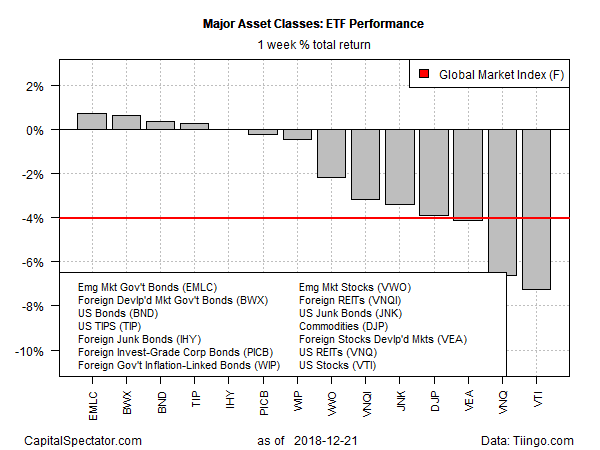

Amid last week’s rout in stocks, bonds in foreign markets posted the strongest gains for the major asset classes, according to a set of exchange-traded products.

Fixed-income securities in emerging markets led the field in the volatile week of trading that ended Friday, Dec. 21. Grabbing the top spot, VanEck Vectors JP Morgan Emerging Markets Local Currency Bond (NYSE:EMLC) edged up 0.7%. The ETF has been trending higher in recent months after a sharp correction earlier in the year. At last week’s close, EMLC was near its highest close since August.

Foreign bonds in developed markets posted the second-strongest performance last week via SPDR Bloomberg Barclays International Treasury Bond (BWX). The ETF rose 0.7% on a weekly basis, fractionally behind EMLC’s gain.

Turning to the red ink, US stocks suffered the biggest slide last week for the major asset classes: Vanguard Total Stock Market (NYSE:VTI) fell to its lowest close since August 2017.

Last week’s risk-off sentiment continued to cut into an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights suffered a sharp 4.0% decline — the sixth weekly loss for the index in the past seven weeks.

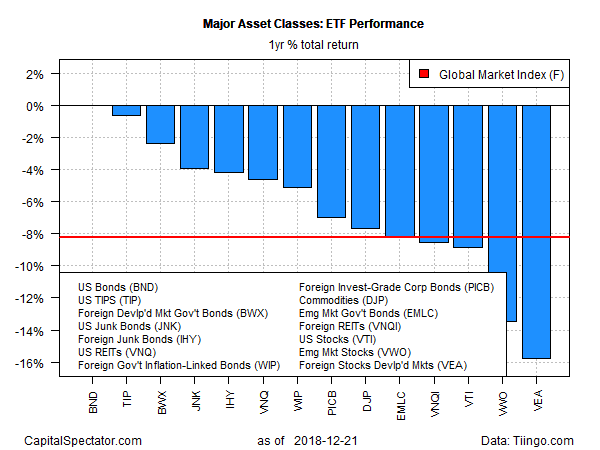

For the one-year change, all the major asset classes are posting losses. The smallest setback at the moment is a slight decline for a broad measure of investment-grade US bonds. Vanguard Total Bond Market (NYSE:BND) is underwater by a fractional degree for the trailing 12-month window through last week’s trading.

By comparison, the deepest one-year setback for the major asset classes is a steep 16.8% loss for foreign stocks in developed markets, based on Vanguard FTSE Developed Markets (VEA).

GMI.F is down 8.2% on a total return basis for the past year.

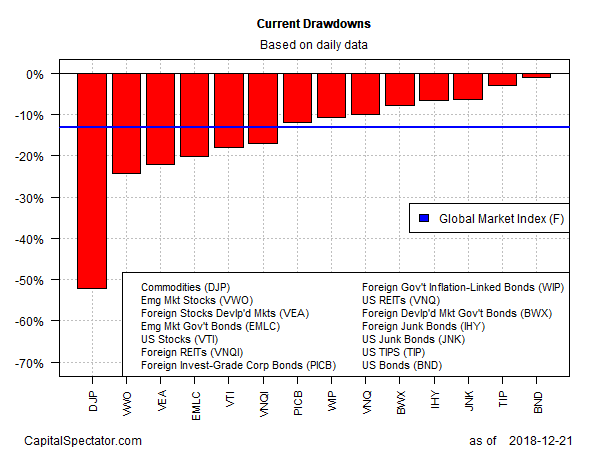

For current drawdown, investment-grade US bonds are posting the smallest decline: BND is off a bit more than 1% from its previous peak.

Meanwhile, the biggest drawdown continues to be found in broadly defined commodities: iPath Bloomberg Commodity (NYSE:DJP) has shed more than 50% relative to its previous peak.

GMI.F’s current drawdown: -13.2%.