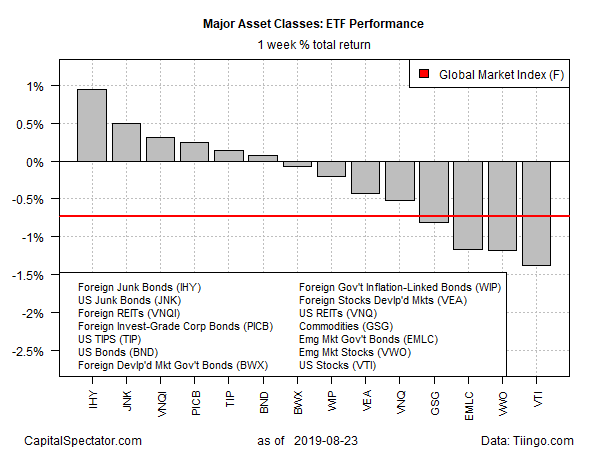

Trade-war risk returned with a vengeance on Friday, taking a bite out of global equity markets. Foreign junk bonds, on the other hand, enjoyed a strong rally, posting last week’s strongest gain for the major asset classes, based on a set of exchange traded funds.

VanEck Vectors International High Yield Bond (NYSE:IHY) surged 0.9% for the trading week ended Friday, Aug. 23. The gain marks the fund’s biggest advance in two months.

What’s the attraction? One answer is that as negative interest rates proliferate around the world, the comparatively high positive yields in below-investment grade debt is increasingly attractive. IHY certainly fits the bill: the ETF’s trailing 12-month yield: 4.66%, according to Morningstar – roughly triple the current yield on a 10-year Treasury note.

Meanwhile, equities plunged last week, courtesy of fears that the US-China trade war is escalating. Cooler heads seem to be prevailing today – Trump on Monday says China is open to new talks to find a path to a trade deal. “I think we are going to have a deal,” the president says.

The optimistic spin today contrasts with the dark outlook on Friday, when US and major foreign equity markets tumbled on trade-related fears. Last week’s biggest loser: US stocks via Vanguard Total Stock Market (NYSE:VTI), which fell 1.4%, the ETF’s fourth straight weekly slide.

Last week’s selling in global stocks took a toll on an ETF-based version of the Global Market Index (GMI.F). This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights, fell 0.7%.

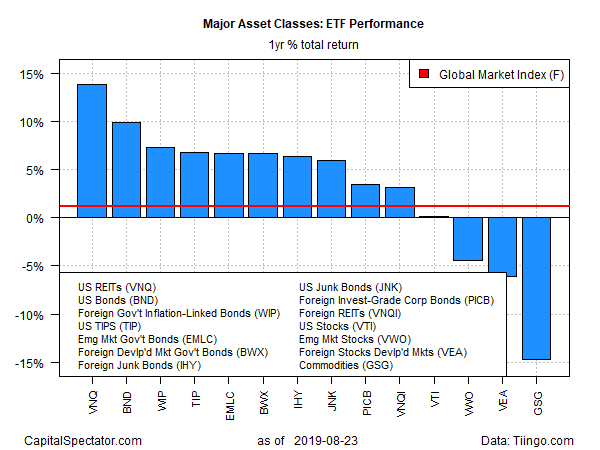

Turning to one-year results, US real estate investment trusts (REITs) continue to stand apart from the crowd with a leading performance for the major asset classes. Vanguard Real Estate (NYSE:VNQ) is up 13.8% over the past 252 trading days after factoring in distributions.

At the opposite extreme, broadly defined commodities are still the biggest one-year loser for the major asset classes: iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) has lost 14.8% over the past 12 months as of Friday’s close.

GMI.F is holding on to a mild gain via a 1.1% total return for the trailing one-year window.

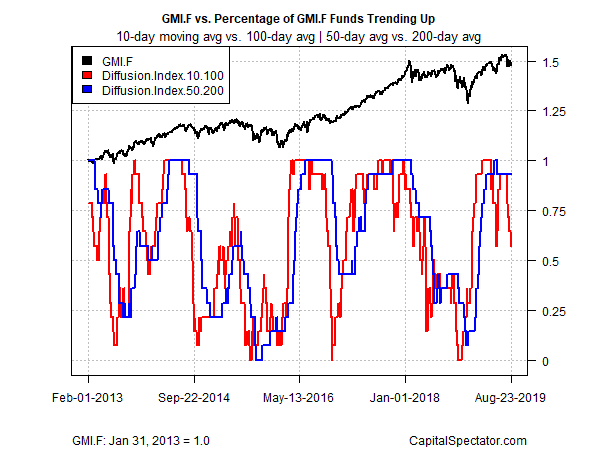

Profiling the major asset classes via momentum indicators continues to reflect a mixed picture. The analysis based on two sets of moving averages for the ETFs listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line). At last week’s close, short-term momentum continued to show marked weakness, but so far the intermediate indicator is holding steady at an elevated level.