FOMC Expectations:

An inconsistent, mixed trading day for the US dollar yesterday and with more of the same expected heading into FOMC, keeping an eye on your major technical levels will be vital.

Today’s economic calendar looks quiet during Asia so we could see an erratic one as traders anticipate the moves to come tomorrow morning during FOMC.

We do see CPI released beforehand, but it’s a release that’s not going to have an effect on decision making this far out, so take the short term volatility that may accompany the release for what it is.

As for the FOMC meeting itself, nobody is expecting a move at this meeting but as we’ve spoken about before, the improvement in the jobs market, the commodity price rebound, as well as a relaxation around market conditions worldwide has surely given reason for the Fed to relax and head forward on the path toward monetary policy normalisation. Something markets aren’t quite pricing in and where some short term trading opportunity lies.

From Monday’s Central Banks’ Right of Reply blog:

“In my opinion, the biggest divergence in market expectation and actual pricing lies between the USD and the Fed rate hike timeline.”

While a rate hike isn’t expected (key word) tomorrow morning, it’s really all about the accompanying policy statement and the famous dot plot. Just a heads up that we also get a press conference following this meeting.

Consider what I’ve said here and where you see markets positioned heading into the release.

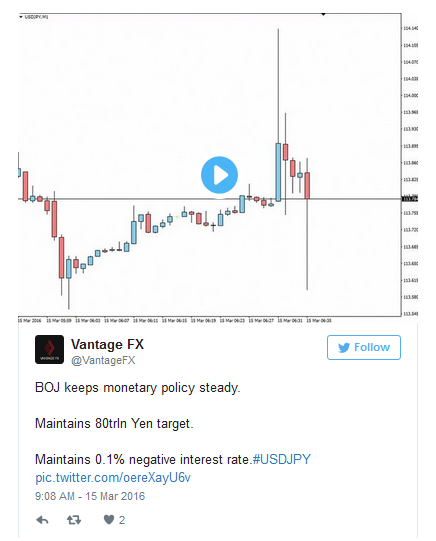

BoJ Keeps us Hanging:

Yesterday’s BOJ monetary policy announcement saw the bulls take control of the Japanese Yen as Kuroda and his merry men didn’t deliver the dovish guidance that markets have come to expect from them.

But in the end, the BoJ announced what was expected and the Yen caught a slight bid. However, it’s worth keeping in mind that Kuroda didn’t actually rule out any additional easing in the short term.

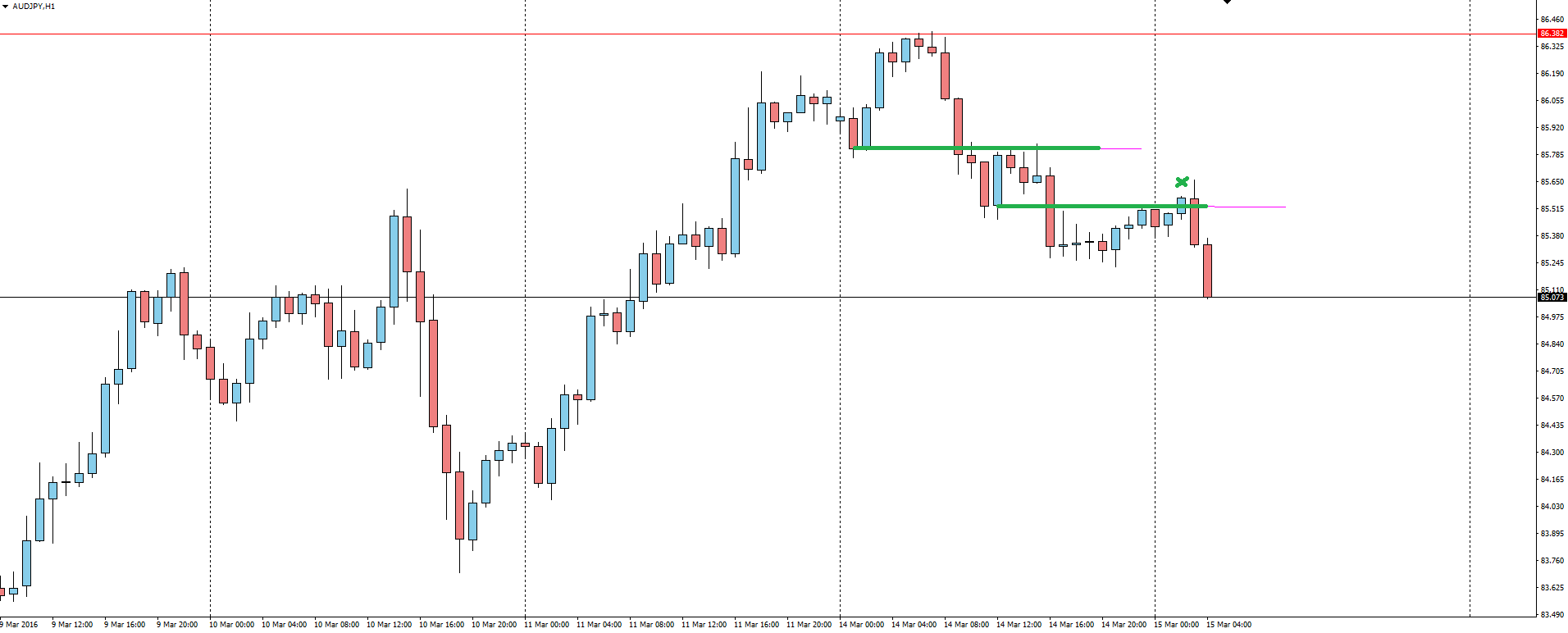

Further to JPY, yesterday’s chart of the day featured a possible AUD/JPY short setup.

AUD/JPY Hourly:

Click on chart to see a larger view.

This setup was a perfect example of why you should be using higher time frame levels even as a day trader. As you can see, price pushed up into the daily resistance level before we got our intra-day short set-ups on the hourly chart at short term support/resistance retests.

———

On the Calendar Wednesday:

GBP Average Earnings Index 3m/y

GBP Claimant Count Change

CAD Manufacturing Sales m/m

GBP Annual Budget Release

USD Building Permits

USD CPI m/m

USD Core CPI m/m

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd does not contain a record of our ECN Forex account prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.