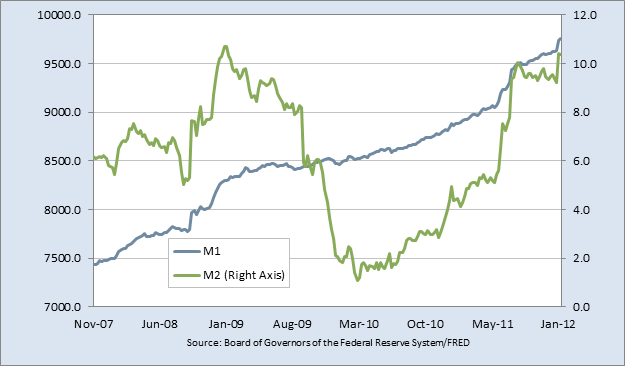

Will these kinds of money supply numbers (see chart below) make the Federal Open Market Committee become less “dovish” when it announces its path for rates tonight? Hardly!

(The chart shows M1 left handside - which is nominal i.e. US dollar right hand access; and M2 left-hand side - which is in percentage growth i.e. showing money stock. Basically it shows that money in circulation in the US economy is rising quite dramatically!)

Do not forget that the Federal Reserve has pre-announced that it will now only have yearly outlooks, not quarterly, making the path forward less “transparent”. The market is pricing in 50/50 odds that the Fed will engage in a third round of quantitative easing within the next three months.

Mads Koefoed, our macro economist, tells me the US economy could create on average 150K jobs per month, if so, then the US will surprise to the upside this year on growth.

Mads is, no surprise, more optimistic than I (who isn't?) but I believe the “austerity headwind” of minus 1 percent from less government consumption will be difficult to fight after the seasonal improvement in the fourth quarter fails to spill-over into H1 2012 for the US, but I have been wrong many times before.

Apple blew most away; Portugal continues to shock too!

Apple blew me and my analysts out of the water – Wow! The risk is always that there will be extensive profit taking in the stock, but as our resident 'super Apple fan' and equity strategist Peter Garnry so aptly said: “With all the bad news in Europe it is truly wonderful to see successful businesses such as Apple innovating our world” – Indeed, indeed – victories should be celebrated.

Talking about victories or rather the opposite (do not look!) Portugal is making new highs – yes highs – in the credit default swap market – the five-year CDS is indeed trading at 1286 basis points! But do not worry as the Portugese Premier minister stated yesterday via Reuters: ‘2012 targets to be met, turning point’ which is the worst thing a politician can say. Almost to the day, one year ago at Davos the then PM for Greece Papandreou was interviewed by Bartiromo and spoke about (yes, you got it) this being a turning point! The only thing we learn from history is that we do not learn from it!

Finally, on stress indicators – we at Saxo Bank, or rather Peter Garnry, has once again improved them adding Portugese CDS and Portugese banks deposit bases to the stress indicators. Yesterday became, at least for now, a turning point for most indicators, but let us see after the FOMC tonight plus the increased rhetoric concerning the EU Summit on Monday.

Meanwhile please read George Soros’ latest piece on the Euro debt crisis and my subsequent comments below:

Soros - worth a read

As always George Soros is worth 10 minutes of your time. This piece is elegantly written and holds several true definitions of cause and resultant impact.

I doubt his solution can or will be implemented - but who am I am to question the big G. Soros! He fails to draw the conclusion though that: It’s too late. However he does make arguments on the opposite view: There is still time!

The final part of this newsletter outlines the United States of Europe theme I myself touched on earlier this week and I agree – but ‘extend and pretend’ has now been the main game for so long, that Soros becomes “Johnny come late” rather than the man with the solution.

He should – in my view - do like he did in 1992 with ERM – force the change instead of waiting for policymakers to fail first – but I guess age gives you less energy and will to fight “injustice”!

However Soros will always have my deepest respect - not for the money he made, but his ability to take extremely difficult issues and make them crystal clear for his readers and listeners.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FOMC - The Path To? Portugal on the Path To?

Published 01/25/2012, 10:41 AM

Updated 03/19/2019, 04:00 AM

FOMC - The Path To? Portugal on the Path To?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.