Consider the golfer who focuses all of his game-improving efforts on hitting from the tee and the fairway. By ignoring the putter in his bag, he fails to improve at putting — an action that account for 50% of one’s overall score. Many in the financial media are no different. There is an extraordinary tendency by American media personalities to focus on the Dow or S&P 500 at the near exclusion of equally compelling market-based securities abroad. Like the golfer who has dismissed putting on the practice green, those who disregard non-U.S. equities are overlooking 50% of the total value of stocks worldwide.

Perhaps ironically, passing over overseas stocks has been remarkably beneficial in the current decade. Slowing growth in China, inflation in India as well as debt contagion in Europe have made diversified investors cringe for nearly three years. Indeed, the outflow from emerging market ETFs in August of 2013 was one of the largest on record.

Nevertheless, if there is one investing tidbit that I rank as one of the greatest lessons ever it is the fact that things change. For instance, those that erroneously believed that bonds would always insulate them from portfolio volatility failed to see the perversion of capital allocation that occurred due to quantitative easing and the accompanying zero-interest rate policy. On the mildest hint of policy change by the Fed (a la slowing down, or tapering, bond buying activity), the spike in longer-term yields is one of the most painful on record. Similarly, gains in foreign stocks and emerging market stocks far outpaced U.S. equities in the prior decade. Then, things changed; the current decade presented difficulties that witnessed bigger woes for overseas assets whereas as U.S. assets tended to thrive on Federal Reserve intervention/manipulation.

Those that do not anticipate change in investing markets tend to miss out in more ways than one. For example, fearing stocks in the 2008-2009 meltdown, many moved to U.S. bonds without ever wanting to look forward. Not only did they miss the remarkable bull market gains of 2009-2013, but the more recent spike in bond yields (decline in bond prices) have pressured them into rejoining the U.S. stock market today at all-time highs. Others believed that the emerging market growth story would never face bruises and bumps. Rather than anticipate the likelihood of severe bearish pullbacks in overseas stocks — rather than have a plan for selling or hedging — these folks abandoned the theme only when the losses became unbearably deep. Most have no plan to return.

While it is true that international and emerging markets have severely underachieved for roughly three years, the silence regarding the possibility of change is deafening. Granted, some value-oriented fund managers talk about better valuations abroad. On the whole, however, the media still run with the idea that the U.S. is the “cleanest dirty shirt in the laundry basket.”

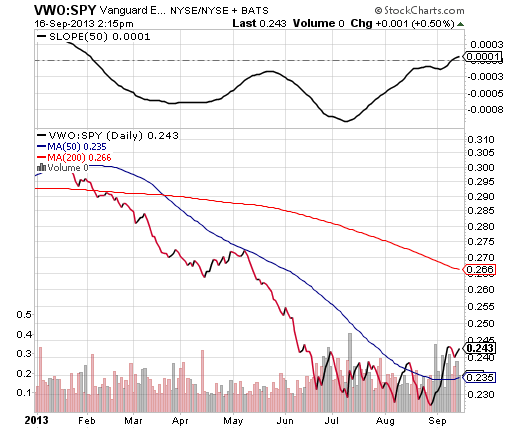

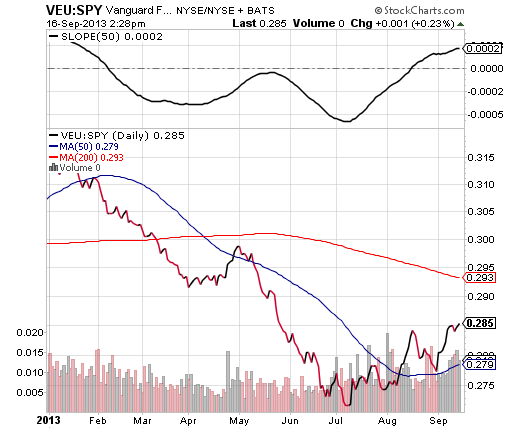

Take a look at both of the relative strength price ratios above. Both Vanguard Emerging Markets (VWO):SPDR S&P 500 Trust (SPY) and Vanguard All-World Excl U.S (VEU):SPDR S&P 500 Trust (SPY) demonstrate that VWO and VEU are rising more rapidly in price than SPY. Perhaps more encouraging are the occurrences in these charts that have not transpired in 2013… until now. The slopes of the 50-day moving averages for these ratios have crossed into positive territory for the first time this year.

While it is not clear that the recent moves higher are sustainable, it is clear that change may indeed occur. Investors need to pay attention to the possibilities here. In all likelihood, the end of the Summers push for chairman of the Fed helps foreign stocks and bonds more than it might help U.S. stocks and bonds. Why? Other candidates are seen as more likely to continue extremely accommodating policies longer than Sanders might have. In turn, the circumstances weakened the U.S. dollar as well as propped up U.S. bonds, making foreign currency stock assets and foreign currency bond assets attractive again.

There is no way to predict how long the enthusiasm for the Summers departure will last, let alone predict how long the agreement on Syria will benefit investors. Nevertheless, monitoring the ratios for foreign and emerging stock ETFs relative to U.S. benchmarks may help the ETF enthusiast anticipate change, rather than fear it.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Foreign ETFs, Emerging Market ETFs Cheer Louder For The End Of Summers

Published 09/17/2013, 01:48 AM

Updated 03/09/2019, 08:30 AM

Foreign ETFs, Emerging Market ETFs Cheer Louder For The End Of Summers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.