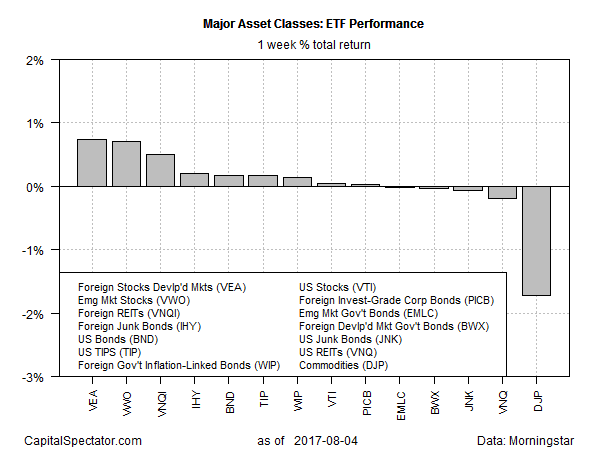

Stocks in off-shore markets were the top performers among the major asset classes last week, based on a set of exchange-traded products. Equities in developed countries posted the strongest weekly advance, fractionally ahead of stocks in emerging markets.

Vanguard FTSE Developed Markets (NYSE:VEA)) secured its fourth straight weekly gain over the five trading days through Friday. The ETF edged up 0.7%, touching a record high for the ten-year-old fund. In a virtual tie for last week’s top performer, Vanguard FTSE Emerging Markets (NYSE:VWO) was also ahead by 0.7% last week (three basis points behind VEA’s 0.73% total return).

Broadly defined commodities posted the biggest weekly loss for the major asset classes. After rallying for three weeks, iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) tumbled 1.7%, the portfolio’s first weekly setback in a month.

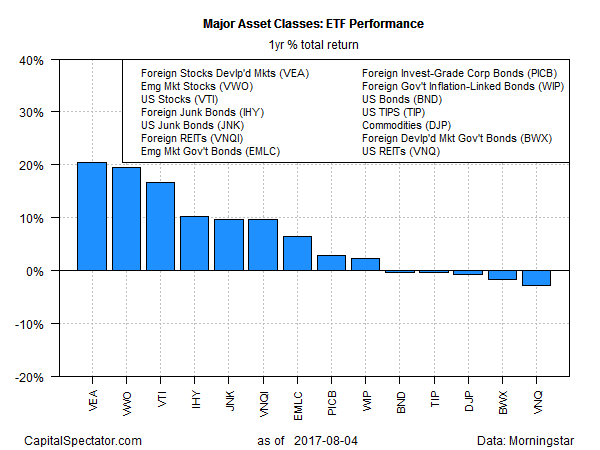

Foreign stocks are also in the lead for trailing one-year results. VEA is the top performer, posting a strong 20.4% total return through Aug. 4. VWO is a close second, rising 19.6% over the past 12 months as of Friday’s close.

“International is starting to catch up [to US stocks],” notes Paul Quinsee, global head of equities at JP Morgan Asset Management. “The key to that is better profits in the rest of the world,” supported by a weak dollar, he explains.

Danske Bank analyst Jakob Christensen points to “this background of global growth that is in quite good condition – we saw very strong numbers out of Europe last week – and inflation pressures still being quite subdued, so you don’t have central banks being forced to raise rates very significantly and fast to spoil the party.”

The macro climate is especially beneficial for emerging markets, he adds, advising that “the combination of high growth and low inflation pressures in the Western world is a perfect combination” for these equities.

Meantime, the current bottom performer for one-year performance: US real estate investment trusts. Vanguard REIT (NYSE:VNQ) remains in last place among the major asset classes relative to its year-ago price. The ETF is off 2.7% as of last week’s close for the one-year change.