It has been another quiet morning in the foreign-exchange market with risk aversion and deleveraging driving the dollar slightly higher against all of the major currencies. There is no major U.S. economic data on the calendar today but fundamentals matter once again with the GBP slipping on softer retail sales numbers and the EUR hit by lower German factory orders and Eurozone retail sales. Profit taking on long USD/JPY positions also drove the currency pair lower while the AUD/USD declined after a wider trade balance.

U.S. Small Business Confidence Up...Barely

According to NFIB, Small Business Confidence increased slightly in the month of December. This improvement is encouraging because it shows that businesses did not become more pessimistic last month despite the uncertainty about the Fiscal Cliff and Obamacare. However the increase is small considering that the index dropped steeply in November.

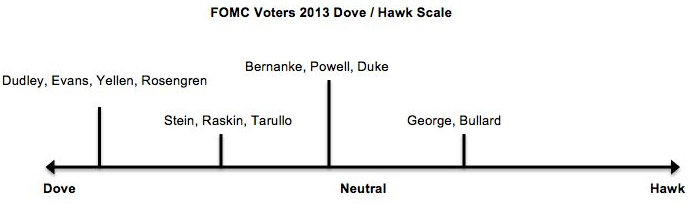

Since the main focus for the dollar this week will be the speeches from Fed officials, we want to take this opportunity to update our dove/hawk scale for the Federal Reserve this year. Jeffery Lacker will be speaking at 3 pm this afternoon on the economic outlook and as an outspoken hawk, there's a very good chance he led the call to end asset purchases this year. However, Lacker is not a voting member of the FOMC in 2013, so his ability to influence monetary policy will be limited.

Doves And QE

On balance, the 2013 Federal Reserve will be more dovish, making the chance of an early end to asset purchases less likely. The committee gains two major doves (Evans and Rosengren) and loses one (Williams). The most hawkish member of the FOMC in 2012 (Lacker) will also be a nonvoter this year and will be replaced by a more moderate hawk (George). The real wild-card is St Louis Fed President Bullard who has both supported Operation Twist and a timeline for keeping rates low. These new members will have their first opportunity to vote on monetary policy at the January 25 FOMC meeting.

Kathy Lien, Managing Director of FX Strategy for BK Asset Management

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FOMC: More Doves Than Hawks To Come

Published 01/08/2013, 10:29 AM

Updated 07/09/2023, 06:31 AM

FOMC: More Doves Than Hawks To Come

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.