Foot Locker, Inc. (NYSE:FL) made a strategic investment in Carbon38. Following, the $15 million Series A funding, the retailer of athletic shoes and apparel has taken a minority stake in the world’s major women's luxury active apparel firm. Carbon38 has raised $26 million since 2013.

Carbon38 co-founder and CEO, Katie Warner Johnson said “We are excited to have Foot Locker as an investor as we continue to scale our business and expand our omni-channel strategy, both in the U.S. and internationally.” Further, Foot Locker’s Executive Vice President and Chief Financial Officer, Lauren B. Peters, is set to join Carbon38's Board of Directors.

Foot Locker’s Long-term Strategies Bode Well

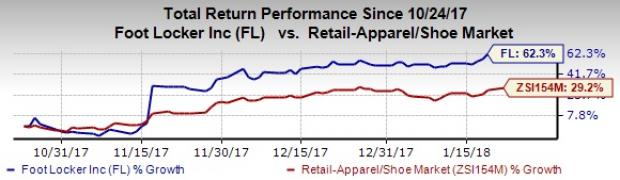

Shares of the company have surged a whopping 62.3% in the last three months, substantially outperforming the industry’s growth of 29.2%. Much of this share price momentum can be attributed to the company’s third-quarter results where both the top and bottom lines outpaced the Zacks Consensus Estimate, following a dismal show in the preceding two quarters.

Furthermore, this New York-based apparel and shoe retailer is trying to improve performance through operational and financial initiatives. Management believes that by continually capitalizing on opportunities like kids’ and women’s business, shop-in-shop expansion in collaboration with its vendors, store banner.com business, store refurbishment and enhancement of assortments, is likely to benefit the company in the long run. International expansion, especially in Europe, is another catalyst.

This Zacks Rank #3 (Hold) company is also focusing on augmenting e-commerce platform, growing direct-to-consumer operations, margin expansion and tapping underpenetrated markets. Additionally, it is effectively managing inventory, improving supply chain infrastructure and rationalizing store fleet. The company’s brand portfolio and shareholder-friendly moves remain noteworthy.

Hot Stocks in the Retail Space Worth Checking Out

Investors interested in the retail space may consider better-ranked stocks such as American Eagle Outfitters, Inc. (NYSE:AEO) , Boot Barn Holdings, Inc. (NYSE:BOOT) and The Children's Place, Inc. (NASDAQ:PLCE) . These three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Eagle Outfitters has a long-term earnings growth rate of 7.5%.

Boot Barn Holdings has an impressive long-term earnings growth rate of 15.7%.

Children's Place has reported better-than-expected earnings surprise in three of the trailing four quarters, with an average earnings beat of 14%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Foot Locker, Inc. (FL): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research