- The Fed is expected to maintain current interest rates (4.25%-4.50%) and a cautious approach, emphasizing data-driven decisions.

- Market participants will focus on the Fed's "dot plot" and Chair Powell's press conference for clues about the timing and trajectory of future rate cuts.

- Technically, the US Dollar Index (DXY) is showing signs of potential recovery after hitting a low, with RSI divergence suggesting a possible rebound. Will the FOMC prove to be the catalyst?

The FOMC meeting today is poised to be a pivotal moment for financial markets. Weakening US data off late has ramped up recessionary fears as inflation expectations have also increased on tariff fears.

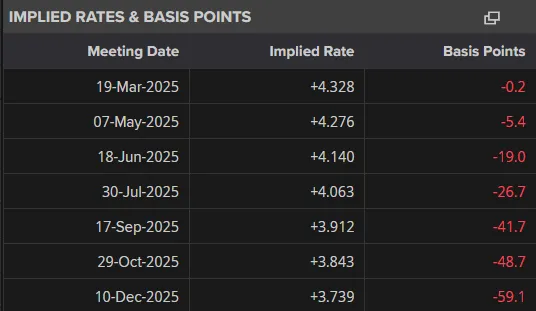

The result of these developments has led to an increase in rate cut expectations as market participants weigh up a host of uncertainties for the rest of year.

As things stand, heading into today's meeting and markets are pricing in around 59 bps of rate cuts through December 2025. This has increased from 50 bps a month ago.

The question heading into today's meeting will be whether the Fed will persist with its cautious approach, or will any subtle shifts in rhetoric signal changes to its long-term policy trajectory?

What to Expect from the FOMC Meeting?

The Fed’s decision-making process for this meeting hinges on several critical economic factors:

- Inflation Trends: Although inflation is gradually edging closer to the Fed’s 2% target, disparities across different sectors persist. The Consumer Price Index (CPI) data is trending positively but still demands careful scrutiny from policymakers.

- Labor Market Observations: Unemployment rates remain near historical lows, but there are signs of cooling in job creation and wage growth. These metrics are a critical component of the Fed’s dual mandate of maximum employment and price stability.

- Consumer Sentiment: With consumer sentiment dipping to a 29-month low, the Fed must weigh how declining optimism from consumers may affect overall economic activity.

- Broader Economic Indicators: Housing market data, retail sales, and manufacturing output present a mixed picture, complicating the Fed’s policy choices.

The Federal Reserve is expected to keep interest rates between 4.25% and 4.50%. They are being cautious because the economy is sending mixed signals. Chair Jerome Powell has noted that while inflation is easing, they need to avoid cutting rates too soon, which could bring inflation back. The strong job market also gives the Fed no reason to change its current strategy.

Market participants have also shown that their inflation expectations for the next 12 months are on the rise. That coupled with the unknown impact of universal tariffs will in my opinion keep the Fed rhetoric steady and in line with the previous FOMC meeting.

Federal Reserve Communication and Powell Press Conference

Markets are anticipating that the March FOMC meeting will deliver more than just clarity on short-term interest rates. The Fed’s updated “dot plot”, showcasing projections of future rates, is expected to offer insights into the long-term trajectory of monetary policy.

The Fed faces mounting pressure to clarify its timeline for potential rate cuts. Economic growth concerns and easing inflation trends have already led markets to speculate that the first cuts could occur in the latter half of 2025.

Chair Powell’s press conference will be key to understanding when the Fed might start cutting rates. Traders should analyze the exact wording of the Fed statement to spot policy changes, as even small edits can affect markets. Chair Powell will likely stress that decisions depend on data and avoid making long-term promises. This lets the Fed stay adaptable while giving markets some direction.

This would be a wise move in my opinion as Geopolitical risks and uncertainty continue to be an issue.

Technical Analysis - US Dollar Index

From a technical standpoint, the US Dollar continues to struggle since its peak on January 13, 2025.

The US Dollar Index (DXY) printed a fresh low today running into support at 103.18 ahead of the FOMC meeting.

There is a sign that the US Dollar might be ready to recover from a technical aspect as the RSI and price action are flashing signs of divergence. The RSI has made a higher low while price action has made a lower low which could be a warning sign that a recovery might be imminent.

Will the FOMC be the catalyst?

US Dollar Index (DXY) Daily Chart, March 18, 2025

Source: TradingView.com

Support

- 103.18

- 102.95

- 102.64

Resistance

- 103.65

- 104.00

- 104.96

Most Read: GBP/USD Analysis: Testing 1.3000 Resistance Amid Central Bank Uncertainty. Will Cable Break 1.3000?