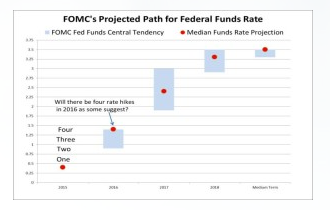

Economic commentators and pundits are now hyping what they are calling a significant pullback from the four rate hikes they maintained the FOMC had penciled in for 2016. As we argued in an earlier commentary following the release of the FOMC’s Summary of Economic Projections (SEP) in December, it was hard to look at the dot charts and median, reproduced below, and conclude that there was a high probability of four rate moves just because the median was for four hikes. Focusing on the median ignores the fact the Chair Yellen and the rest of the Board plus President Dudley constitute a majority of the voting members of the FOMC and hence their views control going forward, just as they did in December.

How have things changed since the December meeting? We contend that very little has changed as far as expected path for policy is concerned. Growth is moderate, and the March set of SEP projections are little different from what they were in December. Moreover, while inflation has shown some signs of a pickup, there are no warning signs that the FOMC is significantly behind the curve. What has changed is the weight that the FOMC is now giving to turbulence abroad and the desire not to add to that turbulence by moving rates now.

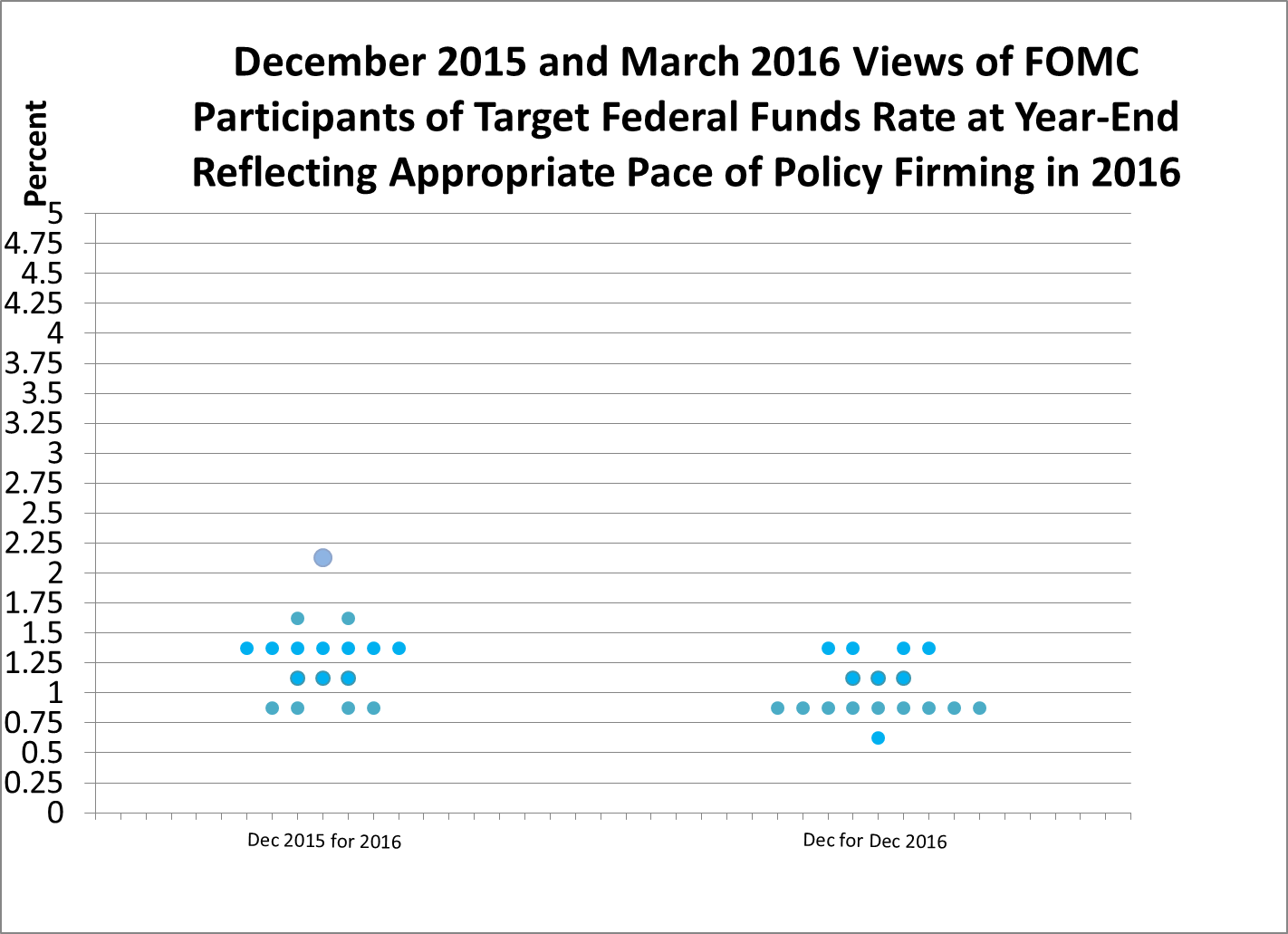

It is also instructive to compare FOMC participants’ policy stance in the March SEP with their stance back in December regarding possible rate moves in 2016. The following chart compares the dots from December with those from March. The striking feature of the chart is the movement downward in the policy preferences of those who favored four or more moves as compared with those who favored fewer than four moves. A similar downward shift is evident in the 2017 Fed Funds target among those previously favoring a more aggressive approach.

Additionally, in her press conference, Chair Yellen again cautioned that the FOMC favored a gradual approach to policy moves, that those moves would be data-dependent, and that the focus would be on inflation.

Our final point concerns the press’s fixation with negative interest rates and the likelihood that negative rates might be an option for the FOMC. Chair Yellen was about as clear as anyone could be that negative rates were not a live policy option, especially at a time when the economy was continuing to expand and the recovery was on track.

We continue to believe that there is a positive probability, but not a certainty, of two policy moves in 2016, with the most likely meetings for setting those moves being June and December, for three reasons. First, the April meeting is only six weeks away and little is likely to change, especially with respect to inflation, there is no press conference scheduled, nor is a new set of SEP projections scheduled for that meeting. Second, June is the next meeting with both a new set of SEP projections and the first reading on Q1 GDP to support those forecasts. And, finally, the December meeting is not only after the election but is also the meeting at which the FOMC will have readings on both Q2 and Q3 GDP.