Ford Motor Co. (NYSE:F) is a global automotive, financial services, and mobility company. The company’s product line boasts of heavyweights such as the legendary Ford Mustang and the F-Series truck, which has been the highest-selling vehicle in the U.S. for the last 34 years. It also owns the luxury vehicle brand, Lincoln.

Ford is gaining from its product launches, global expansion, efficient capital deployment and success of the One Ford plan. The company is renewing the majority of its product line-up and has planned several vehicle launches under the One Ford plan, which is helping boost sales.

However, weakness in South America, frequent product recalls and rising structural expenses are concerns.

As a result, investors have been eagerly awaiting Ford’s latest earnings report. Let’s take a quick look at this Michigan-based automobile giant’s second-quarter release.

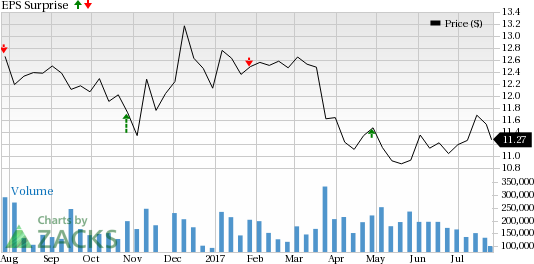

Estimate Trend & Surprise History

Investors should note that the earnings estimate for Ford for the second quarter have decreased in the past seven days.

The company delivered positive earnings surprises in two of the trailing four quarters with an average beat of around 4.74%.

Earnings

Ford raked in adjusted earnings of 56 cents per share that beat the Zacks Consensus Estimate of 44 cents. Adjusted earnings were up by 4 cents from the year-ago quarter figure. Lower tax rate was responsible for this improved performance.

Revenues

Ford logged automotive revenues of $37.1 billion, lagging the Zacks Consensus Estimate of $38 billion. Automotive revenues in the prior year-ago quarter were $36.9 billion.

Key Stats/Developments to Note

Automotive profits during the quarter were driven by North America, with Europe and Asia Pacific also profitable. Ford Credit pre-tax profit was $619million, up 55% year over year.

The company expects 2017 adjusted EPS to be in the range of $1.65–$1.85. It also anticipates adjusted effective tax rate to be around 15%.

Zacks Rank

Ford currently has a Zacks Rank #5 (Strong Sell), but that could change following its earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Check back later for our full write up on Ford’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Ford Motor Company (F): Free Stock Analysis Report

Original post