Focusrite PLC (LON:TUNE), which already has market leadership in niche product areas, is evolving its strategy, to set up new brands targeting the professional interface and app markets. Focusrite has beaten our FY17 forecasts with 30% earnings growth, and we upgrade for the third time this year. With its attractive c 85% overseas revenue structure, we believe Focusrite is well placed in the short and medium term to sustain its independent strength.

FY17 earnings beat with vibrant US growth

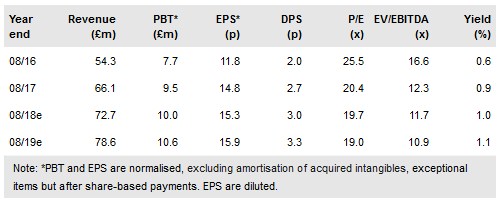

FY17 EPS grew by 30%, beating our forecast by 6%. Revenue grew 21.6% (13.5% at constant currency), with growth across both brands and in all regions, but led by the US region (+31%, 18% at constant currency) and the Novation segment (+38%). EBITDA grew 27.9% and net cash was at £14.2m (£5.6m at August 2016).

To read the entire report Please click on the pdf File Below: