- We expect the Fed to cut again next week in line with market pricing.

- We stick to our 1% target for U.S. 10-Year Treasury yields.

Things have worsened since the July cut

At next week’s FOMC meeting, we expect the Fed to cut its target range by a further 25bp. The three factors that explained the initial cut in July were (1) higher global political uncertainty, (2) slower global growth and (3) subdued inflation pressure

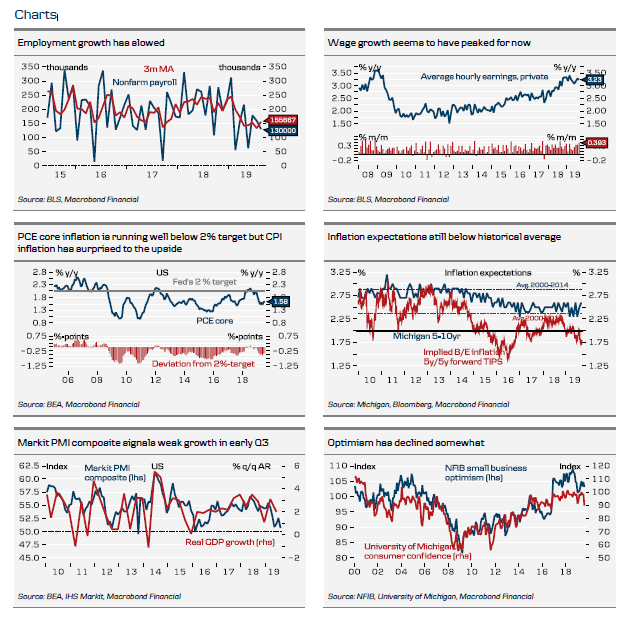

Two out of three factors have worsened since July. Donald Trump escalated the trade war (although the tone has been more constructive recently) and data out of China and Europe have disappointed. U.S. inflation has been stronger than expected over the past couple of months but inflation expectations have declined further. Focusing on U.S. growth, both the ISM and PMI indicators show growth has peaked.

This is particularly visible in the manufacturing sector, with the ISM manufacturing index now in recession territory. The service sector and private consumption remain robust but there are also signs service sector growth has slowed. There is always the risk that the downturn in manufacturing will spread to the service sector. Nonfarm payrolls have been on the weak side in recent months.

Prior to the Fed blackout period, which began on Saturday, we have heard from most FOMC members, including the most prominent ones. Fed Chair Jerome Powell has said that things have been ‘eventful’ since the July meeting and emphasised the easing bias that the Fed ‘will act appropriate[ly] to sustain the expansion’. This view has been echoed by both New York Fed President John Williams and Fed Vice Chair Richard Clarida in recent speeches. While FOMC members have not pre-committed to more cuts, Powell did not rule out more easing coming.

We would expect him to have done so if he had disagreed with current market pricing (25bp cut fully priced). Esther George and Eric Rosengren have laid out the argument for dissenting again. James Bullard prefers a 50bp cut but, in our view, he will probably support the 25bp without dissenting. We do not expect the Fed to change much in the statement and believe it will repeat its easing bias (‘act as appropriate to sustain the expansion’). The dot plot will lower automatically, simply reflecting that the Fed will have cut twice since last time (assuming the September cut is a done deal). We think the Fed will signal that another cut may be on the cards this year, otherwise, in our view, it is a hawkish signal, compared with both our view and market pricing. The Fed has downplayed the importance of the dot plot.