On Feb 11, we issued an updated research report on Ford Motor Company (NYSE:F) .

The U.S. automaker announced fourth-quarter and 2018 earnings on Jan 23. In the reported quarter, automotive revenues were $38.7 billion compared with $38.5 billion in the prior-year quarter. The top line surpassed the Zacks Consensus Estimate. However, the company’s adjusted earnings of 30 cents per share missed estimates.

Ford’s North American operations generated $2.2 billion in quarterly EBIT, supported by favorable market factors consisting of product mix and higher net pricing. Out of its wide product portfolio, the major sales driver was F-Series trucks.

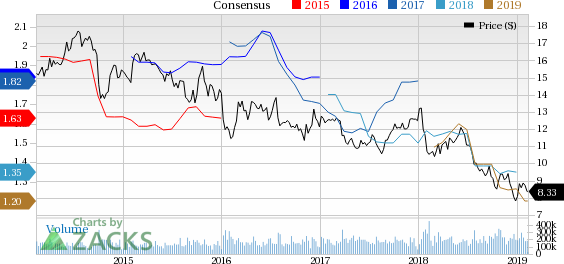

Ford Motor Company Price and Consensus

In 2018, Ford achieved the target of selling 1 million F-Series vehicles, globally. Among the launches that partly contributed to the company’s rise in the market are new Expedition, Edge and Navigator. The rising demand for trucks and SUVs encouraged this automaker to build a product portfolio, 90% of which will consist of trucks, utilities and commercial vehicles.

Despite decent performance in North America, the company’s quarterly EBIT was $1.1 billion, majorly due to weakening performance in China and Europe. Challenging economic conditions in China, along with lowering demand, hampered Ford’s performance in the world’s leading automotive market. Further, tumbling sales in Europe added to the company’s woes.

Ford is focusing to restructure business operations, launch vehicles and discontinue loss-making models to manage its operations in Europe. It also announced a collaboration with Volkswagen (DE:VOWG_p) AG in January 2019 to reduce expenses. The companies will team up for commercial vans and pickups, and explore electric and autonomous technological developments.

While focusing on strategies to sustain its position, Ford has to manage rising commodity prices and volatile foreign currencies. Increased investments to develop advanced vehicle technology are expected to drive revenues in the long term while draining financials in the near term. Additionally, frequent vehicle recalls not only reduce consumers’ confidence in a brand but, also elevate expenses.

Over the past three months, shares of Ford have lost 12.7% compared with the industry’s decrease of 2.5%. The Zacks Consensus Estimate for Ford’s earnings in first-quarter 2019 moved down 16% over the last 30 days.

Zacks Rank & Stocks to Consider

Ford currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader auto sector are General Motors Company (NYSE:GM) , Allison Transmission Holdings, Inc. (NYSE:ALSN) and Oshkosh Corporation (NYSE:OSK) , each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

General Motors has an expected long-term growth rate of 8.5%. Share price of the company has increased 6.8% in the past six months.

Allison has an expected long-term growth rate of 10%. Over the past six months, shares of the company have gained 3.5%.

Oshkosh has an expected long-term growth rate of 11.3%. Shares of the company have gained 8.8% in the past six months.

Zacks' Best Stock-Picking Strategy

It's hard to believe, even for us at Zacks. But from 2000-2018, while the market gained +4.8% per year, our top stock-picking strategy averaged +54.3% per year.

How has that screen done lately? From 2017-2018, it sextupled the market's +15.8% gain with a soaring +98.3% return.

Free – See the Stocks It Turned Up for Today >>

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

Original post