Our research team has been watching the foreign currency markets with great interest. Recently, the strength of the US dollar has put extended pressures on many foreign currencies. The recent crash of the Chinese yuan has alerted many traders to the concern that China could be edging over the precipice in terms of debt and credit market collapse.

As traders/investors, we need to understand how these currencies move, and future moves may drive the global equity markets to new highs or lows. Let’s take a brief look at how some of our proprietary indicators are set up on these Weekly charts.

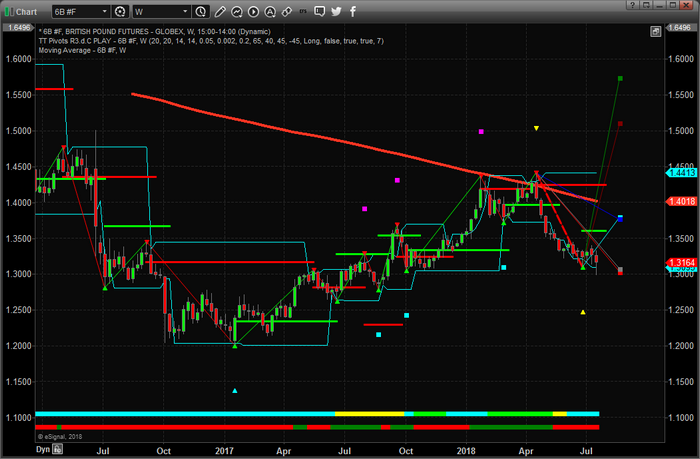

Weekly British Pound Chart

This Weekly British pound shows that our proprietary Fibonacci Price Modeling system presents a very clear picture that the current trend is bearish and that price is contracting. The Weekly Fibonacci price modeling system functions as an adaptive price modeling system – allowing the price rotations (peaks and valleys – highlighted by the yellow, cyan, magenta and white markers on the chart) to develop into a concise and efficient current model of price expectations and projections. The multiple price projection levels (the six projected lines to the right of the current price bar) show us where price may attempt to target should a breakout move happen.

Notice that the current British pound price has reached and stalled near the 1.3100 level – which is exactly where our Fibonacci price modeling system predicted with the red and grey projection levels. Also, notice how the blue and cyan projected levels are aligning near 1.3775. This would be a proper expected price level should price find some support near the 1.3000 level and attempt a short recovery.

As we get further into these charts, please understand the key elements and what they are attempting to illustrate. With each pivot high or low, this price modeling system identifies a “trigger price level” that is used to confirm a trend reversal (if it happens) as well as to identify key future support/resistance. These are drawn as green and red horizontal lines. You’ll notice a green trigger price level near the current price bar – this is the “upside price trigger level” that would have to be breached if we were to see any further upside price advance. As long as price stays below this level, we should continue to expect a downside price move with a strong potential for new lows.

Summarizing this analysis, the current trend is bearish. The current bullish trigger level is near 1.3600. Price is trending lower from a previous bearish price trigger level near 1.4240. Price has reached the two (red and grey) projected price levels, which means we should expect some price consolidation near these levels before establishing a new price trend (extending lower or rotating higher). Recently, new price-bar lows show a very strong potential for further downside price activity. At this point, we see that support from a previous bottom, near 1.3060, will likely cause the price to stall near this level. We believe the price will continue to fall below the 1.3000 eventually as the strength of the US dollar continues to push higher and the Brexit issues continue. The British pound could fall well below 1.2500 before finding real support. Wait for this consolidation period to end and watch for lower prices to continue.

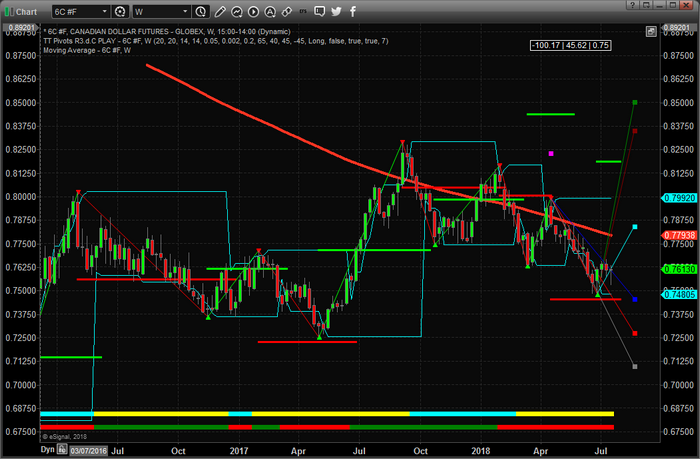

Weekly Canadian Dollar Chart

This Weekly Canadian dollar chart below shows a very interesting setup with our price modeling system. Notice the wide range between the trigger price levels (green and red) near the right edge of this chart. This extended range of trigger price levels happens when the adaptive price modeling system finds price trend rotation. Previously, on this chart, we can see the trigger price levels were closer to price and within rotational ranges – the most recent breached trigger level being a red (bearish) trigger – indicating the start of a new bearish trend near February 5, 2018.

