NZD/JPY continues to fall after the violation of the accumulation area between the key support level 79.00 and the 61.8% Fibonacci retracement of the previous sharp upward impulse from the start of November. The breakout of this zone accelerated the active minor impulse wave 3, which belongs to the intermediate correction from the middle of February. NZD/JPY should continue to descend to the next short target at the support level 77.00.

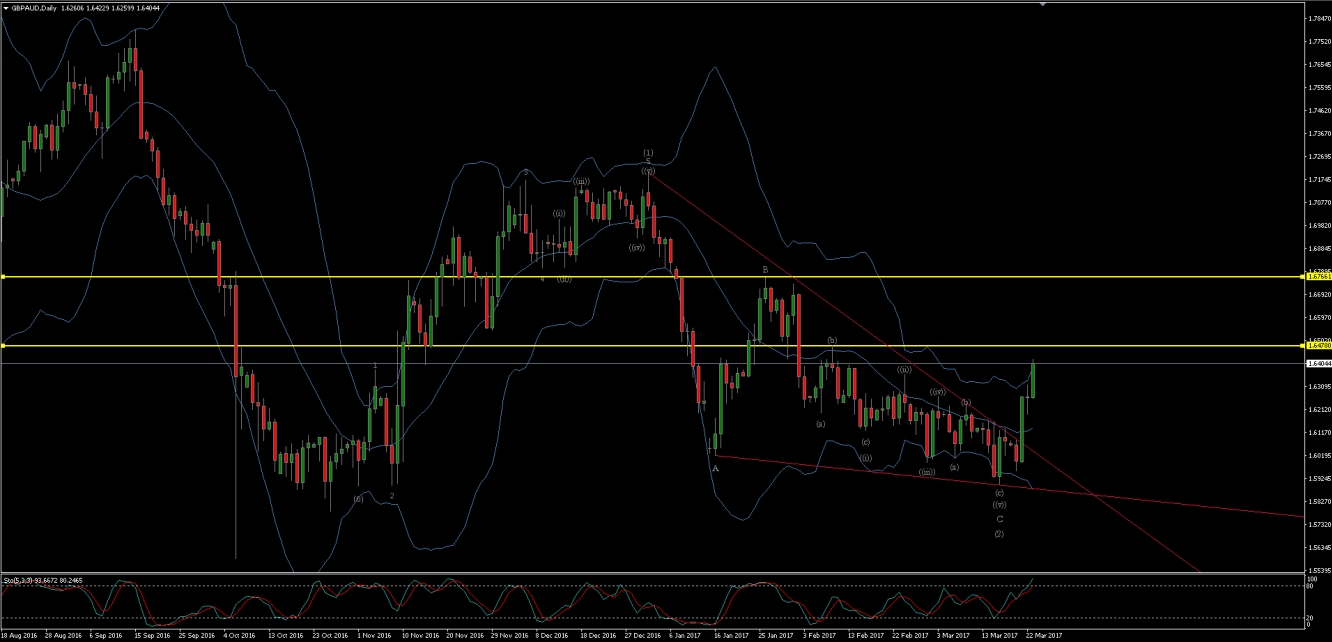

GBP/AUD reached the resistance level 1.6360 after breaking through the resistance trendline of the wide daily falling wedge, which accelerated the active intermediate impulse wave (3), started from the key support level 1.5930. The decise break-out of the resistance level 1.6360 could project GBP/AUD to the next buy targets at the resistance levels 1.6480 and 1.6720.

