If you’re one of the many readers who did, you’re excused for forgetting about Thursday’s Federal Reserve meeting. After all, the high political drama in Washington and London continues to draw plenty of headlines, it’s the first time we’ve seen an FOMC meeting conclude on a Thursday in three years and the central bank was never going to make any changes to monetary policy at its final meeting without a press conference anyway.

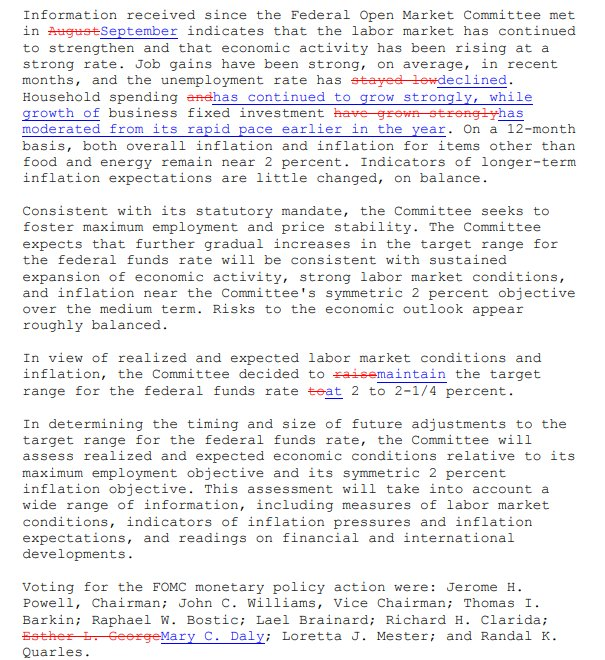

That said, it’s always worth tuning in for the latest pronouncements from the world’s most important central bank…and according to the Fed, not much has changed since late September. In fact, the central bank left interest rates unchanged in the 2.00-2.25% range and changed just 24 words from September’s monetary policy statement, with only two noteworthy tweaks:

- The unemployment rate has “declined” [from “stayed low” last month]

- Growth of business fixed investment has “moderated from its rapid pace earlier in the year” [from “grown strongly” last month]

Source: FOREX.com

It’s worth noting that the central bank continued to signal “further gradual rate increases ahead,” suggesting that the once-a-quarter pace for increased interest rates by 25bps may continue through the first half of 2019 as well. Not surprisingly, the market-implied odds of a December interest rate increase hardly budged, with traders pricing in a 78% chance of such a move.

Market Reaction: Minimal

Market participants almost immediately disregarded the statement, leading to minimal moves across the board. US stocks are hovering slightly in negative territory, oil is shedding 1.5%, and the benchmark 10-year Treasury is yielding 3.24% (unchanged on the day). We have seen a bit of strength in the greenback, with the US dollar index ticking up to test the weekly highs in the mid-96.00s.

Cheers