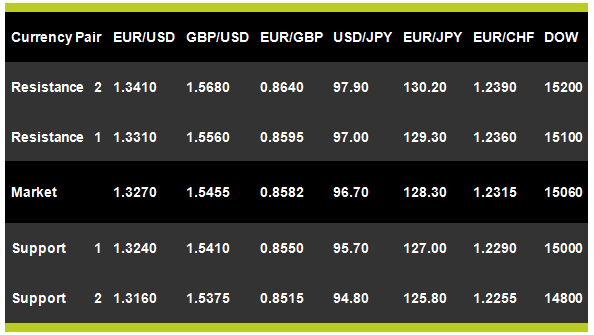

The FOMC signaled that the Fed will begin tapering this year if the U.S. economy matches forecasts, which helped the dollar to soar and stocks to slip.Bernanke’s hawkish tone was more than the market had anticipated. Bernanke stated that the Fed can reduce its pace of purchases later in 2013, and end the program altogether in mid-2014 providing data meets forecasts. The EUR/USD hit a low of 1.3262 on the news, while the USD/JPY went as high as the 97.00 level before pulling back. Another highlight of the night was Chinese HSBC Flash Manufacturing PMI for June came in at 48.3, its lowest reading in 9 months, taking the AUD/USD to a 33-month low of $0.9238.

Trade Idea

USDJPY

The market is heading higher and now a test of the 97.00 resistance level seems to be in focus. A break and close above this level on the four hour chart should have the pair targeting 97.45 and possibly 97.80.

Disclaimer • Risk Warning

This document should not be relied upon as being an impartial or objective assessment of the subject matter and is not deemed to be “investment research” as defined by the applicable law. This document has been issued by TFI FX only for information purposes and should not be construed in any circumstances as an offer to sell or solicitation of any offer to buy any financial instrument, nor shall it, or the fact of its distribution, form the basis of, or be relied upon in connection with, any contract relating to such action.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FOMC Surprises, Dollar Soars And Stocks Slip

Published 06/20/2013, 05:54 AM

Updated 04/25/2018, 04:40 AM

FOMC Surprises, Dollar Soars And Stocks Slip

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.