Bring together some of the brightest, most engaging minds in investing and politics inside the Hilton New Orleans Riverside Hotel along with hundreds of investors eager for market knowledge and insight, and you get the 39th Annual New Orleans Investment Conference.

It was a pleasure to attend the conference again this year, speaking among some of the very best in the industry including Adrian Day, Brien Lundin, Rick Rule and Mark Skousen, to name a few. Former Texas Congressman Ron Paul took the stage and Financial Times’ “most influential commentator in America” Charles Krauthammer also spoke during the four-day conference.

Among important debates, such as when the Federal Reserve will begin to taper its bond purchases, the debt ceiling, and Obamacare, investors were eager to learn the latest on gold.

Speakers shared their diverse opinions on the massive drop in the precious metal this year. Many were optimistic, some were cautious and a few were outright bearish.

Co-editors and publishers of The Aden Forecast, Mary Anne and Pamela Aden of Aden Research, commented that “gold is at a crossroads.” Eric Coffin, publisher of the Hard Rock Analyst, said that in the mining industry, there “needs to be more discoveries to spark liquidity hope.” In regards to gold’s downward trend, Dennis Gartman of The Gartman Letter bluntly advised to “quit fighting it.” Though he reminded investors the movement of gold continues to go from “top left to bottom right,” showing no recent positive signs, I like to put the negativity on gold into perspective.

Think of the metal’s movement like a rubber band. The market keeps pulling, pulling, pulling the price down, but eventually it will have to snap back. That’s when you might wish you would’ve held onto your gold investments.

As always, I reminded conference attendees that gold is not a means to get rich quick, but it should act as a portfolio diversifier and as insurance. By using this strategy, a long-term, smaller allocation to gold in a portfolio has the potential for risk reduction and possible gains, even amid a drop in the price.

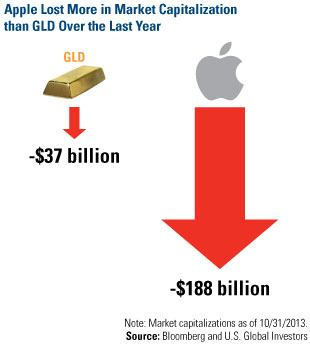

Attendees were most surprised when I presented the chart comparing the loss in market capitalization in the biggest gold ETF alongside the loss in market cap in a very familiar technology company. I’m continuously surprised that the media promote and talk about investing in the latest technology IPO while at the same time disparaging gold for its short-term declines. Meanwhile, Apple has lost more in market capitalization over the past year than the biggest gold ETF! See my entire gold presentation here.

I talked to many curious investors during the conference, several of whom brought their grandchildren to help pass along wisdom to the next generation. If these attendees leave with one piece of advice, I hope it is to include 5 to 10 percent weighting in gold and gold stocks and rebalance each year.

It is my belief that investors are surrounded by value in the marketplace, but to truly recognize these opportunities, you need both positivity and patience.

Until next year!

The commentary references the investment theory of an investment as insurance against a separate market event that could negatively affect performance of an investment. The reference does not guarantee performance or a safeguard from loss of principal by investing in that asset. By clicking the links above, you will be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Follow the Leaders: Gold Opinions from New Orleans

Published 11/20/2013, 10:34 AM

Updated 07/09/2023, 06:31 AM

Follow the Leaders: Gold Opinions from New Orleans

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.