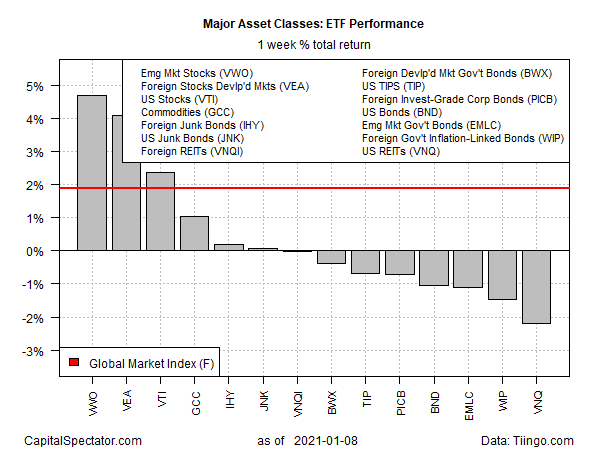

Shares in emerging markets topped last week’s gains for the major asset classes, based on a set of exchange traded funds as of Friday’s close (Jan. 8). Equities in developed markets ex-US were a close second-place weekly performer.

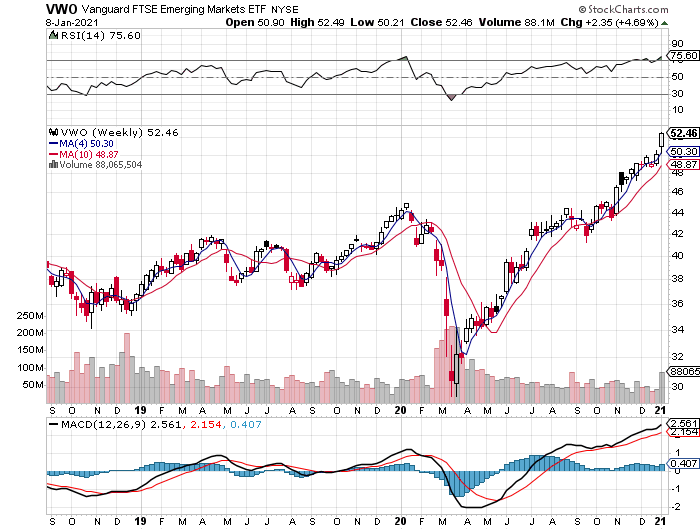

Leading the winners: Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO), which surged 4.7% last week. The rally lifted the fund to a record high. The latest gain marks the fund’s strongest weekly advance since the first week of November.

“There’s a lot of opportunity, a lot of risks, but I think emerging markets are really attractive right now,” says Ben Kirby, co-portfolio manager of Thornburg Investment Income Builder Fund.

“Emerging market cycles tend to last several years,” he told CNBC on Friday. “Emerging markets have underperformed for quite a few years until last quarter, and emerging markets outperformed in a bull market. That’s interesting to us, so we think we’re probably at the early innings of what could be a sustained period of emerging market outperformance.”

But Henrik Gullberg, a macro-economist at Coex Partners in London, says rising US interest rates pose a challenge.

“For emerging markets, higher US yields are a negative, so markets need to hear from the Fed that they will not tolerate an excessive rise,” advises Henrik Gullberg, a macro economist at Coex Partners in London.

Despite the rally in stocks last week (US equities were the third-best performer), most slices of the major asset classes lost ground. The biggest loser: US real estate investment trusts (REITs). Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) sunk 2.2%, it’s first weekly decline in a month.

The Global Markets Index (GMI.F) rose for a second week, rallying 1.9%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETF proxies.

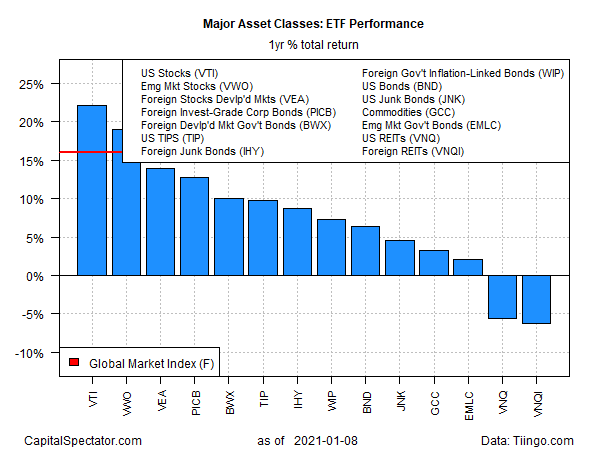

For the one-year window, US equities are still leading the major asset classes. VTI ended last week’s trading with a 22.9% total return for the past 12 months. That’s moderately ahead of the second-best one-year performer: stocks in emerging markets via VWO, which is up 19.7%.

US and foreign property shares continue to post the only losses for one-year results. Vanguard US Real Estate (VNQ) and its offshore counterpart (VNQI) are down 5.6% and 6.3%, respectively, vs. their year-ago levels after factoring in distributions.

GMI.F is up a strong 16.0% over the past year, an unusually bullish gain for a multi-asset-class index relative to history.

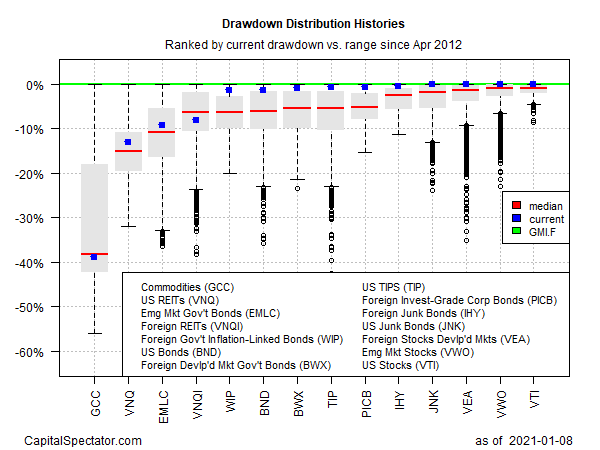

Ranking global markets by current drawdown continues to show that stocks, led by US shares (VTI), are leading in this corner with zero peak-to-trough declines.

At the opposite end of the spectrum: broadly defined commodities: WisdomTree Continuous Commodity Index Fund (NYSE:GCC) continues to post a steep peak-to-trough slide of nearly -39%.

GMI.F’s current drawdown is zero.