Equities ex-US posted the strongest increases last week for the major asset classes, based on a set of exchange-traded funds. But on Monday morning that rally suddenly looks like ancient history after the attacks on oil-production facilities in Saudi Arabia over the weekend.

The attacks represent a “historically large disruption on critical oil infrastructure,” advises Jeff Currie, head of commodities research at Goldman Sachs, via a research note.

Taimur Baig, chief economist at DBS Bank Ltd, says:

“This weekend’s drone attacks on Saudi oil facilities mark a major setback to the global geopolitical landscape.”

“Other than helping some oil exporting companies, the overall impact of heightened risk is negative for global equities in the near-term.”

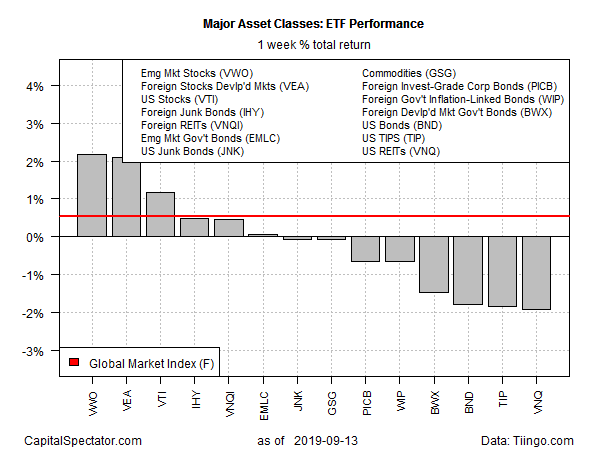

As for last week’s trading, shares in emerging markets topped the winner’s list for the major asset classes. Vanguard FTSE Emerging Markets (NYSE:VWO) rose 2.2% for the week through Sep. 13. The gain marks the third straight weekly advance. Foreign stocks in developed markets were a close second in last week’s horse race: Vanguard FTSE Developed Markets (NYSE:VEA) gained 2.1%.

The biggest loss last week for the major asset classes: real estate investment trusts (REITs) in the US. After a strong rally in recent history, investors took profits and Vanguard Real Estate (NYSE:VNQ) fell 1.9%, the fund’s first weekly decline in three weeks.

An ETF-based version of the Global Market Index (GMI.F) continued to rise last week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights, increased 0.5% — the index’s third straight weekly advance.

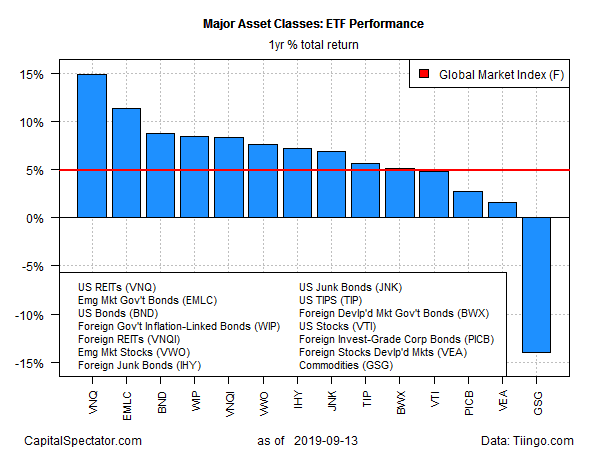

For one-year results, however, US REITs remain firmly in the lead. VNQ is up 14.8% for the trailing 12 months on a total-return basis through Friday’s close.

Broadly defined commodities remained dead last for one-year results. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) is down 14.0% over the past year, although the attacks on Saudi oil facilities will probably strengthen commodity prices (energy in particular) this week.

GMI.F continues to post a moderate total return for the trailing one-year window, rising 4.9% at last week’s close.

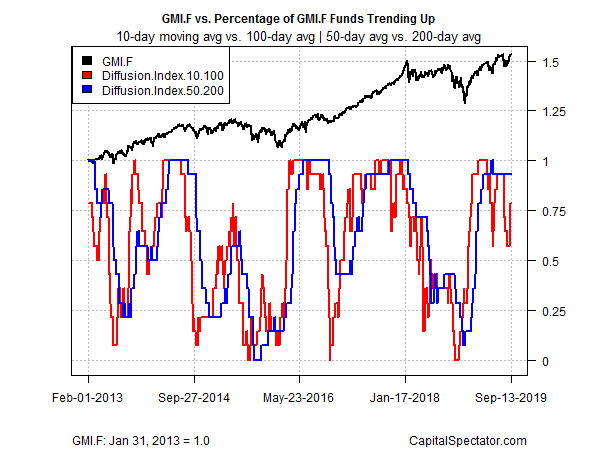

Profiling the major asset classes via momentum indicators continues to paint a relatively strong trend, albeit one that will be tested this week in the wake of heightened geopolitical risk in the Middle East. At last week’s close, a moderate upside bias was in place, based on two sets of moving averages for the ETFs listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line). At Friday’s close, short-term momentum posted a rebound after weakness in the previous week. But all eyes are now focused on how the attacks on Saudi Arabia reshuffle the risk outlook for the global economy and markets.