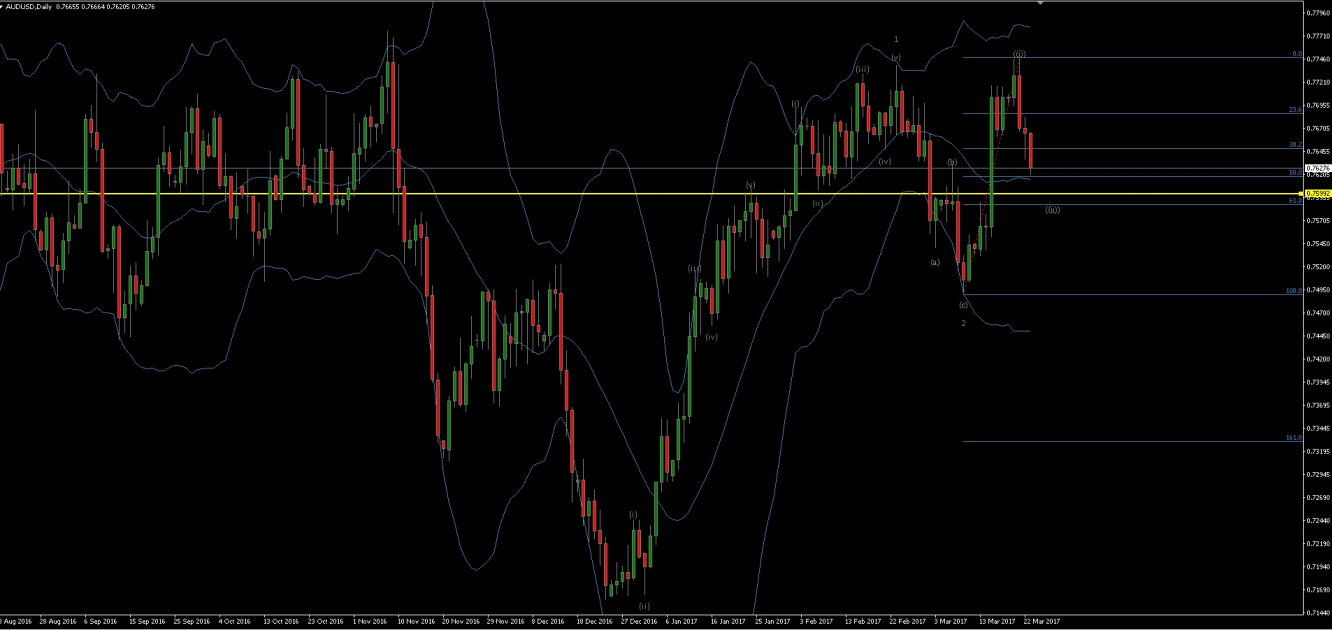

AUD/USD is correcting downward inside the minor corrective wave (ii), started when the pair inverted down from the powerful resistance level 0.7720. The downward reversal from this resistance level created the daily Japanese pattern bearish engulfing. AUD/USD should reach the next short target at the support level 0.7600.

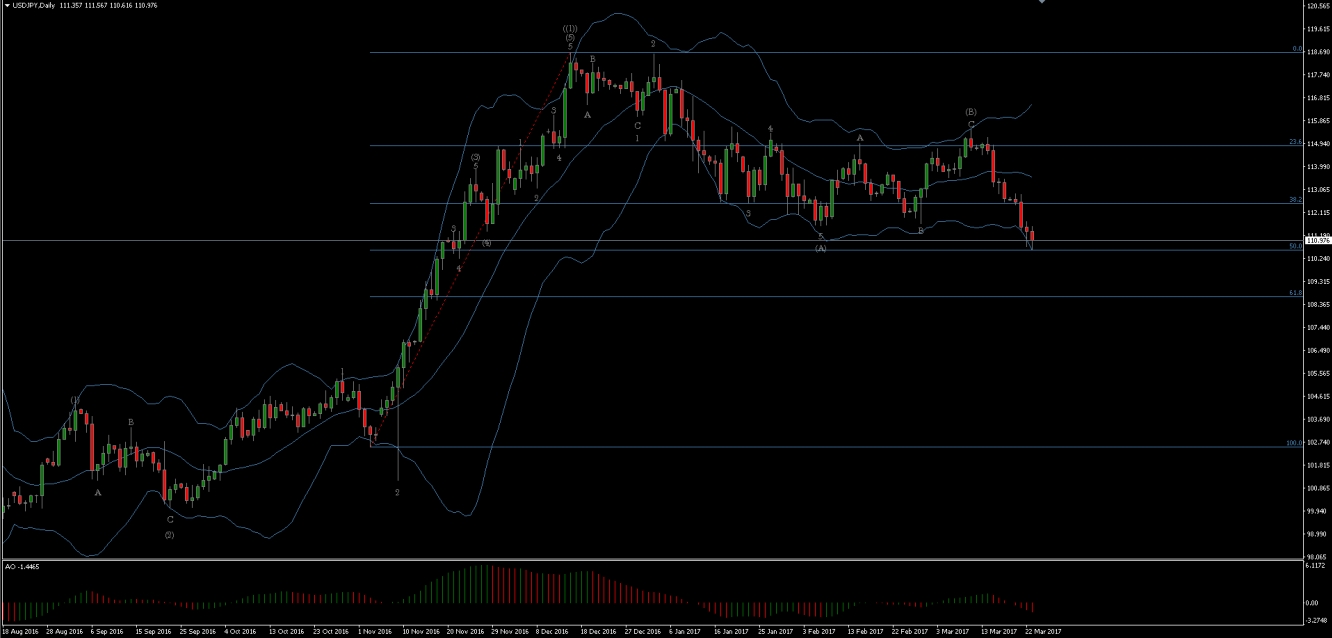

USD/JPY moves downward after the earlier violation of the demand area between the support levels 112.60 and 111.60, further strengthened by the 38.2% Fibonacci retracement of the previous bullish impulse from the start of November. The breakout of this zone accelerated the active minor impulse wave 1, which belongs to the active intermediate correction from the start of the month. USD/JPY should continue to fall to the next short target at the support level 110.00.