Market Brief

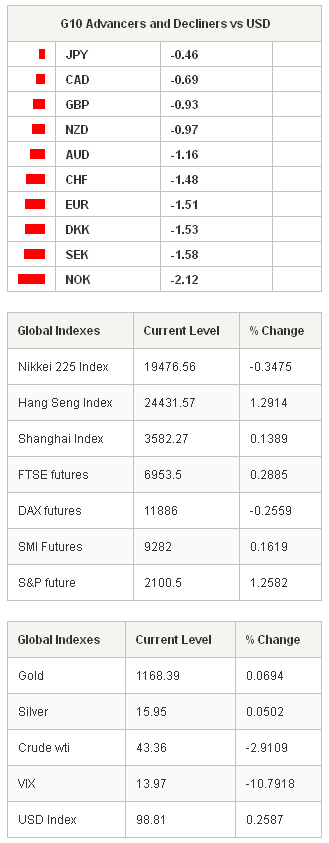

The USD has been squeezed heavily as the FOMC delivered a cautious statement at the end of its two day meeting. As widely expected, the Fed dropped its call for “patience”, yet the pace of rate normalization is now expected to be significantly slower. The Fed dots median forecast has been lowered from 1.125% previously to 0.625% (this is far below expectations), shifting the majority’s call the first rate hike to September. It is noteworthy to mention that a June hike is still possible and might be preferred. The frequency of action would then be lower in line with an “early and gradual” normalization, rather than a “late and steeper” action. The US indices rallied with S&P500 back above $2,100, Dow Jones futures traded to $18,070 on expectations of longer low rate environment. The US 10-Year yields eased to 1.8975%, giving the opportunity for G10 and EM currencies to take a deep breath.

USD/JPY hit Jan-Mar uptrend bottom (119.30) and rebounded to 120.75 in Tokyo. Lower US yields will certainly prevent the fresh highs in USD/JPY in the short-run. Resistance is seen pre-122.03. A daily close below the conversion line (120.67) should pave the way to Ichimoku cloud cover (118.37/71).

EUR/USD shortly tested offers above 1.10 (hit 1.1043). The strong negative bias in EUR/USD however rapidly dried the buying interest, Asian traders pushed the pair down to 1.0758. Consolidation is underway in between 1.0458/1.0870 (Mar 16th low / Fib 38.2% on Feb-Mar drop) area. The mid-term target remains the parity. We see thick area of offers in between 1.0850/1.1000 with rising protest against the ECB. Eurozone citizens criticize the ECB to help the banks, rather than helping people. Combined to unresolved Greek situation, the EUR/USD spike has been an excellent opportunity to strengthen the short positioning. We remain seller on rallies. EUR/GBP cleared resistance at 0.7200/50 area, advanced to 0.72931. Yesterday’s close above the conversion and the baseline keep the appetite on the upside. Especially with broad GBP reluctance on election jitters. Despite stronger positive momentum in EUR/GBP, we remain cautious vis-à-vis the event risk in EUR (Greek insolvability, Grexit).

GPB/USD spiked to 1.5166 post-FOMC and rapidly gave back gains through Asia. The Cable opened downbeat in London, suggesting the USD weakness has been a flash in the pan. We do not expect sustained follow up to upside attempt. Large option barriers at 1.4875/1.4950 should curb the upside today.

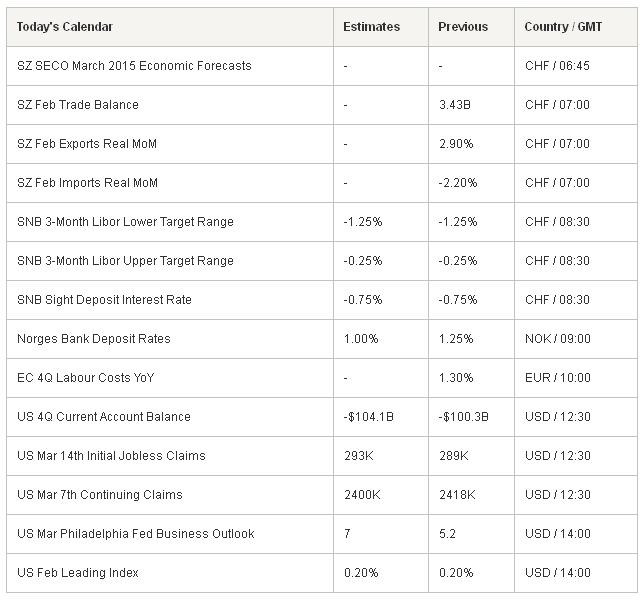

Norges bank is expected to cut its deposit rate from 1.25% to 1.0% at today’s meeting, amid Riksbank surprised the market by lowering its rate by an additional 10 basis points to -0.25% yesterday. The DNB pledged to defend the EUR/DKK peg regardless of the size of its FX reserves, while January, February pressures on the EUR/DKK are now put on pension funds and insurance companies’ shoulders, perhaps rushing to safer-heaven investments rather than carrying the EUR risk. Scandinavian currencies will remain subject to inflows from the EUR and will be increasingly part of the currency wars. The NOK/SEK recovered to 1.0544 post-Riksbank. Trend and momentum indicators play against the Nordic cross as oil prices fall to fresh lows, while lower SEK rates should curb the negative trend at 1.0300/21 (Jan 13th low / Fib 38.2% on Dec’14-Jan’15 rebound).

The consensus for the SNB meeting is status quo at today’s meeting. The euroswiss futures advanced to 110.890 with open interest spike at 66710 (vs 36601 average over the past 15-days). The money market pricing confirms that the anxiety on more negative rates will remain in the headlines as long as selling pressures on EUR are not ready to dissipate, regardless of more negative SNB rates at today’s meeting. The SNB is suspected to purchase sizeable amount of EUR to maintain the EUR/CHF within its implicit 1.05/1.10 range. The growth and inflation forecasts in 2015 have been revised significantly down from 2.1% to 0.9% and from 0.2% to -1.0% respectively.

Today’s economic calendar: Swiss February Trade Balance, Exports & Imports m/m, SNB rate decision, Euro-zone 4Q Labor Costs, US 4Q Current Account Balance, US March 14th Initial Jobless & March 7th Continuing Claims, Philadelphia Fed’s March Business Outlook and US February leading Index.

Currency Tech

EUR/USD

R 2: 1.1043

R 1: 1.0869

CURRENT: 1.0717

S 1: 1.0580

S 2: 1.0458

GBP/USD

R 2: 1.5166

R 1: 1.5027

CURRENT: 1.4848

S 1: 1.4700

S 2: 1.4547

USD/JPY

R 2: 124.14

R 1: 122.03

CURRENT: 120.59

S 1: 119.30

S 2: 118.37

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 0.9925

S 1: 0.9825

S 2: 0.9629