If you would like to learn about the Turkish housing market, you should visit Upton Park in East London tomorrow.

Let me start with the song that was the inspiration for my column. I share the “original” version, but a reader’s reaction to the column was “Cockney Rejects“, referring of course to the English punk rock group’s version. No need to say they are West Ham fans, I guess:)

The chant itself is part of an American song from 1919. Nothing like the West Ham version, right:) But the original song explains some aspects of the Turkish housing bubble I did not get to mention in the column but have referred to several times in earlier columns. The first lines of the song are: ” I’m dreaming dreams I’m scheming schemes I’m building castles high.” That sums up the ruling Justice and Development Party’s (AKP’s) and PM Recop Tazyik Gazbogan’s approach to the construction sector, especially residential housing. A recent Bloomberg article titled “Erdogan’s Edifice Complex“:) summed it up well, and I mentioned why economists were not surprised that the sector is deeply involved in the graft scandal. And it is not just housing: Gazbogan is obsessed with building airports whereas Turkey’s peers are building airplanes.

The adjustment in the housing market that I predict in the column may have already begun: Sales of builder Emlak REIT, whose majority shareholder is state-owned public housing development administration (TOKI), plummeted in January (compared to same period last year). Bloomberg quotes an official at the firm saying that there were new projects last January whereas there are none now, but that in itself is quite telling.

Incidentally, Emlak REIT (EKGYO) is one of the two publicly-traded Turkish companies I am getting lots of questions from foreign investors- the other is of course Halk Bank, the state bank that uses shoeboxes instead of safes:) Investors are well aware that Emlak’s business model of getting Treasury land via TOKI is semi-legit at best. The company will make good returns while the music plays, but investors are worried that the music could stop soon, either with AKP/Gazbogan trying to stay low for a while, or in the longer run, a new government putting a stop to such shenanigans. In fact, foreigners’ share at Emlak REIT, which had hit 70 percent after its secondary public offering in November, is now around 63 percent.

Moving on, I need to mention important data issues: My buddy Sinan argued the following in Facebook in response to my column: “… real estate market, esp commercial, is very very inelastic in a synthetic kind of way. Builders go the extra mile to make sure the transaction value does not fall. Say an apt goes for USD500K and nobody’s buying. Instead of decreasing the price to USD400K, they give you extras such as a car worth USD100K. This is mainly done to prevent the public to think prices are decreasing. This I know from the US market but I am pretty sure Turkish builders are doing or will do similar things when the conditions dictate…”

Friends and relatives who bought houses in the last few months did not report something like that happening when I asked them after reading Sinan’s comments, but there is another issue where he is spot on: As far as I know, REIDIN reports ask prices, not actual transaction prices. Besides, transaction prices tend to be under-reported in Turkey for “tax purposes”, although this is not as common nowadays as it used to be. However, I don’t see these issues affecting the data in a significant way. After all, we are looking at an index, not actual prices, and so as long as the ask-transaction spread and the degree of under-reporting are the same, we’ll be OK. But it is likely that the spread between ask and transaction prices would widen when the economy is not doing well. In that case, house prices would be over-reported in bad times and/or the adjustment would be delayed in the statistics…

