25bp or 50bp?

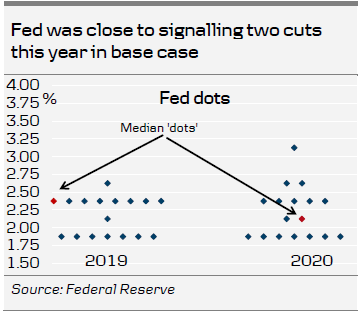

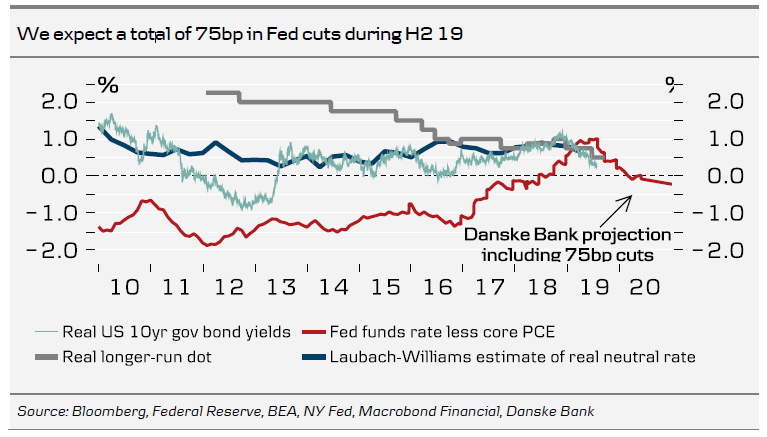

When the Federal Reserve meets next week, the question is more about the size of the rate cut and not about whether to cut at all, at least if one looks at market pricing. We remain in the camp expecting the Fed to cut its target range by 25bp on Wednesday. While investors got very excited on Friday by NY Fed Chair John Williams (NYSE:WMB)' seemingly dovish comments and at some point priced in a higher probability of a 50bp cut than a 25bp cut, it was very striking to us that a NY Fed spokesperson rejected the idea that Williams' comments were about what the Fed will/should do at the upcoming meeting. This, combined with über dove St Louis Fed president Bullard's view that a 25bp cut should be sufficient initially, means that we stick to our call that the Fed is more likely to cut by 25bp than 50bp. Markets have priced in an approximately 20% probability of a 50bp cut. Consensus among economists is for a 25bp cut but a few are calling for 50bp.

