As my colleague Fiona Cincotta noted earlier today,“[g]iven the outdated nature of the minutes in light of the recent US - Sino trade dispute escalation and global recession fears, the reaction to the minutes could be limited.”

Interestingly, while the international economic outlook has worsened due to new tariffs and an outright contraction in German GDP, US data released since last month’s Fed meeting has generally improved. Since then, we’ve seen a solid (if unspectacular) Non-Farm Payrolls report, a hotter-than-expected CPI report, and a strong retail sales reading. More to the point, Fed speakers in the intervening weeks (Bullard and Daly) haven’t implied any change in their outlooks since last month’s “mid-cycle adjustment.”

The just-released minutes confirmed the Fed’s generally optimistic domestic/pessimistic international outlook. Top headlines from the minutes follow [emphasis mine]:

- A NUMBER OF FED OFFICIALS STRESSED NEED FOR FED FLEXIBILITY

- A FEW POLICYMAKERS EXPRESSED CONCERN OF 3M/10Y YIELD CURVE INVERSION

- MOST VIEWED A 25 BP BP CUT AS A … MID-CYCLE ADJUSTMENT

- A COUPLE POLICYMAKERS WOULD HAVE PREFERRED A 50 BP CUT TO ADDRESS LOW INFLATION

The divergent viewpoints (“several” favored unchanged rates, “a couple” would have preferred a 50bp cut) suggests that we may continue to see dissents in response to future Fed decisions. Therefore, it will be particularly important to watch comments from central bank’s leadership (Powell and Clarida) for the most accurate signals on future policy.

Market Reaction

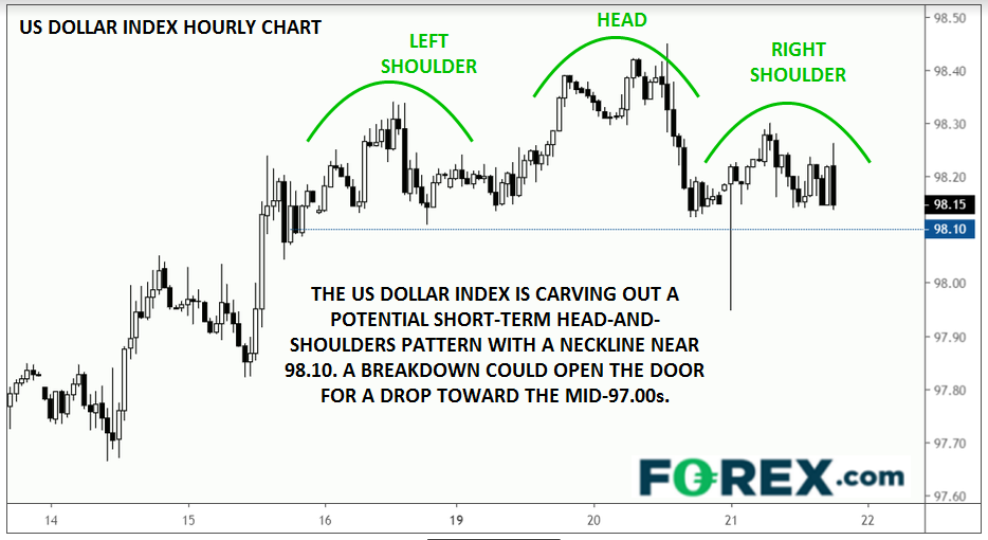

To call the market’s reaction to the FOMC minutes lackluster would be an understatement. The US dollar ticked about 5 pips higher against its rivals before reversing and trading about 5 pips below pre-Fed levels as we go to press – as the chart below shows, rates are showing a potential short-term head-and-shoulders topping pattern. Gold prices bumped up a couple bucks to $1506 while major US indices and Treasury yields are essentially unchanged.

All eyes now turn to Fed Chairman Powell’s big speech on "Challenges for Monetary Policy" at Jackson Hole Friday morning.