Ford Motor Company ( (NYSE:F) ), along with other automakers, is set to be sued by Hawaii for air bags that can spew shrapnel when deployed. Nissan Motor Company Ltd (OTC:NSANY) and Toyota Motors (NYSE:TM) will also face the same legal battle. The lawsuit seeks damages of $10,000 per violation. Last year, Hawaii was the first state to sue Takata and Honda Motor Company over defective air bags.

The complaint filed on May 24 says that the concerned manufacturing companies should have been aware of the serious and fatal dangers the defective air bags installed in their cars may pose to the passengers.

The defective air bags are manufactured by Japanese car parts maker Takata. As per available reports, 16 people have been killed worldwide and more than 180 have suffered injuries because of the defect. This technical fault has also led to the largest automotive recall in the U.S. history.

The air bags contain ammonium nitrate, which is volatile and unpredictable. Hawaii’s humid climate and temperature changes accelerate chemical breakdown, making the air bags prone to explosion and more vulnerable for state’s residents.

While the exact number of Ford, Nissan and Toyota vehicles in Hawaii containing the air bags is unclear, roughly 30,000 vehicles have been estimated to be affected.

The company’s accelerated product transformation plan “One Ford” is positively impacting the company. The foremost mission is to produce common vehicle models for all of its global segments. Another key objective of the plan is to shift focus from trucks to small cars and deliver more vehicles from fewer core platforms. The company expects utility vehicles to comprise 29% of its global sales by 2020.

Ford has been replacing its older models and rolling out new ones. This involves substantial expenditure, which resulted in high structural costs in 2013. The costs also increased in 2014 due to higher volumes as well as the expansion and improvement of the company’s line-ups. Structural costs increased in 2015 as well, mainly related to manufacturing volumes and the new UAW agreement. It went up by $1.5 billion in 2016.

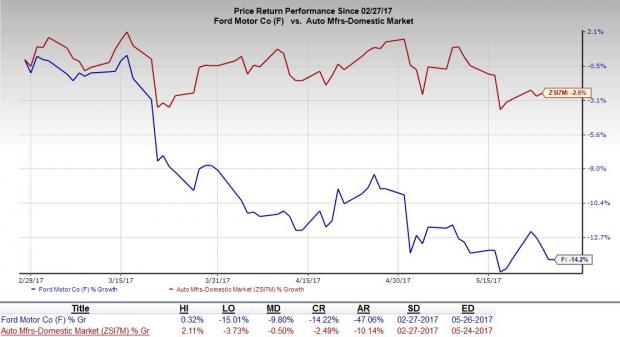

Ford has underperformed the Zacks categorized Auto Manufacturers-Domestic industry over last three months. The company’s shares decreased 14.2% over this period, while the industry saw a 2.5% decline. Increasing recalls, concerns in certain end markets and lower-than-expected earnings are adversely affecting the share performance.

Zacks Rank & Key Picks

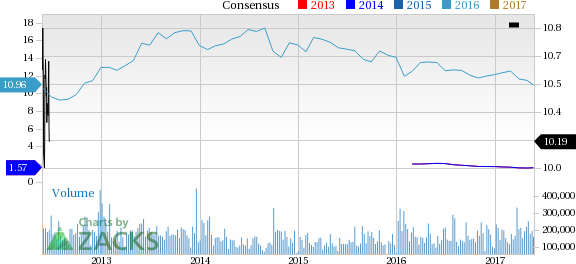

Ford currently carries a Zacks Rank #3 (Hold).

Other better-ranked companies in the auto space include, Fiat Chrysler Automobiles N.V. (NYSE:F) , holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fiat has expected long-term growth rate of 22.4%.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

Ford Motor Company (F): Free Stock Analysis Report

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Nissan Motor Co. (NSANY): Free Stock Analysis Report

Fiat Chrysler Automobiles N.V. (FCAU): Free Stock Analysis Report

Original post

Zacks Investment Research