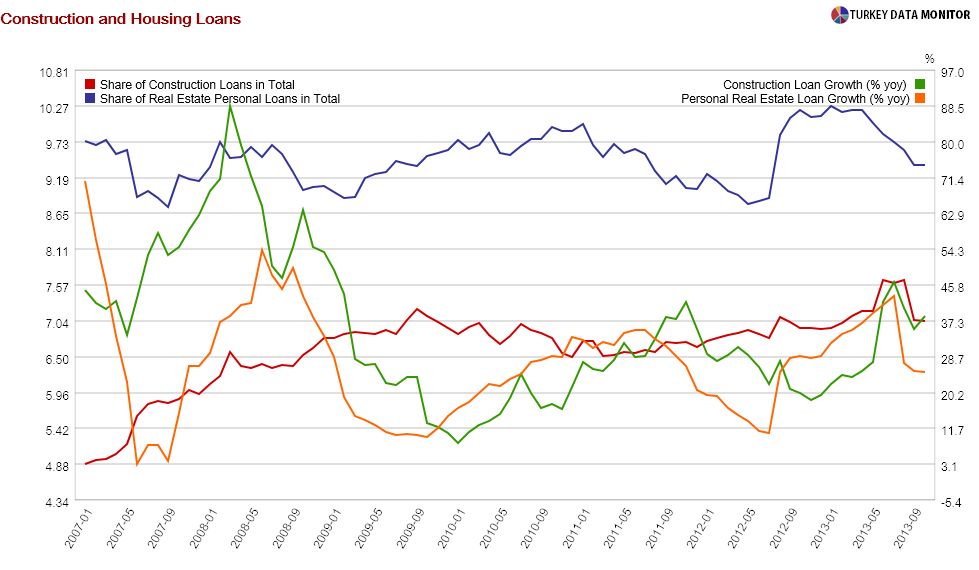

Of course, another interesting question I did not get to discuss in the column is what would happen to construction companies, some of which are probably heavily FX-leveraged, when housing demand and prices begin to fall. And this brings into discussion the banks. After all, the FX loans are from the banks, and you probably all know the famous J. Paul Getty remark: “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.” And Turkish banks are usually double-exposed to a construction project: After lending to the construction company, they become the “lender of choice” for that particular project. Turkish consumers are usually loyal to their debt, especially when they buy a house, so I am not that worried on the NPLs from consumers, but I would not be surprised if some construction companies fall into payment difficulties- or even go bankrupt (or get saved by state banks if they are owned by Gazbogan’s cronies). BTW, if you are interested in Turkish banks’ prospects this year, a recent FT beyond brics blog post summarizes the recent Moody’s and S&P reports that tackled this issue. And here’s some data on banks’ loans to construction companies as well as their housing loans:

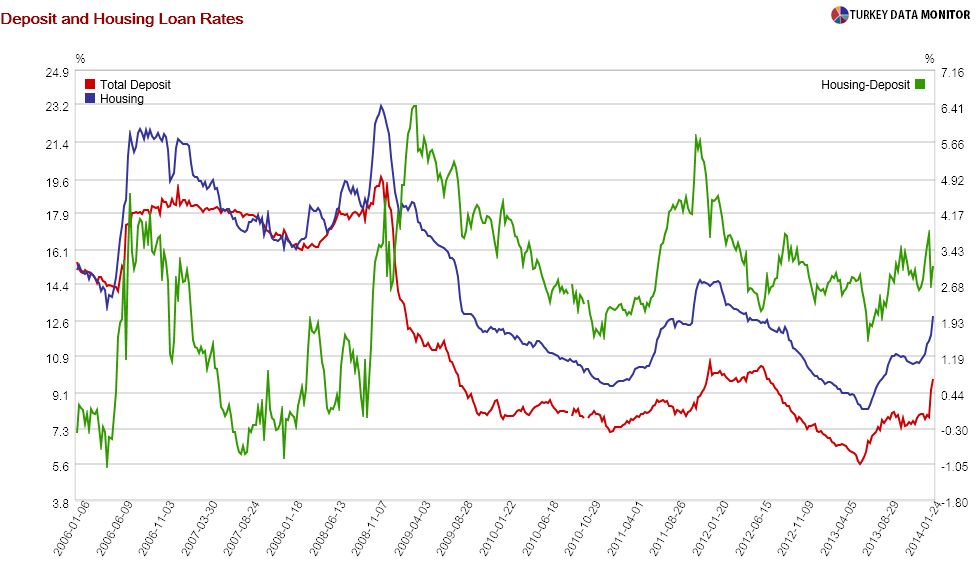

Moving on from quantity to price of credit, I discussed the prospect for housing loan rates this year in the column, but I would just like to make a small but important additional remark: Housing loan-deposit spreads non-surprisingly increase when the economy/financial markets are in distress- as was the case in the summer of 2006, first quarter of 2009, last quarter of 2011 and second half of 2013. So I would not be surprised if the spread increases in the coming weeks as well.