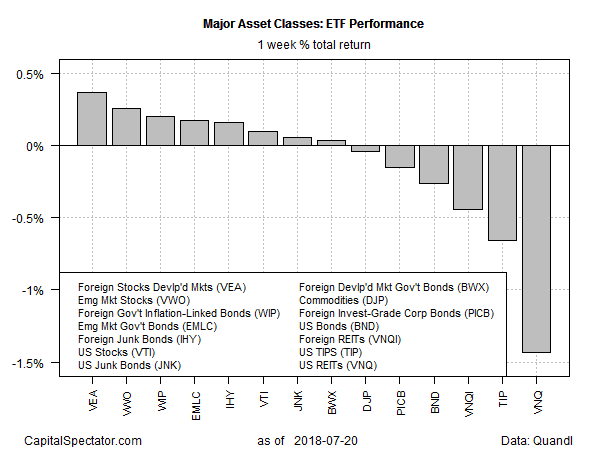

Non-US equity markets posted the strongest gains last week for the major asset classes, based on a set of exchange-traded products. Meanwhile, real estate investment trusts (REITs) in the US fell for a second week by the close of trading on Friday, July 20.

Leading the field on the upside: Vanguard FTSE Developed Markets (NYSE:VEA), which gained 0.4% last week. The modest advance marks the third straight weekly increase. The second-best performer: stocks in emerging markets. Vanguard FTSE Emerging Markets (VWO) inched up 0.3%, the third straight weekly rise in this corner, too.

US REITs suffered the biggest loss last week. Vanguard REIT (NYSE:VNQ) fell 1.4%, leaving the ETF near its lowest price for the month to date.

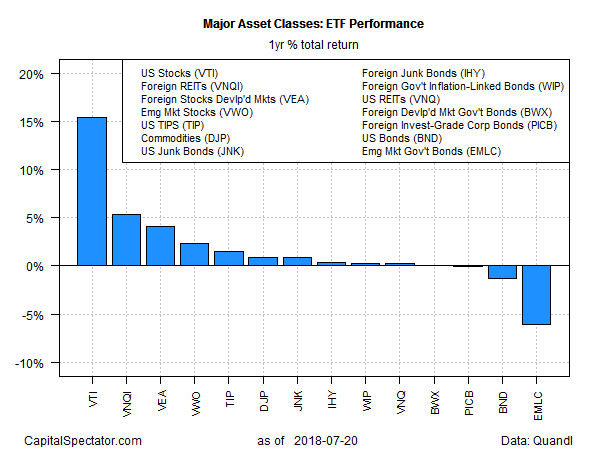

For the one-year window, the US stock market is a bullish outlier among the major asset classes. Vanguard Total Stock Market (NYSE:VTI) is currently sitting on a strong 16.0% total return – far above the other asset classes. The second-best performer – foreign equities in developed markets via VEA – is up a comparatively moderate 5.4% for the trailing one-year period through Friday.

The biggest loser over the past year as of last week’s close: fixed-income securities in emerging markets. Concern that a global trade war is brewing, combined with rising interest rates in the US, has been weighing on emerging-markets bonds in recent months. VanEck Vectors JP Morgan EM Local Currency Bd (NYSE:EMLC) has lost 6.7% for the trailing 12-month period – by far the deepest setback for the major asset classes. Note, however, that the ETF has stabilized in recent weeks after persistently falling from late-April through the end of June.

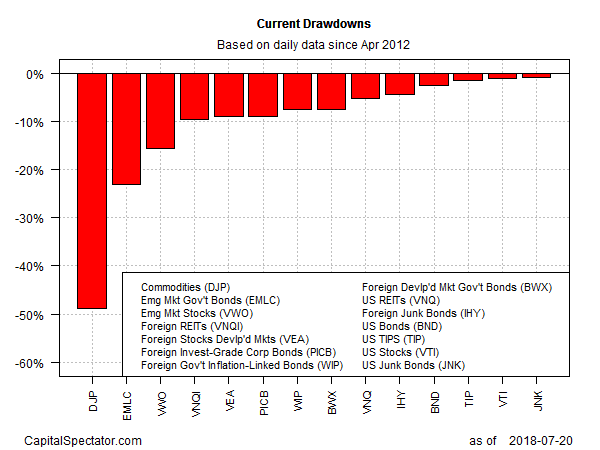

Ranking the major asset classes by current drawdown shows that broadly defined commodities continue to post the biggest peak-to-trough decline. The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) closed last week at nearly 50% below its previous peak.

Emerging-markets bonds have the second-biggest drawdown for the major asset classes. EMLC was 23% below its previous peak at the end of trading last week.