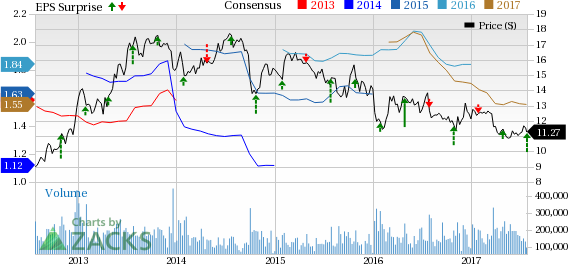

Ford Motor Co. (NYSE:F) posted adjusted earnings per share of 56 cents in the second quarter of 2017. The reported figure was 4 cents higher than the year-ago figure. Also, earnings surpassed the Zacks Consensus Estimate of 44 cents per share. Results were driven by lower tax rate.

Adjusted pre-tax profit was $2.5 billion, reflecting a decline of $0.5 billion from the year-ago quarter.

Second-quarter net income came in at $2 billion, increasing $0.1 billion from the year-ago quarter.

Ford logged automotive revenues of $37.1 billion, lagging the Zacks Consensus Estimate of $38 billion. Automotive revenues in the prior year-ago quarter were $36.9 billion.

Ford Automotive

Wholesale volumes at the Ford Automotive segment decreased 43,000 units to 1.65 million. Pre-tax profit declined to $2.2 billion from $2.8 billion in the year- ago quarter.

In North America, revenues increased $0.7 billion to $24.5 billion. Wholesale volumes declined 1% year over year to 807,000 units. Further, pre-tax profit decreased to $2.2 billion from $2.7 billion in second-quarter 2016.

In South America, revenues increased $0.2 billion to $1.5 billion. Wholesale volumes rose 12% to 93,000 units. Pre-tax loss amounted to $185 million, narrower than $265 million in the prior-year quarter. The loss was due to an improving but weak economy.

In Europe, revenues declined $1 billion to $7.1 billion. Wholesale volumes decreased by 55,000 year over year to 375,000 units. The region recorded pre-tax profit of $88 million, decreasing $379 million from the prior-year quarter.

In the Middle East & Africa segment, revenues declined 0.4 billion year over year to $0.6 billion. Wholesale volumes plunged 14,000 units to 24,000 units. The region reported a pre-tax loss of $53 million, narrowing down from the prior-year quarter loss of $65 million.

In the Asia-Pacific region, revenues of $3.4 billion improved 21% year over year. Wholesale volumes rose 7% to 352,000 units. The Asia-Pacific region reported a pre-tax profit of $143 million, up from the year-ago quarter loss of $8 million.

Financial Services

Ford Credit recorded best pre-tax profit since 2011. The unit recorded around 55% year-over-year increase in pre-tax profit during the quarter.

Financial Position

Ford had cash and cash equivalents of $16.2 billion as of Jun 30, 2017, down from $17.1 billion as of Jun 30, 2016.

2017 Guidance

The company expects 2017 adjusted EPS to be in the range of $1.65–$1.85. Also, the company expects adjusted effective tax rate to be 15%.

Zacks Rank and Top Picks

Ford currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the auto space include Allison Transmission Holdings, Inc. (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Ferrari N.V. (NYSE:RACE) .

While both Allison Transmission Holdings and Volkswagen sport a Zacks Rank #1 (Strong Buy), Ferrari carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission, Volkswagen and Ferrari have a long-term expected growth rate of 11%, 17.3% and 14.1%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Ford Motor Company (F): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research