Almost two weeks ago, I described some bullish setups on solar stocks. Here is a quick update on those setups and related trades:

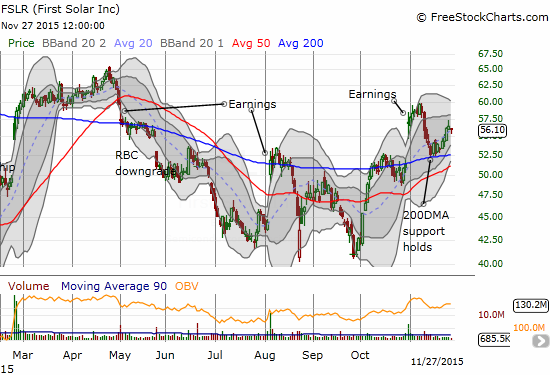

First Solar: Picture Perfect Setup

First Solar (O:FSLR) is a picture-perfect setup from 200-day moving average (DMA) support. I sold my call options into the rally that stalled a little on the shortened trading day on Friday. FSLR is still my favorite solar stock, so I will be scoping it for the next short-term entry point.

First Solar (FSLR) rallies successfully off 200DMA support.

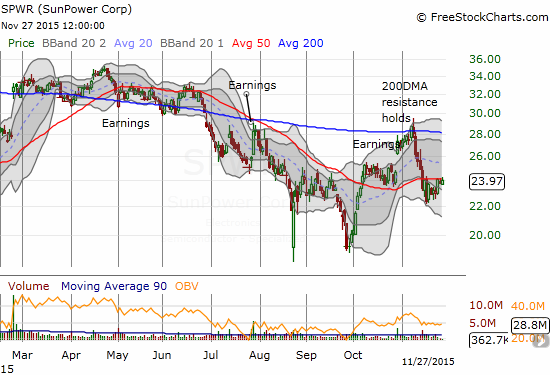

SunPower Corporation: Churn Continues Below Resistance

SunPower (O:SPWR) is still struggling to trigger a bullish setup. It continues to churn just below resistance at its 50DMA. SPWR is now a short if it manages to close below $22, the recent low. I am still looking for a bullish breakout above the 50DMA.

SunPower (SPWR) continues to struggle below its 50DMA resistance.

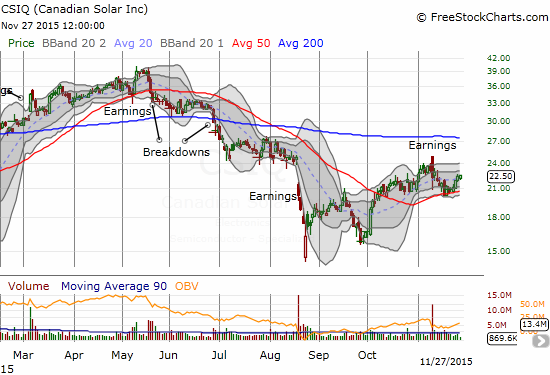

Canadian Solar: Short-term Upside Potential

Canadian Solar (O:CSIQ) is a picture-perfect setup at 50DMA support. I never made a trade on this one. CSIQ still has sort-term upside potential to at least 24. A new post-earnings high would be very bullish, but resistance looms overhead from the 200DMA.

Canadian Solar (CSIQ) maintains a bullish bounce off 50DMA support.

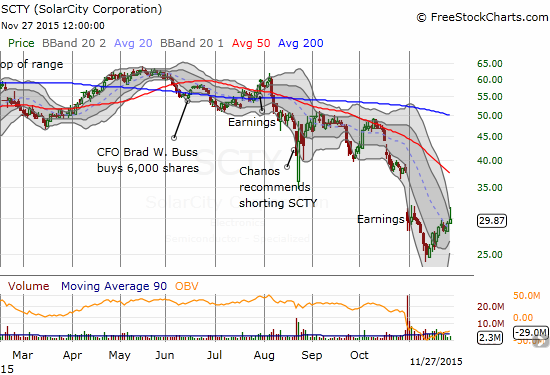

Solar City: Finally Bottomed (For Now)

Solar City (O:SCTY) may have finally bottomed for now. The rally off the recent bottom has put about 20% back on the stock. I sold my call options into the rally. The next threshold for SCTY is a move into the post-earnings gap down. Overhead resistance looms large as the 50DMA quickly trends downward.

Solar City (SCTY) makes a strong bounce off its recent bottom.

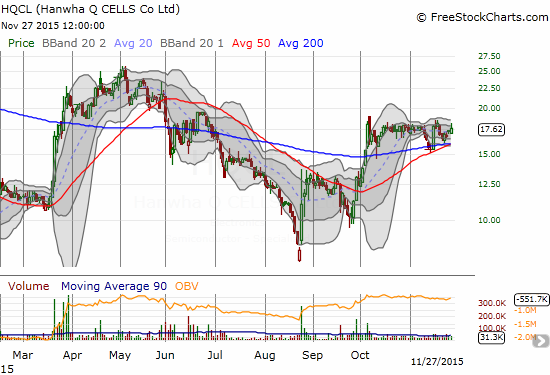

Hanwha Q CELLS Co.: Progress Limited

Hanwha Q Cells (O:HQCL) has been unable to make more progress since a strong bounce off 50DMA support. There is no new bullish trade here until the stock can print a breakout and close above $20.

Hanwha Q CELLS Co. (HQCL) is still coiling for a potential breakout.

Overall, these select solar stocks remain of great interest even as Guggenheim Solar ETF (N:TAN) still sits near its low for 2015.

Be careful out there!

Full disclosure: no positions