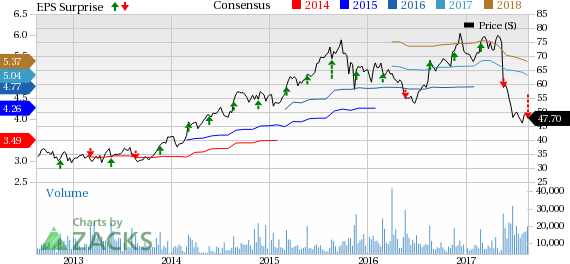

Foot Locker, Inc. (NYSE:FL) reported lower-than-expected financial numbers for the second straight quarter, when the company posted second-quarter fiscal 2017 earnings. The New York-based retailer delivered quarterly earnings of 62 cents per share that fell substantially short of the Zacks Consensus Estimate of 90 cents and also declined 34% year over year. The company’s results in the quarter were impacted by soft performance of “some recent top styles”, which also lagged the company’s projections.

Following, the results share of this operator of athletic shoes and apparel retailer are down nearly 17% during the pre-market trading session. In fact in the past three months, the stock has tanked 18.8% compared with the industry’s decline of 11.2%.

Total sales of $1,701 million were down 4.4% year over year and also came below the Zacks Consensus Estimate of $1,813 million. Excluding the impact of foreign currency fluctuations, total sales decreased 4.3%. Comparable-store sales (comps) fell 6% during the quarter. The company’s results were also affected by the lack of innovative fresh products in the market. Further, it believes industry dynamics will continue in 2017, as a result of this it expects comparable sales decline in the range of 3-4% in remaining part of 2017.

Nevertheless, we believe by continually capitalizing on opportunities like children’s business, shop-in-shop expansion in collaboration with its vendors, store banner.com business, store refurbishment and enhancement of assortments, Foot Locker is likely to benefit in the long run. International expansion, especially in Europe, is another growth catalyst. Further, the company is enhancing eCommerce platform.

Gross margin contracted 340 basis points to 29.6% of sales. The selling, general and administrative expense rate rose 20 basis points to 19.9% during the quarter.

Store Update

During the quarter under review, Foot Locker opened 24 new outlets, remodeled or relocated 38 outlets and shuttered 19 outlets. As of Jul 29, 2017, the company operated 3,359 outlets across 23 countries in North America, Australia, New Zealand and Europe. Apart from these, there are 68 franchised Foot Locker stores in the Middle East. Germany has 14 franchised Runners Point stores.

Other Financial Details

Foot Locker ended the quarter with cash and cash equivalents of $1,043 million, long-term debt and obligations under capital leases of $126 million, and shareholders’ equity of $2,894 million.

During the quarter, the company repurchased 350,000 shares worth $21 million and paid a quarterly dividend of 31 cents a share.

Zacks Rank & Key Picks

Foot Locker currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the retail sector include The Children's Place, Inc. (NASDAQ:PLCE) , Burlington Stores, Inc. (NYSE:BURL) and Dollar General Corporation (NYSE:DG) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters and has a long-term earnings growth rate of 9%.

Burlington Stores delivered an average positive earnings surprise of 22.6% in the trailing four quarters and has a long-term earnings growth rate of 15.9%.

Dollar General delivered an average positive earnings surprise of 1.4% in the trailing four quarters and has a long-term earnings growth rate of 10.6%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Foot Locker, Inc. (FL): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research