Key takeaways

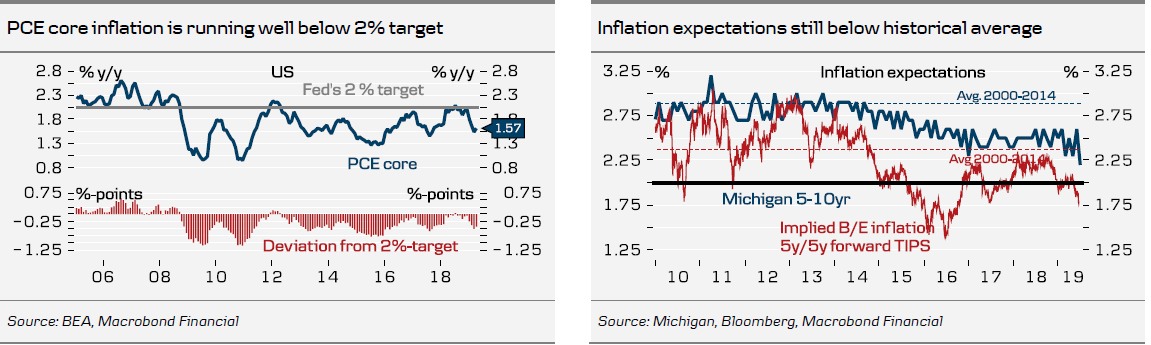

- As growth has moderated, inflation expectations have fallen and uncertainties have increased, the Fed now says it "will act as appropriate to sustain the expansion".

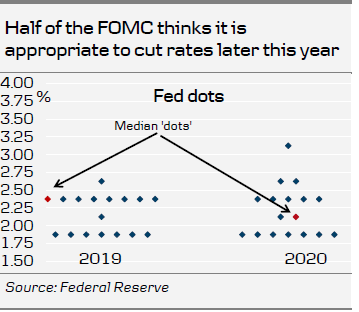

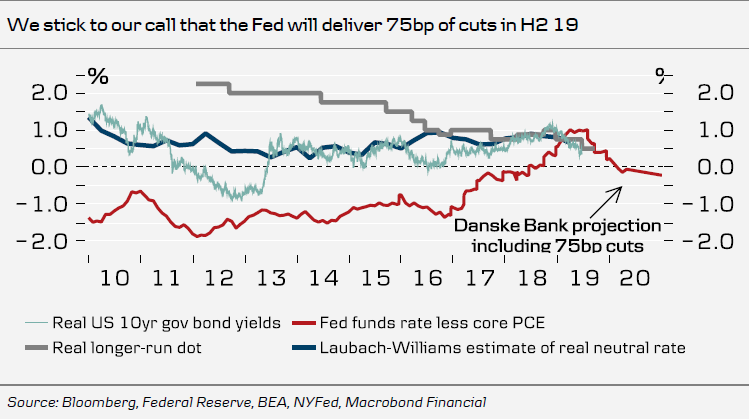

- We stick to our view that the Fed will cut rates in July by 25bp and deliver a total of 75bp of rate cuts in the second half of 2019 (July, September and December). The trade war is an important risk to our outlook in both directions.

- After two days of dovish central banks, we still see a strong case for a higher EUR/USD and lower USD/JPY as the Fed is set to ease more than other central banks.

Several important dovish changes to the FOMC statement

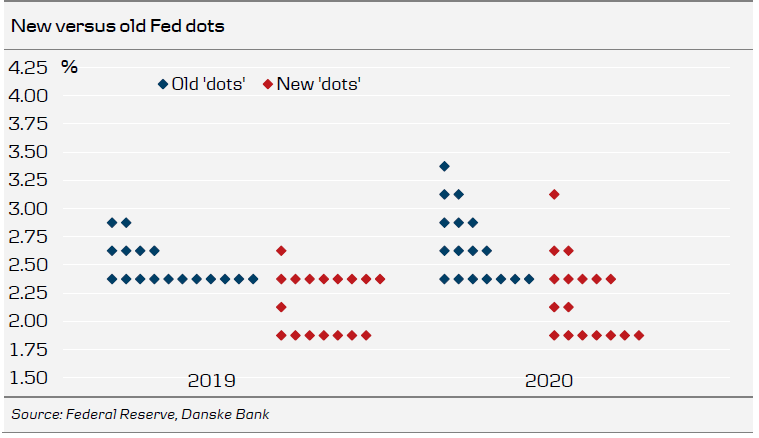

Overall, the Fed was as dovish as it could be without cutting rates at its meeting. In line with our view, there were several important dovish changes to the statement. Most importantly, the Fed removed the wording that it was “patient” and now said, “the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion”, which we believe, as outlined in our preview, is a strong easing signal. To the dovish side was also that the committee was divided on whether to signal cuts outright this year or not (see chart to the right). The Fed also lowered its longer-run dot (the Fed’s estimate of the neutral rate, where monetary policy is neither easy nor tight), which means the current monetary policy stance is tighter than it thought three months ago (see chart below).

