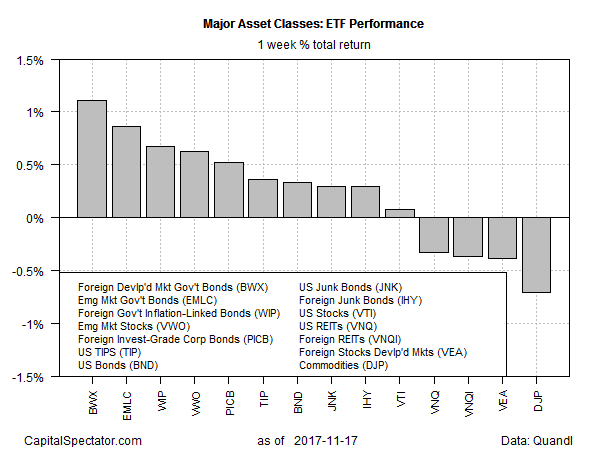

Fixed-income markets in developed and emerging nations topped the winners list last week for the major asset classes, based on a set of exchange-traded products. The gains mark the second week of flat to higher prices after two months of a downtrend for offshore bonds.

The SPDR Bloomberg Barclays International Treasury Bond (NYSE:BWX) was the strongest performer for the five trading days through November 17. The ETF increased 1.1%, followed by a 0.9% rise for last week’s second-strongest performer: VanEck Vectors JP Morgan Emerging Markets Local Currency Bond (NYSE:EMLC).

The softest corner of global markets last week: broadly defined commodities. The iPath Bloomberg Commodity (NYSE:DJP) slumped 0.7%, its first weekly decline since mid-October.

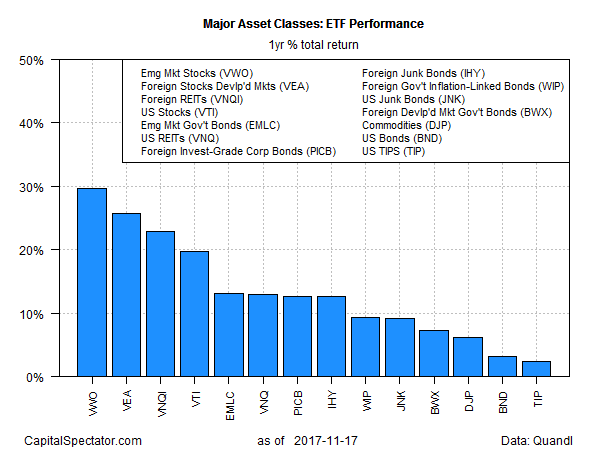

For the one-year trend, all the major asset classes are currently posting gains. The top performer: equities in emerging markets. Vanguard FTSE Emerging Markets (NYSE:VWO) is up a strong 29.7% for the 12 months through November 17.

Meanwhile, inflation-indexed Treasuries are in last place for the 12-month change. The total return for the iShares TIPS (NYSE:TIP) is a thin 2.3% as of Friday’s close vs. the year-earlier price.

Disclosure: Originally published at Saxo Bank TradingFloor.com