Forex News and Events

The FOMC meeting is the key event today. Financial markets are expected to remain quiet today, waiting for the outcome of the two-day FOMC meeting due at 18:00 GMT. However there will be no press conference. Initially markets didn’t expect a rate hike before September, but the slowdown of the world’s biggest economy during the first quarter has shift expectations towards a rate hike in December at the earliest. We expect the statement to emphasis that the weakness in the US economy was only temporary and that the Committee expect the growth to pick up during the following quarters. Therefore, we do not expect much change vis-à-vis the economic outlook. A hawkish statement would therefore increase the odds of a rate hike in September. Consequently, the next round of economic indicators – starting Friday with ISM Man. and Michigan Index for April - will be of prime importance and be closely watched. However we expect the Fed to deliver a dovish statement as a stronger dollar can jeopardize the recovery of the US economy.

Preliminary US Q1 GDP is due today at 12:30 GMT with market participants expecting the economy to have expanded 1%y/y, down from 2.2% in Q4 2014. March pending homes sales are also due later in the afternoon and are expected around 1%.

UK economy grew slower

United Kingdom GBP figures for the first quarter was released yesterday and came in weaker than expected. The UK economy grew only 2.4%y/y while the market expected the economy to grow at 2.6%. A few economic indicators were already pointing towards an economic slowdown as industrial production remained subdued in February (0.1%y/y, prior revised down to 1.2%y/y) and should stay unchanged in March; February manufacturing production figures were released at 1.1%y/y (1.3% exp, prior read revised down by 0.2% to 1.7%). GBP/USD is currently taking advantage of the greenback’s weakness while disregarding the uncertainty generated by the upcoming election. Cable is currently trading at 1.5390, an eight-week high.

BoB to increase Selic rate

Today traders will watch Brazil Copom rate decision then tomorrow fiscal data. We expect Brazil’s central bank to increase the Selic rate by 50bps from 12.75% to 13.25% as inflation rose massively over the last year, reaching 8.13%y/y last month - far away from the 4.5% target the BoB set for 2016. . It’s imperative for the central bank to get inflation under control now. A proactive move to lower inflation will help preserve fragile social stability and restore the markets confidence in the central bank ability to steer the economy. The Real’s appreciation accelerated over the last week on growing carry appetite (USD/BRL vol has been on a downwards trend). We expect USD/BRL to move lower (2.65 target) as the Fed should leave its fund rate unchanged and traders continue to rush into the higher-yielding currency. In addition, the stronger BRL will clearly help contain price pressures, so it unlikely the central bank will stand in the way of further appreciation.

The Risk Today

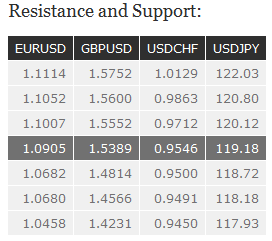

EUR/USD is preparing to challenge consolidation phase. The break of resistance at 1.0927 (27/04/2015 high) indicates an improving short-term technical configuration. A key resistance stands at 1.1043. Hourly supports can be found at 1.0963 and 1.0862. In the longer term, the symmetrical triangle from 2010-2014 favours further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. A strong resistance stands at 1.1114 (05/03/2015 low). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD has broken to the upside above key resistance 1.5166 (see declining trendline). However, a break of the resistance at 1.5552 (25/02/2015 recovery high) is needed to improve the mid-term technical structure. Another resistance stands at 1.6287. Hourly supports can be found at 1.5166 (18/03/2015) and 1.5028 (24/04/2015 low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). A decisive break of the key resistance at 1.5166 (18/03/2015 high) is needed to invalidate this scenario. Another key resistance stands at 1.5552 (26/02/2015 high).

USD/JPY continues to consolidate above its key support at 118.18. A break of the resistance at 120.12 (14/04/2015 high, see also the declining trendline) is needed to suggest exhaustion in the selling pressures. An hourly support stands at 118.53. Another resistance can be found at 120.84 (13/04/2015 high). A long-term bullish bias is favoured as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 118.18 (16/02/2015 low), whereas a key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF continues to move in a sideways pattern above key support area between 0.9491 and 0.9450 (see also the 38.2% retracement). Hourly resistances can be found at 0.9628 (intraday low) and 0.9712. In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. As a result, the current weakness is seen as a countertrend move. Key supports can be found at 0.9450 (26/02/2015 low, see also the 200-day moving average) and 0.9170 (30/01/2015 low).