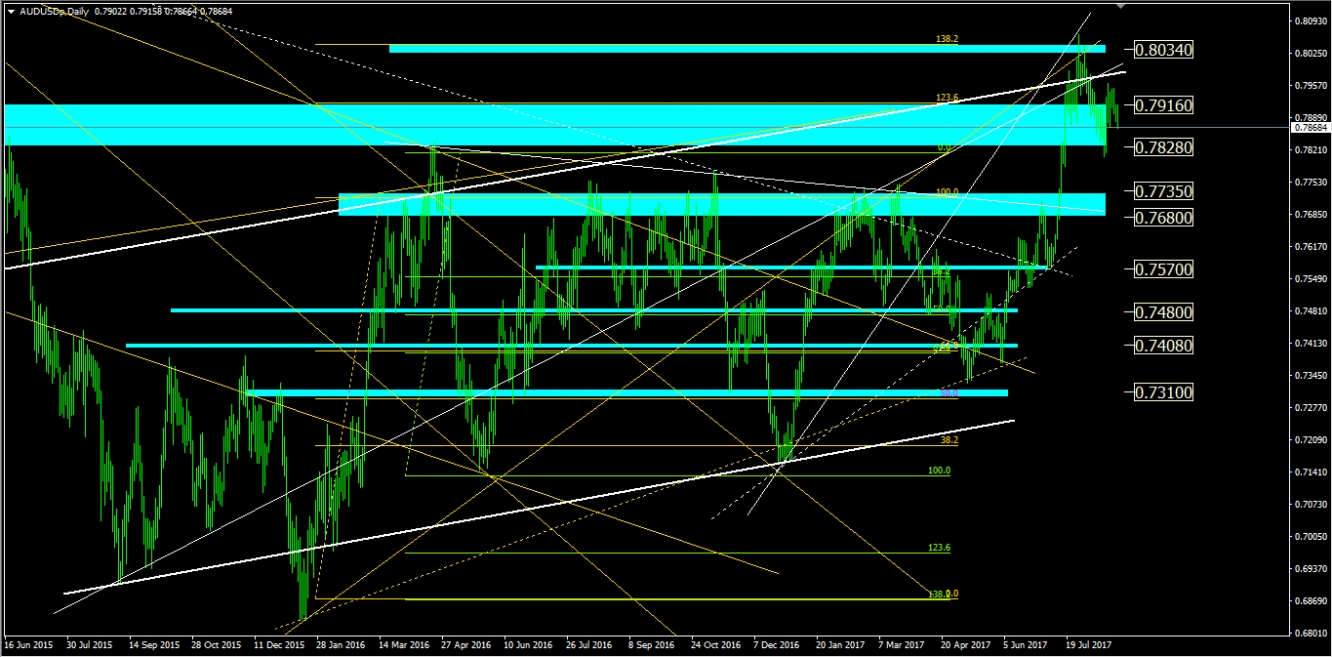

As we wrote previously, breakout of 0.7916, important level, led down to 0.783 area, our first target. Now 0.7916 Resistance area should push price down again. We are still bearish until 0.774 area, but first 0.783 has to be successfully violated again.

Our special Fibo Retracements are confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Overbought

1st Resistance: 0.7916

2nd Resistance: 0.8034

1st Support: 0.7828

2nd Support: 0.7735