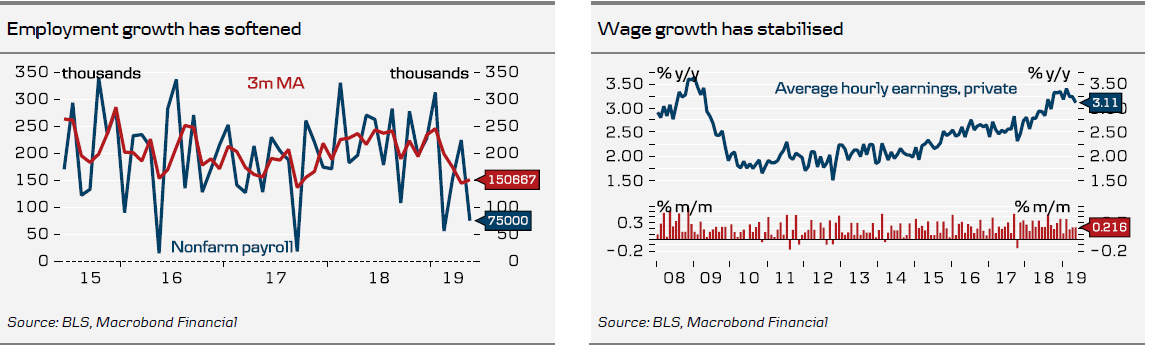

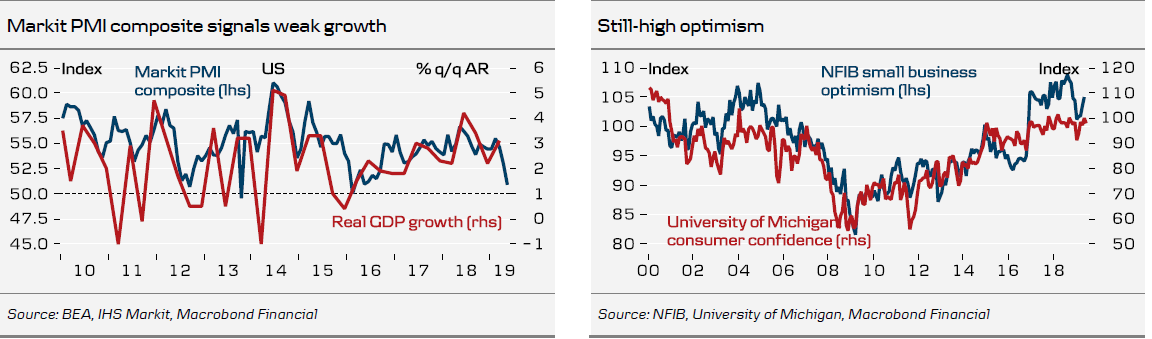

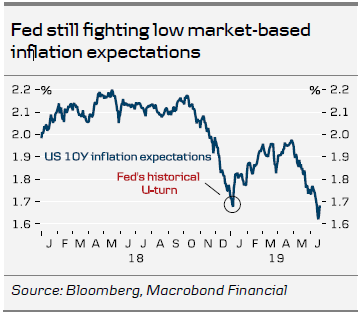

In the statement, the Fed also recognised that economic growth is now “moderate” (versus “solid” in May), that market-based inflation expectations have “declined” and that “uncertainties” to the outlook “have increased” (which is a new element to the statement). The latter is mostly, but not only, a reference to the ongoing trade war with China.

Trade uncertainty the key risk to our Fed outlook

Listening to Fed Chair Powell during the press conference, we also think he was dovish. While he highlighted the Fed wants more information before delivering, he hinted that data needed to improve and (trade) uncertainty needed to fade to really change the rate path outlook. Another interesting thing was that he said the Fed has not yet discussed whether rate cuts should be 25bp or 50bp. That said, it also seems clear to us that the Fed is not in panic mode and any rate cuts should be seen as insurance cuts, not recession cuts.

We stick to our view that the Fed will cut rates in July by 25bp and deliver a total of 75bp of rate cuts in the second half of 2019 (July, September and December). The trade war is an important risk to our outlook in both directions. Also, notice that Powell mentioned at the press conference that the Fed may change the balance sheet runoff plan if it ends up cutting rates.

FX: Fed paves the way for more USD weakness

EUR/USD tested 1.1250 and USD/JPY tested 108 levels on a dovish Fed, which justified the dovish pricing heading into the meeting. USD rates fell sharply, where the market is now about fully priced for a July rate cut. Fed Chair Powell stressed that the Fed is monitoring trade talks and needs to see more weak data to pull the trigger. It means that the upcoming G20 meeting, along with upcoming key data releases, i.e. PMIs, ISM, non-farm payrolls etc., will be particularly important for the pricing of upcoming Fed meetings and hence for the direction of the USD. We do not see data turning around for the better and see the risk of no breakthrough in the trade talks before the next Fed meeting, which should pave the way for a continued trend lower in the USD.

After two days of dovish central banks, we still see a strong case for a higher EUR/USD and lower USD/JPY as the Fed is set to ease more than other central banks. We continue to look for EUR/USD to rise to 1.15 in 3M (NYSE:MMM), although we note that despite large movements in rate markets, EUR/USD has so far had a difficult time breaking out of its long-held range close to 1.12.

Charts