At this point, should price fall below 0.7450, we should expect price to continue to drop toward 0.7250. Upside resistance should be near the cyan projected price level – near 0.7850. Unless the Canadian dollar finds support near 0.7500 and rotates higher to breach 0.81875 – this is nothing but extended price rotation. Typically, as price sets up an extended top or bottom, the trigger price levels will eventually tighten to establish a breakout trend setup. Right now, the extended ranges of these trigger levels are showing us that volatility and price rotation should be expected and the downward sloping moving average level will likely operate as a key resistance zone. The YELLOW markers at the bottom of the chart show us that price range is expanding and volatility is increasing. We could see some bigger swings in CAD over the next few weeks and months – but the trend is still bearish.

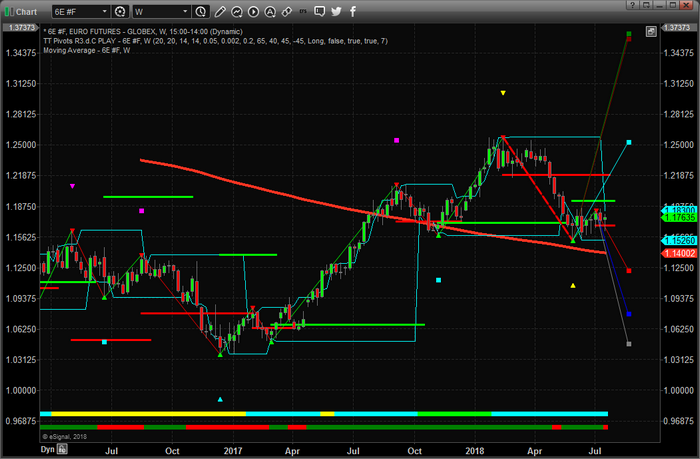

Weekly Euro Chart

This Weekly euro shows a more traditional price rotation setup. Notice how the trigger price levels are very narrow and close to the current price. You’ll also notice the cyan price trend indicator, near the bottom of the chart, which is indicating that price range is contracting. The two price trigger levels (red and green) provide very clear breakout trigger levels (bullish near 1.1913 and bearish near 1.1687). The most recent trigger level to be breached was the bearish level near 1.2200. A recent low price rotation has established a new low price pivot that is projecting much higher price projection points. Additionally, a more recent high price rotation has established new lower price projection points.

This sideways price rotation will be broken and a new trend will be established in time. At this point, we know the 1.1913 level is the bullish trend trigger point and the 1.1687 level is the bearish trend trigger point. Price trend is still bearish and any lower price breakdown below 1.1576 would be a strong indication that price is breaking below current support and should attempt to move to near 1.1000. To summarize, the euro appears to be under extended pressure and any price breakdown could be a great short for traders.

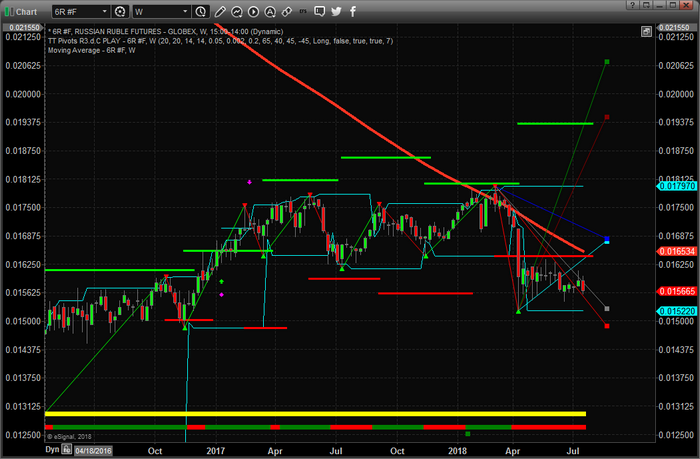

Russian Ruble Weekly Chart

Lastly, the weekly Russian Ruble shows, again, price rotation and volatility. Notice how the bullish trigger price levels have been expanding throughout this sideways price rotation for the past year or longer.

As we've said before, the adapting modeling component of our Fibonacci price modeling system identified this rotation as “extended price congestion” and attempts to identify broader market breakout levels as a means to confirm a true change in price trend. The most recent bearish trigger price level was breached on April 9, 2018. Price is trending lower/bearish and the price trend indicator near the bottom is showing yellow – price volatility is expanding. We should expect further downside price moves with expanded volatility. Any price move below 0.01520 will indicate a very strong downside price move with the potential for price to reach 0.01250.

Concluding Thoughts

Overall, we need to remember that recent political, economic and geopolitical tensions are indicating that global economies and currencies should expect price pressures moving forward. What was once a given, that the world would continue to operate without much disruption in the global balance of things, is now open for debate. We are watching global concerns and liabilities as a result of China’s recent downturn and currency devaluation reflect in additional concerns throughout the global currency markets. We have to be aware that these issues typically don’t end quickly or without some form of government intervention. This means we may have quite a bit of time to play these moves and find good trades.

Right now, the Russian ruble, British pound and the Canadian dollar appear to be poised for a breakdown in prices in the immediate future – breaking through support and possibly dropping to recent historical lows. The euro is setting up for a breakout/breakdown move with a very narrow trigger price level range. The euro may rally, briefly, if USD retraces a bit from current levels. Remember, these are weekly charts and help to understand the broader price trend. A breakdown in the ruble, pound and Canadian dollar would likely coincide with a rally in the US dollar and possibly the euro, too. Therefore, watch for weakness in these markets and strength in the US dollar as these moves happen.