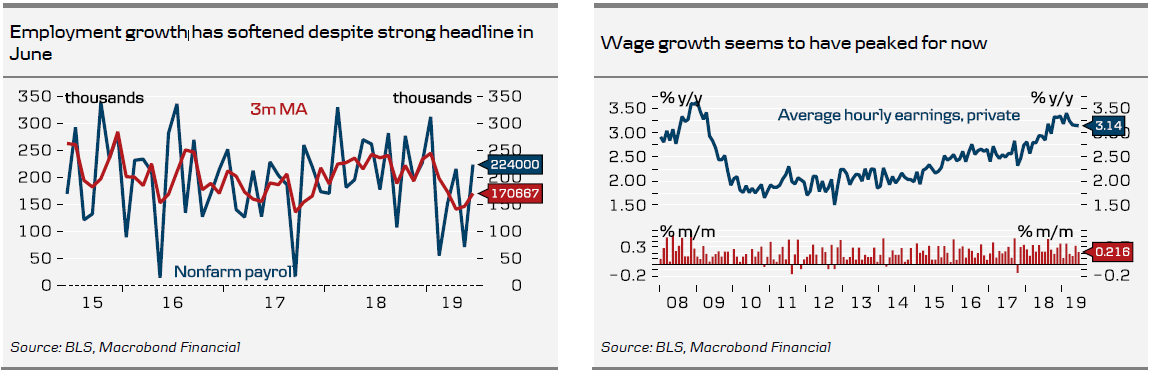

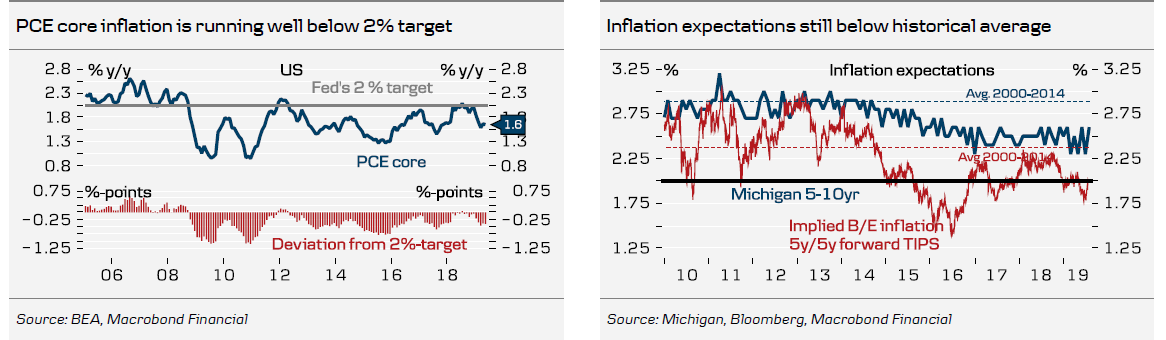

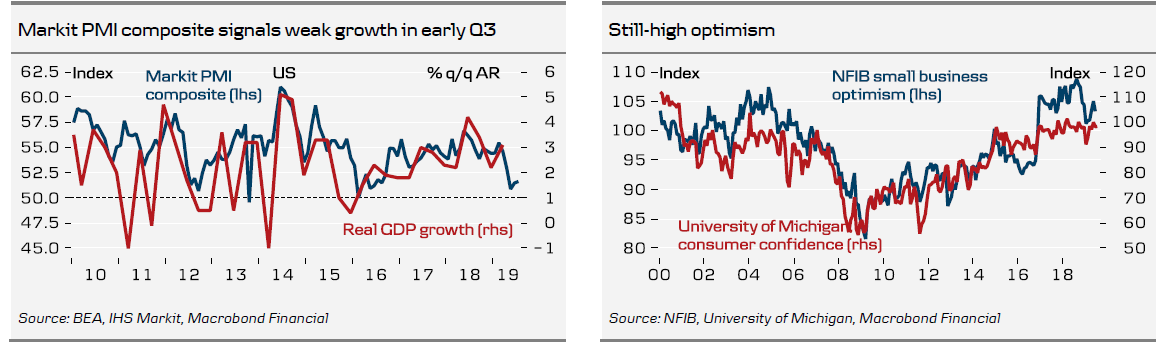

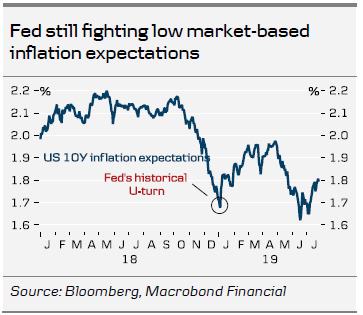

Despite the US economic surprise index having rebounded slightly in July and the fact that the US expansion is now the longest on record , we stick to our view that the cost of not easing monetary policy is greater than easing too much or too early , as inflation remains on the low side and the uncertainty surrounding the macro outlook has increased. We think the Fed will repeat both arguments in the statement and that the Fed will repeat that it 'will act as appropriate to sustain the expansion'. It is one of the 'smaller' meetings without updated projections, so the focus is on the rate announcement, statement and Powell's press conference. We continue to believe the Fed will cut twice more during the autumn (September and December), in line with current Fed pricing.

Despite both the Fed and the ECB being about to ease, we think in the end Fed easing will be more forceful and the Fed-ECB monetary policy divergence should pave the way for a higher EUR/USD over the coming 6M . We forecast EUR/USD at 1.14 in 1M and 1.15 in 3M (NYSE:MMM). We forecast EUR/USD at 1.17 in 6M and 1.17 in 12M. The Fed initiating an easing cycle would do most of the lifting for 1-3M, while for 3-6M a US-China trade deal should weaken the USD.

Charts