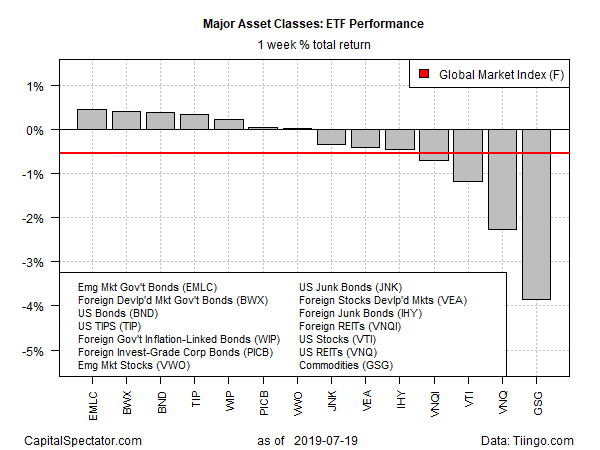

Bonds in emerging and non-U.S. developed markets topped last week’s performance profile for the major asset classes, based on a set of exchange-traded funds. By contrast, broadly defined commodities tumbled, suffering the deepest weekly setback in nearly two months for the trading week through Friday, July 19.

Last week’s best performer for the major asset classes: VanEck Vectors JP Morgan Emerging Market Local Currency Bond (VanEck Vectors JP Morgan EM Local Currency Bd (NYSE:EMLC)), which edged up 0.5%. The gain marks EMLC’s ninth consecutive weekly gain, lifting the ETF to its highest close since April 2018.

Foreign bonds in developed markets were a close second for last week’s performance ledger. SPDR Bloomberg Barclays International Treasury Bond (SPDR Barclays International Treasury Bond (NYSE:BWX)) rose 0.4%.

Last week’s biggest loser by far: commodities, based on iShares S&P GSCI Commodity-Indexed Trust (iShares S&P GSCI Commodity-Indexed (NYSE:GSG)). The fund fell 3.8%, the biggest weekly setback for the fund in seven weeks.

The downside bias in most of the world’s stock markets last week was a contributing factor that weighed on an ETF-based version of Global Market Index (GMI.F). This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights, fell 0.5%–the first weekly decline for GMF.F in seven weeks.

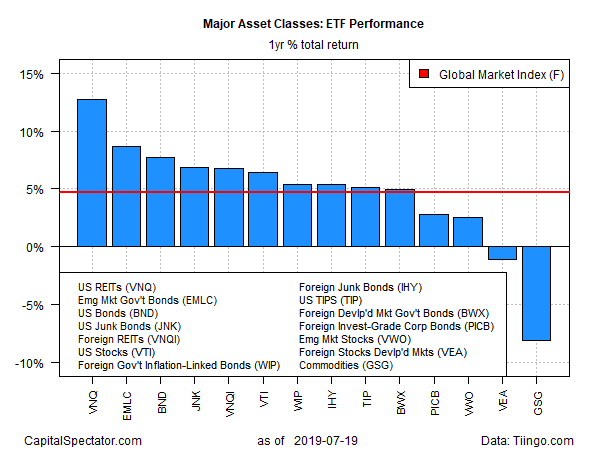

Turning to the one-year trend for the major asset classes, US real estate investment trusts continued to hold on to a sizable lead over the rest of the field through last week’s close. Vanguard Real Estate (Vanguard REIT (NYSE:VNQ)) is up a strong 11.4% for the trailing one-year period, comfortably ahead of the second-best performer: emerging-market bonds via EMLC, which is ahead by 9.5% after factoring in distributions.

Note that commodities are also the biggest loser for the one-year window. GSG is down 8.2% vs. the year-earlier price.

GMI.F’s measure of a broadly diversified multi-asset class portfolio remains in positive terrain for the one-year window with a moderate 4.7% total return.

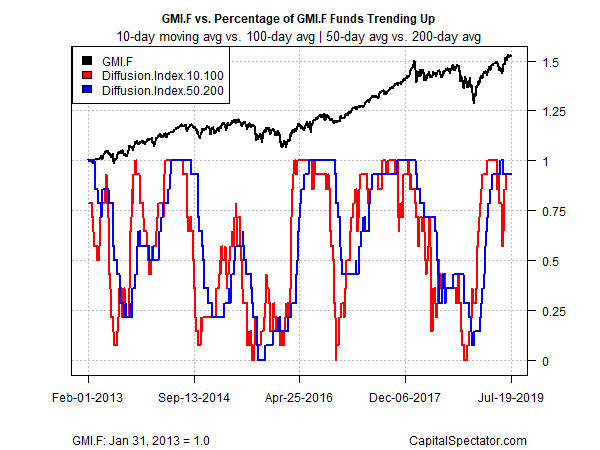

Finally, bullish momentum remains intact for most of the major asset classes, based on two sets of moving averages for the ETFs listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represents an intermediate measure of the trend (blue line). Using this analysis as a guide suggests that most of the world’s markets continue to exhibit an upside bias, as of last week’s close.