Foreign & Col Investm Trust (LON:FRCL) is the oldest collective investment fund in the world, dating back to 1868. Manager Paul Niven aims to generate long-term growth in capital and income by investing in a range of focused strategies run both by BMO Global Asset Management and external managers. The portfolio is diversified by geography, sector and style; the trust is overweight Europe ex-UK and emerging markets, and underweight North America. FRCL also invests in private equity. Gearing of up to 20% of net assets is permitted. FRCL has a progressive dividend policy; the annual dividend has increased in each of the last 45 consecutive years and, following the repayment of a longstanding debenture at the end of 2014, interest costs have declined meaningfully.

Investment strategy: Growth in capital and income

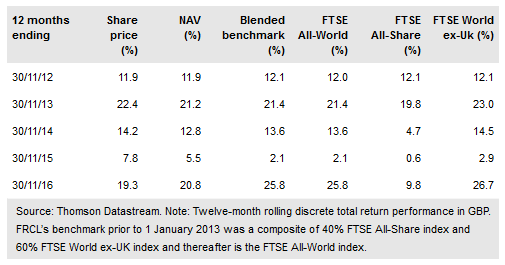

FRCL has a large, diversified portfolio invested in a range of regional and global strategies with a c 10% weighting in private equity. Since the beginning of 2013, the benchmark is the FTSE All World, reflecting a lower weighting to UK and a higher weighting to global equities. On a geographic basis, the portfolio’s largest overweight exposures are Europe ex-UK and emerging markets, while there is a material underweight exposure to the US. The current 6.1% level of gearing is towards the bottom end of the historical range following a reduction in equity exposure and private equity cash returns.

To read the entire report Please click on the pdf File Below